Citibank 2009 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

176

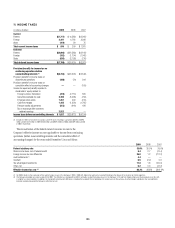

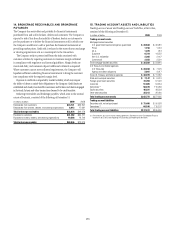

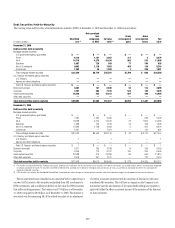

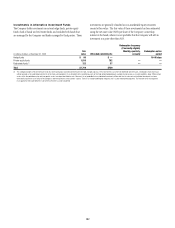

The following table presents the amortized cost and fair value of

debt securities available-for-sale by contractual maturity dates as of

December 31, 2009:

In millions of dollars

Amortized

cost Fair value

Mortgage-backed securities (1)

Due within 1 year $ 2 $ 3

After 1 but within 5 years 16 16

After 5 but within 10 years 626 597

After 10 years (2) 28,952 28,452

Total $ 29,596 $ 29,068

U.S. Treasury and federal agencies

Due within 1 year $ 5,357 $ 5,366

After 1 but within 5 years 35,912 35,618

After 5 but within 10 years 8,815 8,773

After 10 years (2) 4,487 4,357

Total $ 54,571 $ 54,114

State and municipal

Due within 1 year $ 7 $ 8

After 1 but within 5 years 119 129

After 5 but within 10 years 340 359

After 10 years (2) 16,211 15,114

Total $ 16,677 $ 15,610

Foreign government

Due within 1 year $ 32,223 $ 32,365

After 1 but within 5 years 61,165 61,426

After 5 but within 10 years 7,844 7,845

After 10 years (2) 755 883

Total $101,987 $102,519

All other (3)

Due within 1 year $ 4,243 $ 4,244

After 1 but within 5 years 14,286 14,494

After 5 but within 10 years 9,483 9,597

After 10 years (2) 4,280 4,147

Total $ 32,292 $ 32,482

Total debt securities available-for-sale $235,123 $233,793

(1) Includes mortgage-backed securities of U.S. federal agencies.

(2) Investments with no stated maturities are included as contractual maturities of greater than 10 years.

Actual maturities may differ due to call or prepayment rights.

(3) Includes corporate securities and other debt securities.

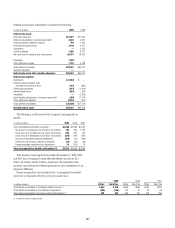

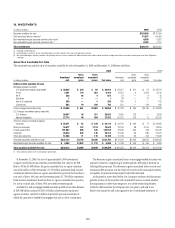

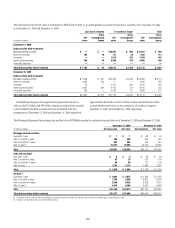

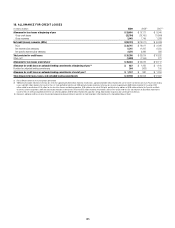

The following table presents interest and dividends on investments:

In millions of dollars 2009 2008 2007

Taxable interest $ 11,970 $ 9,407 $ 12,169

Interest exempt from U.S. federal income tax 864 836 897

Dividends 285 475 357

Total interest and dividends $13,119 $ 10,718 $ 13,423

The following table presents realized gains and losses on investments:

In millions of dollars 2009 2008 2007

Gross realized investment gains $ 2,090 $ 837 $ 1,435

Gross realized investment losses (94) (158) (267)

Net realized gains (losses) $ 1,996 $ 679 $ 1,168

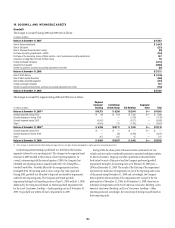

Debt Securities Held-to-Maturity

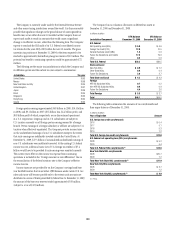

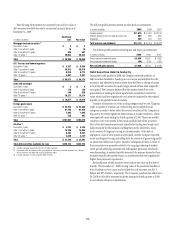

During the fourth quarter of 2008, the Company reviewed portfolios of

debt securities classified in Trading account assets and available-for-sale

securities, and identified positions where there had been a change of intent

to hold the debt securities for much longer periods of time than originally

anticipated. The Company believed that the expected cash flows to be

generated from holding the assets significantly exceed their current fair

value, which had been significantly and adversely impacted by the reduced

liquidity in the global financial markets.

Transfers of securities out of the trading category must be rare. Citigroup

made a number of transfers out of the trading and available-for-sale

categories in order to better reflect the revised intentions of the Company in

response to the recent significant deterioration in market conditions, which

were especially acute during the fourth quarter of 2008. These rare market

conditions were not foreseen at the initial purchase date of the securities.

Most of the debt securities previously classified as trading were bought and

held principally for the purpose of selling them in the short term, many

in the context of Citigroup’s acting as a market maker. At the date of

acquisition, most of these positions were liquid, and the Company expected

active and frequent buying and selling with the objective of generating profits

on short-term differences in price. However, subsequent declines in value of

these securities were primarily related to the ongoing widening of market

credit spreads reflecting increased risk and liquidity premiums that buyers

were demanding. As market liquidity decreased, the primary buyers for these

securities typically demanded returns on investments that were significantly

higher than previously experienced.

Reclassification of debt securities were made at fair value on the date of

transfer. The December 31, 2008 carrying value of the securities transferred

from Trading account assets and available-for-sale securities was $33.3

billion and $27.0 billion, respectively. The Company purchased an additional

$4.2 billion of held-to-maturity securities during the fourth quarter of 2008,

in accordance with prior commitments.