Citibank 2009 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148

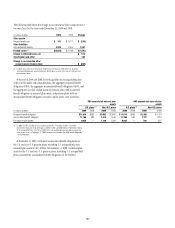

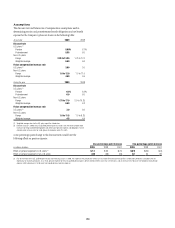

4. BUSINESS SEGMENTS

Citigroup is a diversified bank holding company whose businesses provide

a broad range of financial services to consumer and corporate customers

around the world. The Company’s activities are conducted through the

Regional Consumer Banking, Institutional Clients Group (ICG), Citi

Holdings and Corporate/Other business segments.

The Regional Consumer Banking segment includes a global, full-

service consumer franchise delivering a wide array of banking, credit card

lending, and investment services through a network of local branches, offices

and electronic delivery systems.

The businesses included in the Company’s ICG segment provide

corporations, governments, institutions and investors in approximately 100

countries with a broad range of banking and financial products and services.

The Citi Holdings segment is composed of the Brokerage and Asset

Management, Local Consumer Lending and Special Asset Pool.

Corporate/Other includes net treasury results, unallocated corporate

expenses, offsets to certain line-item reclassifications (eliminations), the

results of discontinued operations and unallocated taxes.

The accounting policies of these reportable segments are the same as

those disclosed in Note 1 to the Consolidated Financial Statements.

The following table presents certain information regarding the Company’s continuing operations by segment:

Revenues,

net of interest expense (1)

Provision (benefit)

for income taxes

Income (loss) from

continuing operations

(1)(2)(3)

Identifiable

assets

at year end

In millions of dollars, except

identifiable assets in billions 2009 2008 2007 2009 2008 2007 2009 2008 2007 2009 2008

Regional Consumer Banking $ 22,771 $ 25,674 $ 26,643 $ (386) $ 136 $ 2,122 $ 1,891 $ (3,140) $ 5,589 $ 213 $ 199

Institutional Clients Group 37,435 34,881 33,454 5,261 2,746 3,116 12,888 9,305 8,969 866 803

Subtotal Citicorp 60,206 60,555 60,097 4,875 2,882 5,238 14,779 6,165 14,558 1,079 1,002

Citi Holdings 30,635 (6,698) 19,513 (7,239) (22,621) (6,338) (8,239) (36,012) (8,692) 547 715

Corporate/Other (10,556) (2,258) (2,310) (4,369) (587) (1,446) (7,606) (2,182) (2,674) 231 221

Total $ 80,285 $ 51,599 $ 77,300 $(6,733) $(20,326) $(2,546) $ (1,066) $(32,029) $ 3,192 $ 1,857 $ 1,938

(1) Includes Citicorp total revenues, net of interest expense, in North America of $19.2 billion, $20.9 billion and $20.4 billion; in EMEA of $15.0 billion, $11.5 billion and $12.3 billion; in Latin America of $12.1 billion,

$12.6 billion and $12.6 billion; and in Asia of $13.9 billion, $15.5 billion and $14.7 billion in 2009, 2008 and 2007, respectively. Regional numbers exclude Citi Holdings and Corporate/Other, which largely operate

within the U.S.

(2) Includes pretax provisions (credits) for credit losses and for benefits and claims in the Regional Consumer Banking results of $7.1 billion, $6.1 billion and $3.3 billion; in the ICG results of $1.7 billion, $1.9 billion and

$557 million; and in the Citi Holdings results of $31.4 billion, $26.7 billion and $14.1 billion for 2009, 2008 and 2007, respectively.

(3) Corporate/Other reflects the restructuring charge, net of changes in estimates, of $1.5 billion for 2008 and $1.5 billion for 2007. Of the total charges, $890 million and $724 million is attributable to Citicorp;

$267 million and $642 million to Citi Holdings; and $373 million and $131 million to Corporate/Other, for 2008 and 2007, respectively. See Note 10 to the Consolidated Financial Statements for further discussion.