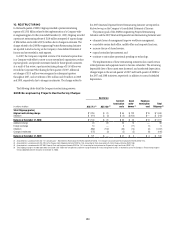

Citibank 2009 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

163

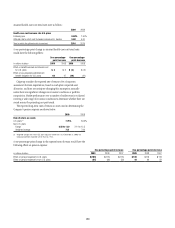

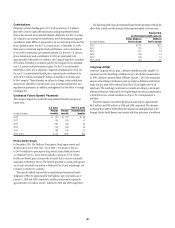

Contributions

Citigroup’s pension funding policy for U.S. plans and non-U.S. plans is

generally to fund to applicable minimum funding requirements rather

than to the amounts of accumulated benefit obligations. For the U.S. plans,

the Company may increase its contributions above the minimum required

contribution under ERISA, if appropriate to its tax and cash position and the

plans’ funded position. For the U.S. pension plans, at December 31, 2009,

there were no minimum required cash contributions, and no discretionary

or non-cash contributions are currently planned. For the non-U.S. pension

plans, discretionary cash contributions in 2010 are anticipated to be

approximately $160 million. In addition, the Company expects to contribute

$35 million of benefits to be directly paid by the Company for its unfunded

non-U.S. pension and postretirement plans. For the U.S. postretirement

benefit plans, there are no expected or required contributions for 2010. For

the non-U.S. postretirement benefit plans, expected cash contributions for

2010 are $72 million including $3 million of benefits to be directly paid

by the Company. These estimates are subject to change, since contribution

decisions are affected by various factors, such as market performance and

regulatory requirements; in addition, management has the ability to change

funding policy.

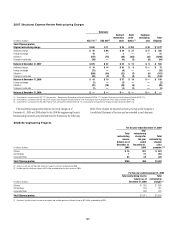

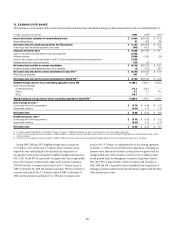

Estimated Future Benefit Payments

The Company expects to pay the following estimated benefit payments in

future years:

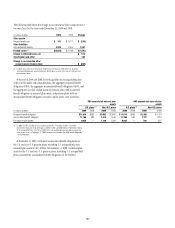

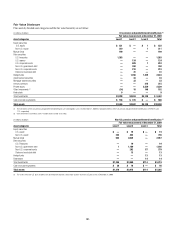

U.S. plans Non-U.S. plans

In millions of dollars

Pension

benefits

Pension

benefits

Postretirement

benefits

2010 $ 727 $ 327 $ 45

2011 739 290 47

2012 760 295 50

2013 774 302 54

2014 788 316 57

2015–2019 4,113 1,815 357

Prescription Drugs

In December 2003, the Medicare Prescription Drug Improvement and

Modernization Act of 2003 (the “Act of 2003”) was enacted. The Act

of 2003 established a prescription drug benefit under Medicare known

as “Medicare Part D,” and a federal subsidy to sponsors of U.S. retiree

health-care benefit plans that provide a benefit that is at least actuarially

equivalent to Medicare Part D. The benefits provided to certain participants

are at least actuarially equivalent to Medicare Part D and, accordingly, the

Company is entitled to a subsidy.

The expected subsidy reduced the accumulated postretirement benefit

obligation (APBO) by approximately $148 million and $142 million as of

January 1, 2009 and 2008, respectively, and the postretirement expense by

approximately $13 million and $17 million for 2009 and 2008, respectively.

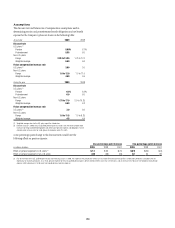

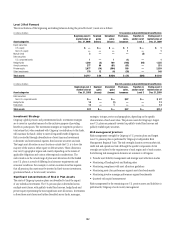

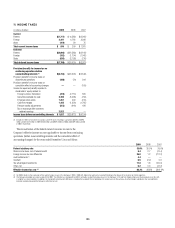

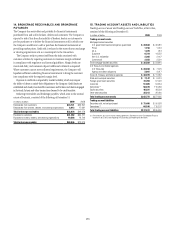

The following table shows the estimated future benefit payments without the

effect of the subsidy and the amounts of the expected subsidy in future years:

Expected U.S.

postretirement benefit payments

In millions of dollars

Before Medicare

Part D subsidy

Medicare

Part D subsidy

2010 $ 113 $ 13

2011 113 13

2012 111 13

2013 109 14

2014 106 14

2015–2019 479 67

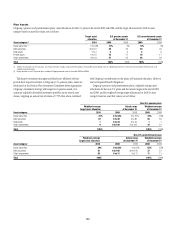

Citigroup 401(k)

Under the Citigroup 401(k) plan, a defined-contribution plan, eligible U.S.

employees received matching contributions up to 6% of their compensation

in 2009, subject to statutory limits. Effective January 7, 2010, the maximum

amount of matching contributions paid on employee deferral contributions

made into this plan will be reduced from 6% to 4% of eligible pay for all

employees. The matching contribution is invested according to participants’

individual elections. Additionally, for eligible employees whose compensation

is $100,000 or less, a fixed contribution of up to 2% of compensation is

provided.

The pretax expense associated with this plan amounted to approximately

$442 million and $580 million in 2009 and 2008, respectively. The decrease

in expense from 2008 to 2009 reflects the reduction in participants due to the

Morgan Stanley Smith Barney joint venture and other reductions in workforce.