Citibank 2009 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

168

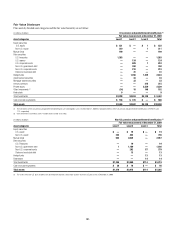

The Company is currently under audit by the Internal Revenue Service

and other major taxing jurisdictions around the world. It is thus reasonably

possible that significant changes in the gross balance of unrecognized tax

benefits may occur within the next 12 months but the Company does not

expect such audits to result in amounts that would cause a significant

change to its effective tax rate, other than the following item. The Company

expects to conclude the IRS audit of its U.S. Federal consolidated income

tax returns for the years 2003-2005 within the next 12 months. The gross

uncertain tax positions at December 31, 2009 for the items expected to be

resolved is approximately $66 million plus gross interest of $10 million. The

potential tax benefit to continuing operations could be approximately $72

million.

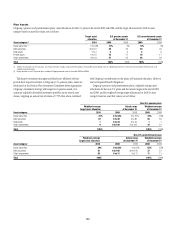

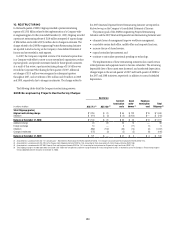

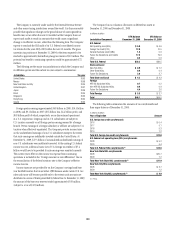

The following are the major tax jurisdictions in which the Company and

its affiliates operate and the earliest tax year subject to examination:

Jurisdiction Tax year

United States 2003

Mexico 2008

New York State and City 2005

United Kingdom 2007

Japan 2006

Brazil 2005

Singapore 2003

Hong Kong 2004

Ireland 2005

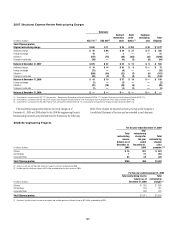

Foreign pretax earnings approximated $6.8 billion in 2009, $10.3 billion

in 2008, and $9.1 billion in 2007 ($0.6 billion loss, $4.4 billion profit, and

$0.8 billion profit of which, respectively, are in discontinued operations).

As a U.S. corporation, Citigroup and its U.S. subsidiaries are subject to

U.S. taxation currently on all foreign pretax earnings earned by a foreign

branch. Pretax earnings of a foreign subsidiary or affiliate are subject to U.S.

taxation when effectively repatriated. The Company provides income taxes

on the undistributed earnings of non-U.S. subsidiaries except to the extent

that such earnings are indefinitely invested outside the United States. At

December 31, 2009, $27.3 billion of accumulated undistributed earnings of

non-U.S. subsidiaries were indefinitely invested. At the existing U.S. federal

income tax rate, additional taxes (net of U.S. foreign tax credits) of $7.4

billion would have to be provided if such earnings were remitted currently.

The current year’s effect on the income tax expense from continuing

operations is included in the “Foreign income tax rate differential” line in

the reconciliation of the federal statutory rate to the Company’s effective

income tax rate.

Income taxes are not provided for on the Company’s savings bank base

year bad debt reserves that arose before 1988 because under current U.S. tax

rules such taxes will become payable only to the extent such amounts are

distributed in excess of limits prescribed by federal law. At December 31, 2009,

the amount of the base year reserves totaled approximately $358 million

(subject to a tax of $125 million).

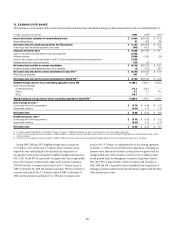

The Company has no valuation allowance on deferred tax assets at

December 31, 2009 and December 31, 2008.

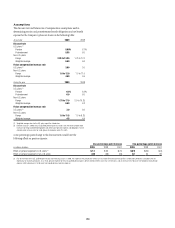

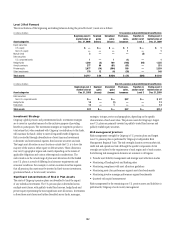

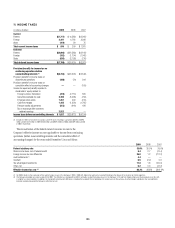

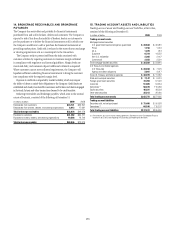

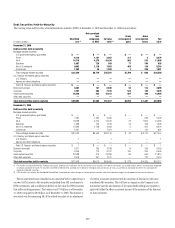

In billions of dollars

Jurisdiction/Component

DTA Balance

December 31, 2009

DTA Balance

December 31, 2008

U.S. Federal

Net Operating Loss (NOL) $ 5.8 $ 4.6

Foreign Tax Credit (FTC) 12.0 10.5

General Business Credit (GBC) 1.2 0.6

Future Tax Deductions and Credits 17.5 19.9

Other 0.5 0.9

Total U.S. Federal $36.3 $36.5

State and Local

New York NOLs $ 0.9 $ 1.2

Other State NOLs 0.4 0.4

Future Tax Deductions 3.0 2.7

Total State and Local $ 4.3 $ 4.3

Foreign

APB 23 Subsidiary NOLs 0.7 0.2

Non-APB 23 Subsidiary NOLs 0.4 0.9

Future Tax Deductions 4.4 2.6

Total Foreign $ 5.5 $ 3.7

Total $46.1 $44.5

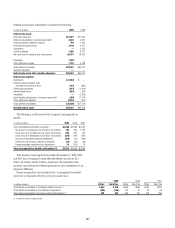

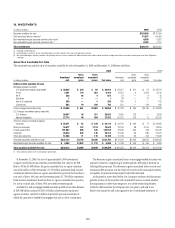

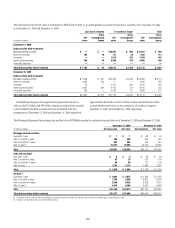

The following table summarizes the amounts of tax carryforwards and

their expiry dates as of December 31, 2009:

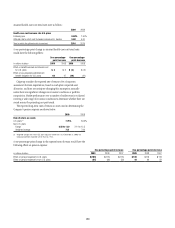

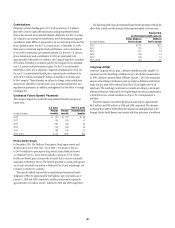

In billions of dollars

Year of Expiration Amount

U.S. foreign tax credit carryforwards

2016 $ 0.4

2017 5.1

2018 5.3

2019 1.2

Total U.S. foreign tax credit carryforwards $12.0

U.S. Federal net operating loss (NOL) carryforwards

2028 $ 9.2

2029 5.4

Total U.S. Federal NOL carryforwards (1) $14.6

New York State NOL carryforwards

2028 $10.7

2029 1.2

Total New York State NOL carryforwards (1) $11.9

New York City NOL carryforwards

2028 $ 3.7

2029 1.2

Total New York City NOL carryforwards (1) $ 4.9

(1) Pretax.