Citibank 2009 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

193

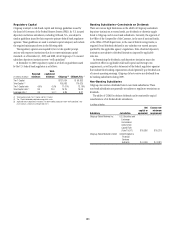

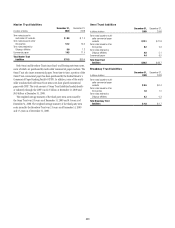

Regulatory Capital

Citigroup is subject to risk based capital and leverage guidelines issued by

the Board of Governors of the Federal Reserve System (FRB). Its U.S. insured

depository institution subsidiaries, including Citibank, N.A., are subject to

similar guidelines issued by their respective primary federal bank regulatory

agencies. These guidelines are used to evaluate capital adequacy and include

the required minimums shown in the following table.

The regulatory agencies are required by law to take specific prompt

actions with respect to institutions that do not meet minimum capital

standards. As of December 31, 2009 and 2008, all of Citigroup’s U.S. insured

subsidiary depository institutions were “well capitalized.”

At December 31, 2009, regulatory capital as set forth in guidelines issued

by the U.S. federal bank regulators is as follows:

In millions of dollars

Required

minimum

Well-

capitalized

minimum Citigroup (3) Citibank, N.A. (3)

Tier 1 Capital $127,034 $ 96,833

Total Capital (1) 165,983 110,625

Tier 1 Capital ratio 4.0 % 6.0% 11.67% 13.16%

Total Capital ratio (1) 8.0 10.0 15.25 15.03

Leverage ratio (2) 3.0 5.0 (3) 6.89 8.31

(1) Total Capital includes Tier 1 Capital and Tier 2 Capital.

(2) Tier 1 Capital divided by adjusted average total assets.

(3) Applicable only to depository institutions. For bank holding companies to be “well capitalized,” they

must maintain a minimum Leverage ratio of 3%.

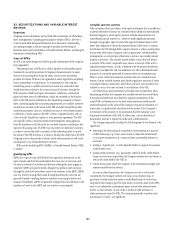

Banking Subsidiaries—Constraints on Dividends

There are various legal limitations on the ability of Citigroup’s subsidiary

depository institutions to extend credit, pay dividends or otherwise supply

funds to Citigroup and its non-bank subsidiaries. Currently, the approval of

the Office of the Comptroller of the Currency, in the case of national banks,

or the Office of Thrift Supervision, in the case of federal savings banks, is

required if total dividends declared in any calendar year exceed amounts

specified by the applicable agency’s regulations. State-chartered depository

institutions are subject to dividend limitations imposed by applicable

state law.

In determining the dividends, each depository institution must also

consider its effect on applicable risk-based capital and leverage ratio

requirements, as well as policy statements of the federal regulatory agencies

that indicate that banking organizations should generally pay dividends out

of current operating earnings. Citigroup did not receive any dividends from

its banking subsidiaries during 2009.

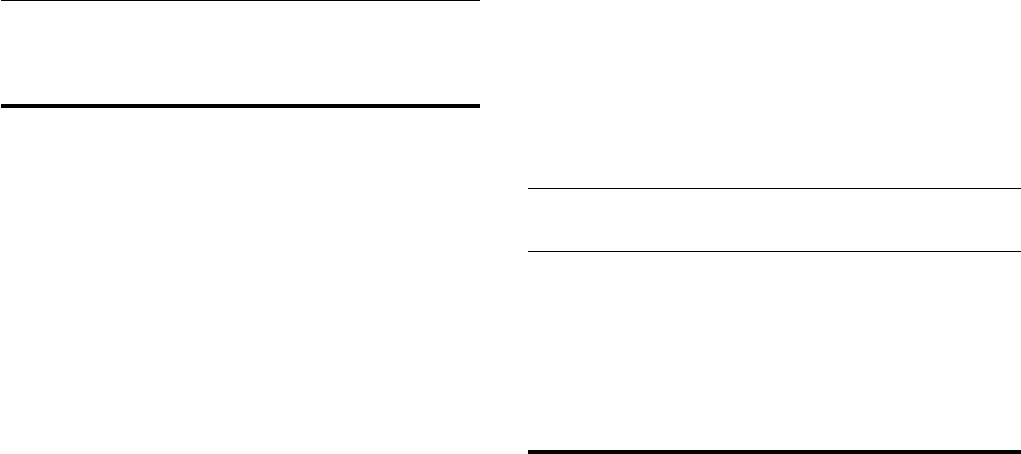

Non-Banking Subsidiaries

Citigroup also receives dividends from its non-bank subsidiaries. These

non-bank subsidiaries are generally not subject to regulatory restrictions on

dividends.

The ability of CGMHI to declare dividends can be restricted by capital

considerations of its broker-dealer subsidiaries.

In millions of dollars

Subsidiary Jurisdiction

Net

capital or

equivalent

Excess over

minimum

requirement

Citigroup Global Markets Inc. U.S. Securities and

Exchange

Commission

Uniform Net

Capital Rule

(Rule 15c3-1) $10,886 $10,218

Citigroup Global Markets Limited United Kingdom’s

Financial

Services

Authority $ 6,409 $ 3,081