Citibank 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

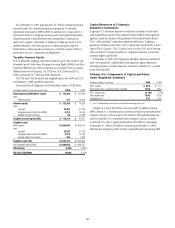

2009 Actions Significantly Impacting

Citigroup’s Capital

Primarily as a result of the preferred stock and trust preferred securities

exchange offers consummated in the third quarter of 2009, and capital raised

in connection with the $20 billion TARP repayment as well as the exiting of

the loss-sharing agreement in the fourth quarter of 2009, the overall quality

of Citigroup’s capital was enhanced, with Tier 1 Common increasing by

approximately $82 billion from December 31, 2008 to December 31, 2009.

In addition, Citigroup’s Tangible Common Equity (TCE) increased by

approximately $87 billion from December 31, 2008 to December 31, 2009.

Tier 1 Common and related capital adequacy ratios are measures used and

relied upon by U.S. banking regulators, while TCE is a capital adequacy

metric used and relied upon by industry analysts. However, both metrics

and related ratios are considered “non-GAAP financial measures” for SEC

purposes. See “Capital Ratios,” “Components of Capital Under Regulatory

Guidelines,” and “Tangible Common Equity” for additional information on

these measures.

2009 Actions Significantly Impacting Citigroup’s

Risk-Weighted Assets

In the fourth quarter of 2009, Citigroup entered into an agreement to exit

the loss-sharing agreement with the U.S. Treasury, FDIC, and Federal

Reserve Bank of New York, which covered losses on a specifically designated

portfolio, principally comprised of consumer assets, and initially valued at

approximately $301 billion as of November 21, 2008. Under the agreement,

these designated assets had been risk-weighted at 20% for purposes of

calculating Citi’s risk-based capital ratios. With the exiting of the agreement,

commencing December 31, 2009, Citigroup discontinued risk-weighting these

assets at 20%. Rather, the assets were risk-weighted as required in accordance

with risk-based capital guidelines, as described above, and consistent to that

prior to entering into the agreement. The exiting of the loss-sharing

agreement increased Citigroup’s risk-weighted assets by approximately

$136 billion, and correspondingly decreased Citi’s Tier 1 Common, Tier 1

Capital, and Total Capital ratios by approximately 125 basis points,

approximately 157 basis points, and approximately 183 basis points,

respectively, at December 31, 2009.

In addition, during the first half of 2009, all three of Citigroup’s

primary credit card securitization trusts—the Master Trust, Omni Trust,

and Broadway Trust—had bonds placed on ratings watch with negative

implications by rating agencies. As a result of the ratings watch status,

certain actions were taken by Citi with respect to each of the trusts. In

general, the actions subordinated certain senior interests in the trust assets

that were retained by Citi, which effectively placed these interests below

investor interests in terms of priority of payment.

As a result of these actions, based on the applicable regulatory capital

rules, Citigroup began including the sold assets for all three of the credit card

securitization trusts in its risk-weighted assets for purposes of calculating its

risk-based capital ratios during 2009. The increase in risk-weighted assets

occurred in the quarter during 2009 in which the respective actions took

place. The effect of these changes increased Citigroup’s risk-weighted assets

by approximately $82 billion, and decreased Citigroup’s Tier 1 Capital ratio

by approximately 100 basis points each as of March 31, 2009, with respect to

the Master and Omni Trusts. The inclusion of the Broadway Trust increased

Citigroup’s risk-weighted assets by an additional approximate $900 million at

June 30, 2009. All bond ratings for each of the trusts have been affirmed by the

rating agencies, and no downgrades had occurred as of December 31, 2009.

2010 Accounting Changes Significantly Impacting

Citigroup’s Capital—Elimination of Qualifying

Special Purpose Entities (QSPEs) and Changes

in the Consolidation Model for Variable Interest

Entities (VIEs)

Changes that the FASB adopted in 2009 regarding sales treatment for assets

and consolidation of off-balance-sheet VIEs, as promulgated in SFAS 166

and SFAS 167, respectively, will have a significant and immediate impact on

Citigroup’s capital ratios beginning in the first quarter of 2010. Specifically,

the pro forma impact on Citigroup’s capital ratios of the adoption on January

1, 2010 of SFAS 166 and SFAS 167 (based on financial information as of

December 31, 2009) would be as follows:

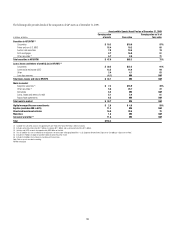

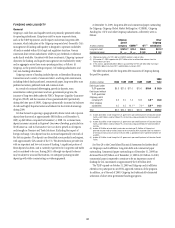

As of December 31, 2009

As reported Pro forma Impact

Tier 1 Common 9.60% 8.21% (139) bps

Tier 1 Capital 11.67 10.26 (141) bps

Total Capital 15.25 13.82 (143) bps

Leverage 6.89 6.14 (75) bps

TCE (TCE/RWA) 10.86% 9.99% (87) bps

For more information, see Notes 1 and 23 to the Consolidated Financial

Statements, including “Funding, Liquidity Facilities and Subordinate

Interests” below.

Common Stockholders’ Equity

Citigroup’s common stockholders’ equity increased during 2009 by $81.4

billion to $152.4 billion, and represented 8.2% of total assets as of December

31, 2009. Citigroup’s common stockholders’ equity was $71.0 billion, which

represented 3.7% of total assets, at December 31, 2008.

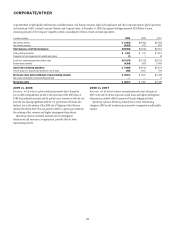

The table below summarizes the change in Citigroup’s common

stockholders’ equity during 2009:

In billions of dollars

Common stockholders’ equity, December 31, 2008 $ 71.0

Net loss (1) (2) (1.6)

Employee benefit plans and other activities 1.0

Dividends (3.4)

Exchange offers (1) 58.8

Issuance of common equity and T-DECs 20.3

Net change in accumulated other comprehensive income (loss), net of tax 6.3

Common stockholders’ equity, December 31, 2009 $152.4

(1) Net loss includes a $0.9 billion after-tax gain related to the conversion of trust preferred securities

held by public investors into common stock, pursuant to Citi’s public and private exchange offers

consummated in July 2009 and completed in their entirety in September 2009.

(2) Net loss includes a $6.2 billion after-tax loss associated with the $20 billion TARP repayment as well

as the exiting of the loss-sharing agreement in December 2009.