Citibank 2009 Annual Report Download - page 265

Download and view the complete annual report

Please find page 265 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

255

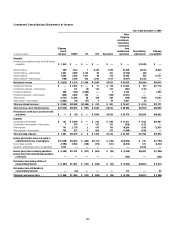

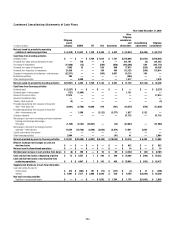

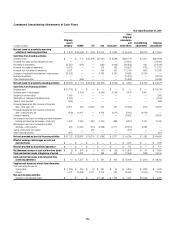

Condensed Consolidating Statements of Cash Flows

Year ended December 31, 2008

In millions of dollars

Citigroup

parent

company CGMHI CFI CCC Associates

Other

Citigroup

subsidiaries

and

eliminations

Consolidating

adjustments

Citigroup

consolidated

Net cash provided by (used in) operating

activities of continuing operations $ 5,600 $ (21,162) $ (1,028) $ 4,591 $ 4,677 $ 108,433 $(4,591) $ 96,520

Cash flows from investing activities

Change in loans $ — $ 91 $ (26,363) $(3,177) $ (1,118) $(243,131) $ 3,177 $(270,521)

Proceeds from sales and securitizations of loans — 98 — — — 313,710 — 313,808

Purchases of investments (188,901) (47) — (1,065) (1,338) (154,050) 1,065 (344,336)

Proceeds from sales of investments 38,020 — — 309 649 54,997 (309) 93,666

Proceeds from maturities of investments 137,005 — 3 670 774 71,530 (670) 209,312

Changes in investments and advances—intercompany (83,055) — — (1,062) 1,496 81,559 1,062 —

Business acquisitions — (181) — — — 181 — —

Other investing activities — (17,142) — — — (62,398) — (79,540)

Net cash (used in) provided by investing activities $ (96,931) $ (17,181) $ (26,360) $(4,325) $ 463 $ 62,398 $ 4,325 $ (77,611)

Cash flows from financing activities

Dividends paid $ (7,526) $ — $ — $ — $ — $ — $ — $ (7,526)

Dividends paid—intercompany (239) (92) — — — 331 — —

Issuance of common stock 6,864 — — — — — — 6,864

Issuance of preferred stock 70,626 — — — — — — 70,626

Treasury stock acquired (7) — — — — — — (7)

Proceeds/(repayments) from issuance of long-term

debt—third-party, net 15,086 (9,543) 2,496 (960) (5,345) (45,181) 960 (42,487)

Proceeds/(repayments) from issuance of long-term

debt—intercompany, net — 26,264 — (956) (2,183) (24,081) 956 —

Change in deposits — — — — — (37,811) — (37,811)

Net change in short-term borrowings and other

investment banking and brokerage borrowings—

third-party (3,197) (6,997) (10,100) — (112) 6,610 — (13,796)

Net change in short-term borrowings and other

advances—intercompany 10,118 27,971 34,991 1,619 2,456 (75,536) (1,619) —

Capital contributions from parent — — — — — — — —

Other financing activities (400) — — — — — — (400)

Net cash provided by (used in) financing activities $ 91,325 $ 37,603 $ 27,387 $ (297) $ (5,184) $(175,668) $ 297 $ (24,537)

Effect of exchange rate changes on cash and

due from banks $ — $ — $ — $ — $ — $ (2,948) $ — $ (2,948)

Net cash used in discontinued operations — — — — — (377) — (377)

Net decrease in cash and due from banks $ (6) $ (740) $ (1) $ (31) $ (44) $ (8,162) $ 31 $ (8,953)

Cash and due from banks at beginning of period $19 $ 5,297 $ 2 $ 321 $ 440 $ 32,448 $ (321) $ 38,206

Cash and due from banks at end of period from

continuing operations 13 4,557 1 290 396 24,286 (290) 29,253

Supplemental disclosure of cash flow information

Cash paid during the year for

Income taxes $ 440 $ (2,742) $ 350 $ 228 $ 287 $ 4,835 $ (228) $ 3,170

Interest 9,341 16,990 3,761 2,677 502 25,084 (2,677) 55,678

Non-cash investing activities

Transfers to repossessed assets $ — $ — $ — $ 1,571 $ 1,621 $ 1,818 $(1,571) $ 3,439