Citibank 2009 Annual Report Download - page 255

Download and view the complete annual report

Please find page 255 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

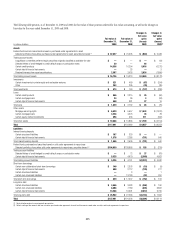

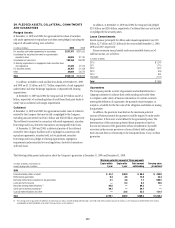

245

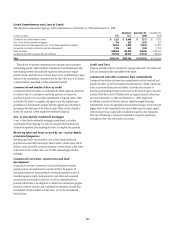

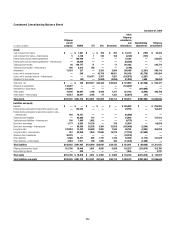

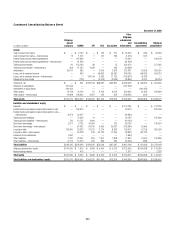

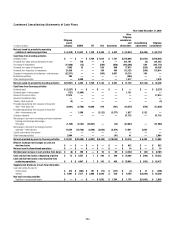

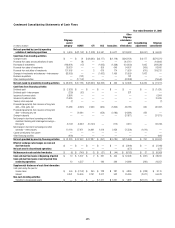

Credit Commitments and Lines of Credit

The table below summarizes Citigroup’s credit commitments as of December 31, 2009 and December 31, 2008:

In millions of dollars U.S.

Outside of

U.S.

December 31,

2009

December 31,

2008

Commercial and similar letters of credit $ 1,321 $ 5,890 $ 7,211 $ 8,215

One- to four-family residential mortgages 788 282 1,070 937

Revolving open-end loans secured by one- to four-family residential properties 20,914 3,002 23,916 25,212

Commercial real estate, construction and land development 1,185 519 1,704 2,702

Credit card lines 649,625 135,870 785,495 1,002,437

Commercial and other consumer loan commitments 167,510 89,832 257,342 309,997

Total $841,343 $235,395 $1,076,738 $1,349,500

The majority of unused commitments are contingent upon customers’

maintaining specific credit standards. Commercial commitments generally

have floating interest rates and fixed expiration dates and may require

payment of fees. Such fees (net of certain direct costs) are deferred and, upon

exercise of the commitment, amortized over the life of the loan or, if exercise

is deemed remote, amortized over the commitment period.

Commercial and similar letters of credit

A commercial letter of credit is an instrument by which Citigroup substitutes

its credit for that of a customer to enable the customer to finance the

purchase of goods or to incur other commitments. Citigroup issues a letter

on behalf of its client to a supplier and agrees to pay the supplier upon

presentation of documentary evidence that the supplier has performed in

accordance with the terms of the letter of credit. When a letter of credit is

drawn, the customer is then required to reimburse Citigroup.

One- to four-family residential mortgages

A one- to four-family residential mortgage commitment is a written

confirmation from Citigroup to a seller of a property that the bank will

advance the specified sums enabling the buyer to complete the purchase.

Revolving open-end loans secured by one- to four-family

residential properties

Revolving open-end loans secured by one- to four-family residential

properties are essentially home equity lines of credit. A home equity line of

credit is a loan secured by a primary residence or second home to the extent

of the excess of fair market value over the debt outstanding for the first

mortgage.

Commercial real estate, construction and land

development

Commercial real estate, construction and land development include

unused portions of commitments to extend credit for the purpose of

financing commercial and multifamily residential properties as well as

land development projects. Both secured-by-real-estate and unsecured

commitments are included in this line, as well as undistributed loan

proceeds, where there is an obligation to advance for construction progress

payments. However, this line only includes those extensions of credit that,

once funded, will be classified as Total loans, net on the Consolidated

Balance Sheet.

Credit card lines

Citigroup provides credit to customers by issuing credit cards. The credit card

lines are unconditionally cancellable by the issuer.

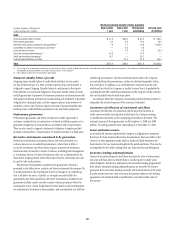

Commercial and other consumer loan commitments

Commercial and other consumer loan commitments include overdraft and

liquidity facilities, as well as commercial commitments to make or purchase

loans, to purchase third-party receivables, to provide note issuance or

revolving underwriting facilities and to invest in the form of equity. Amounts

include $126 billion and $170 billion with an original maturity of less than

one year at December 31, 2009 and December 31, 2008, respectively.

In addition, included in this line item are highly leveraged financing

commitments, which are agreements that provide funding to a borrower with

higher levels of debt (measured by the ratio of debt capital to equity capital

of the borrower) than is generally considered normal for other companies.

This type of financing is commonly employed in corporate acquisitions,

management buy-outs and similar transactions.