Citibank 2009 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

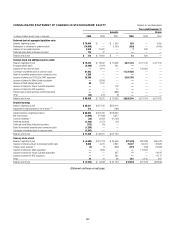

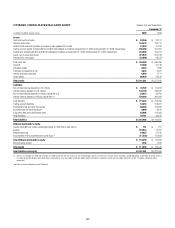

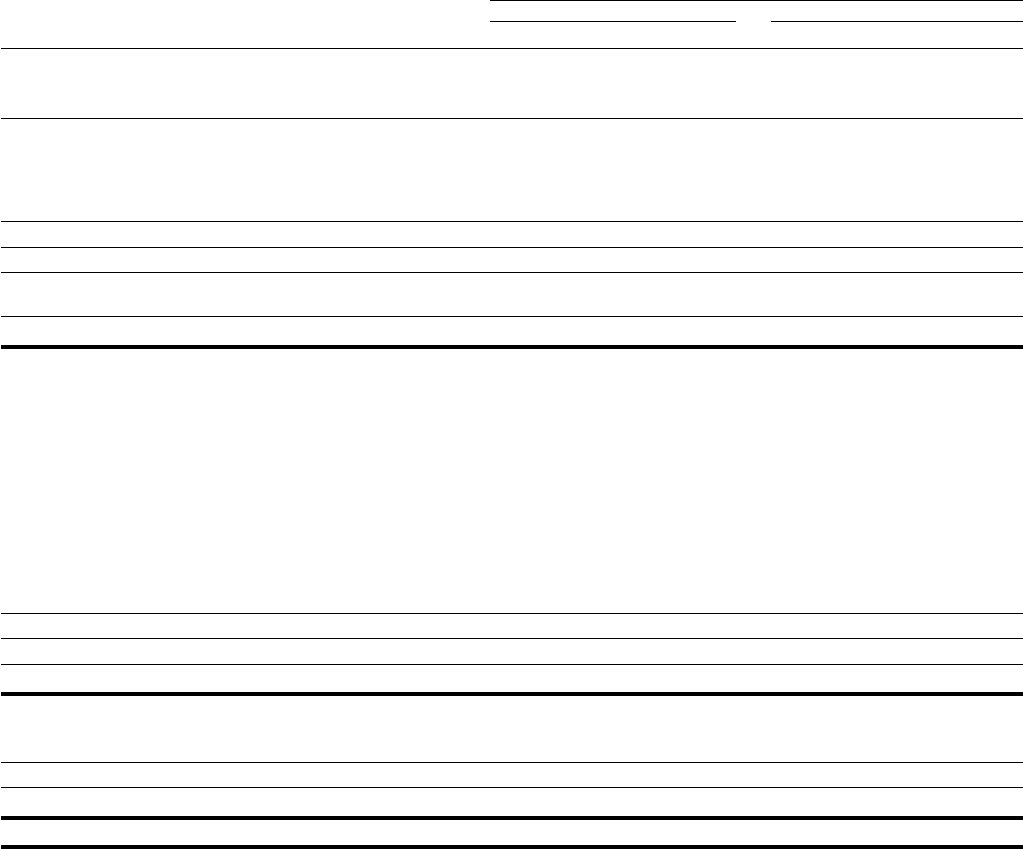

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY Citigroup Inc. and Subsidiaries

(Continued)

Year ended December 31

Amounts Shares

In millions of dollars, except shares in thousands 2009 2008 2007 2009 2008 2007

Accumulated other comprehensive income (loss)

Balance, beginning of year $ (25,195) $ (4,660) $ (3,700)

Adjustment to opening balance, net of taxes (1)(5) (413) — 149

Adjusted balance, beginning of period $ (25,608) $ (4,660) $ (3,551)

Net change in unrealized gains and losses on investment securities, net of taxes 5,713 (10,118) (621)

Net change in cash flow hedges, net of taxes 2,007 (2,026) (3,102)

Net change in foreign currency translation adjustment, net of taxes (203) (6,972) 2,024

