Citibank 2009 Annual Report Download - page 269

Download and view the complete annual report

Please find page 269 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.259

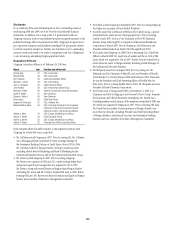

SUPERVISION AND REGULATION

Proposed Legislation

In addition to the regulations and requirements discussed below, legislation

is from time to time introduced in Congress that may change banking

statutes and the operating environment of Citigroup and its subsidiaries

in substantial and unpredictable ways. This has been particularly true as

a result of the financial crisis beginning in late 2007. See “Risk Factors,”

above. Citigroup cannot determine whether any such proposed legislation

will be enacted and, if enacted, the ultimate effect that any such potential

legislation or implementing regulations would have upon the financial

condition or results of operations of Citigroup or its subsidiaries.

Bank Holding Company/Financial Holding Company

Citigroup’s ownership of Citibank, N.A. (Citibank) and other banks makes

Citigroup a “bank holding company” within the meaning of the U.S. Bank

Holding Company Act of 1956.

Bank holding companies are generally limited to the business of

banking, managing or controlling banks, and other closely related activities.

Citigroup is qualified as a “financial holding company,” which permits Citi

to engage in a broader range of financial activities in the U.S. and abroad.

These activities include underwriting and dealing in securities, insurance

underwriting and brokerage, and making investments in non-financial

companies for a limited period of time, as long as Citi does not manage the

non-financial company’s day-to-day activities, and its banking subsidiaries

engage only in permitted cross-marketing with the non-financial company.

If Citigroup ceases to qualify as a financial holding company, it could be

barred from new financial activities or acquisitions, and have to discontinue

the broader range of activities permitted to financial holding companies.

Regulators

As a bank holding company, Citigroup is regulated and supervised by

the Board of Governors of the Federal Reserve System (FRB). Nationally

chartered subsidiary banks, such as Citibank, are regulated and supervised

by the Office of the Comptroller of the Currency (OCC); federal savings

associations by the Office of Thrift Supervision; and state-chartered depository

institutions by state banking departments and the Federal Deposit Insurance

Corporation (FDIC). The FDIC has back-up enforcement authority for

banking subsidiaries whose deposits it insures. Overseas branches of Citibank

are regulated and supervised by the FRB and OCC and overseas subsidiary

banks by the FRB. Such overseas branches and subsidiary banks are also

regulated and supervised by regulatory authorities in the host countries.

Internal Growth and Acquisitions

Unless otherwise required by the FRB, financial holding companies generally

can engage, directly or indirectly in the U.S. and abroad, in financial

activities, either de novo or by acquisition, by providing after-the-fact notice

to the FRB. However, all bank holding companies, including Citigroup,

must obtain the prior approval of the FRB before acquiring more than 5%

of any class of voting stock of a U.S. depository institution or bank holding

company.

Subject to certain restrictions and the prior approval of the appropriate

federal banking regulatory agency, Citi can acquire U.S. depository

institutions, including out-of-state banks. In addition, intrastate bank

mergers are permitted and banks in states that do not prohibit out-of-state

mergers may merge. A national or state bank can establish a new branch in

another state if permitted by the other state, and a federal savings association

can generally open new branches in any state.

The FRB must approve certain additional capital contributions to an

existing non-U.S. investment and certain acquisitions by Citigroup of an

interest in a non-U.S. company, including in a foreign bank, as well as the

establishment by Citibank of foreign branches in certain circumstances.

Dividends

Citi’s bank holding companies and banking subsidiaries are limited in

their ability to pay dividends. See Note 21 to the Consolidated Financial

Statements. In addition to specific limitations on the dividends that

subsidiary banks can pay to their holding companies, federal regulators

could prohibit a dividend that would be an unsafe or unsound banking

practice. Further, pursuant to the various agreements Citigroup entered into

with the U.S. government during late 2008 and 2009, Citigroup is prohibited

from paying a dividend of more than $0.01 per share per quarter generally

so long as the U.S. Treasury or FDIC continue to hold any common stock

or trust preferred securities of Citigroup issued pursuant to Citi’s exchange

offers.

It is FRB policy that bank holding companies should generally pay

dividends on common stock only out of income available over the past

year, and only if prospective earnings retention is consistent with the

organization’s expected future needs and financial condition. In December

2009, the FRB advised bank holding companies to consult with FRB staff

before increasing dividends or taking other actions that could diminish the

bank holding company’s capital base. Moreover, bank holding companies

should not maintain dividend levels that undermine the company’s ability to

be a source of strength to its banking subsidiaries.