Citibank 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

DERIVATIVES

See Note 24 to the Consolidated Financial Statements for a discussion

and disclosures relate to Citigroup’s derivative activities. The following

discussions relate to the Derivative Obligor Information, the Fair Valuation

for Derivatives and Credit Derivatives activities.

Derivative Obligor Information

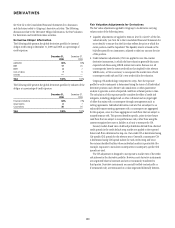

The following table presents the global derivatives portfolio by internal

obligor credit rating at December 31, 2009 and 2008, as a percentage of

credit exposure:

December 31,

2009

December 31,

2008

AAA/AA/A 68% 68%

BBB 17 20

BB/B 87

CCC or below 75

Unrated ——

Total 100% 100%

The following table presents the global derivatives portfolio by industry of the

obligor as a percentage of credit exposure:

December 31,

2009

December 31,

2008

Financial institutions 64% 73%

Governments 87

Corporations 28 20

Total 100% 100%

Fair Valuation Adjustments for Derivatives

The fair value adjustments applied by Citigroup to its derivative carrying

values consist of the following items:

Liquidity adjustments are applied to items in Level 2 or Level 3 of the fair-•

value hierarchy (see Note 26 to the Consolidated Financial Statements for

more details) to ensure that the fair value reflects the price at which the

entire position could be liquidated. The liquidity reserve is based on the

bid/offer spread for an instrument, adjusted to take into account the size

of the position.

Credit valuation adjustments (CVA) are applied to over-the-counter •

derivative instruments, in which the base valuation generally discounts

expected cash flows using LIBOR interest rate curves. Because not all

counterparties have the same credit risk as that implied by the relevant

LIBOR curve, a CVA is necessary to incorporate the market view of both

counterparty credit risk and Citi’s own credit risk in the valuation.

Citigroup CVA methodology comprises two steps. First, the exposure

profile for each counterparty is determined using the terms of all individual

derivative positions and a Monte Carlo simulation or other quantitative

analysis to generate a series of expected cash flows at future points in time.

The calculation of this exposure profile considers the effect of credit risk

mitigants, including pledged cash or other collateral and any legal right

of offset that exists with a counterparty through arrangements such as

netting agreements. Individual derivative contracts that are subject to an

enforceable master netting agreement with a counterparty are aggregated

for this purpose, since it is those aggregate net cash flows that are subject to

nonperformance risk. This process identifies specific, point-in-time future

cash flows that are subject to nonperformance risk, rather than using the

current recognized net asset or liability as a basis to measure the CVA.

Second, market-based views of default probabilities derived from observed

credit spreads in the credit default swap market are applied to the expected

future cash flows determined in step one. Own-credit CVA is determined using

Citi-specific CDS spreads for the relevant tenor. Generally, counterparty CVA

is determined using CDS spread indices for each credit rating and tenor.

For certain identified facilities where individual analysis is practicable (for

example, exposures to monoline counterparties) counterparty-specific CDS

spreads are used.

The CVA adjustment is designed to incorporate a market view of the credit

risk inherent in the derivative portfolio. However, most derivative instruments

are negotiated bilateral contracts and are not commonly transferred to

third parties. Derivative instruments are normally settled contractually, or

if terminated early, are terminated at a value negotiated bilaterally between