Pension liability adjustment, net of taxes (6) (846) (1,419) 590

Net change in Accumulated other comprehensive income (loss) $ 6,671 $ (20,535) $ (1,109)

Balance, end of year $ (18,937) $ (25,195) $ (4,660)

Total Citigroup common stockholders’ equity and common shares

outstanding $152,388 $ 70,966 $113,447 28,483,267 5,450,068 4,994,581

Total Citigroup stockholders’ equity $152,700 $141,630 $113,447

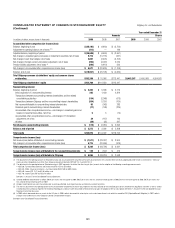

Noncontrolling interest

Balance, beginning of period $ 2,392 $ 5,308 $ 2,713

Initial origination of a noncontrolling interest 285 1,409 2,814

Transactions between noncontrolling interest shareholders and the related

consolidating subsidiary (134) (2,348) (573)

Transactions between Citigroup and the noncontrolling-interest shareholders (354) (1,207) (160)

Net income attributable to noncontrolling-interest shareholders 95 (343) 283

Dividends paid to noncontrolling–interest shareholders (17) (168) (226)

Accumulated other comprehensive income—net change in unrealized gains and

losses on investment securities, net of tax 53 (10)

Accumulated other comprehensive income—net change in FX translation

adjustment, net of tax 39 (167) 140

All other (38) (95) 327

Net change in noncontrolling interests $ (119) $ (2,916) $ 2,595

Balance, end of period $ 2,273 $ 2,392 $ 5,308

Total equity $154,973 $144,022 $118,755

Comprehensive income (loss)

Net income (loss) before attribution of noncontrolling interests $ (1,511) $ (28,027) $ 3,900

Net change in Accumulated other comprehensive income (loss) 6,715 (20,699) (979)

Total comprehensive income (loss) $ 5,204 $ (48,726) $ 2,921

Comprehensive income (loss) attributable to the noncontrolling interests $ 139 $ (507) $ 413

Comprehensive income (loss) attributable to Citigroup $ 5,065 $ (48,219) $ 2,508

(1) The adjustment to the opening balances for Retained earnings and Accumulated other comprehensive income (loss) represents the cumulative effect of initially adopting ASC 320-10-35-34, Investments—Debt and

Equity securities: Recognition of an Other-Than-Temporary Impairment (formerly FSP FAS 115-2 and FAS 124-2).

(2) The adjustment to the opening balance of Retained earnings in 2007 represents the total of the after-tax gain (loss) amounts for the adoption of the following accounting pronouncements:

• ASC 820, Fair Value Measurements and Disclosures (SFAS 157) for $75 million,

• ASC 825-10-05, Financial Instruments—Fair Value Option (SFAS 159) for $(99) million,

• ASC 840, Leases (FSP 13-2) for $(148) million, and

• ASC 740, Income Taxes (FIN 48) for $(14) million.

See Notes 1, 26 and 27 to the Consolidated Financial Statements.

(3) Common dividends declared were as follows: $0.01 per share in the first quarter of 2009, $0.32 per share in the first, second and third quarters of 2008, $0.16 in the fourth quarter of 2008; $0.54 per share in the

first, second, third and fourth quarters of 2007.

(4) All open market repurchases were transacted under an existing authorized share repurchase plan and relate to customer fails/errors.

(5) The after-tax adjustment to the opening balance of Accumulated other comprehensive income (loss) represents the reclassification of the unrealized gains (losses) related to the Legg Mason securities as well as several

miscellaneous items previously reported. The related unrealized gains and losses were reclassified to Retained earnings upon the adoption of the fair value option. See Notes 1, 26 and 27 to the Consolidated Financial

Statements for further discussion.

(6) In 2009, reflects decreased return on assets for the U.S. plan. In 2008, reflects decreased fair value of plan assets and a lower discount rate, which increased the PBO (Projected Benefit Obligation). In 2007, reflects

changes in the funded status of the Company’s pension and postretirement plans.

See Notes to the Consolidated Financial Statements.