Citibank 2009 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.225

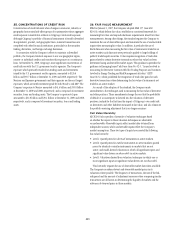

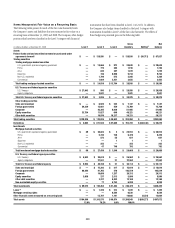

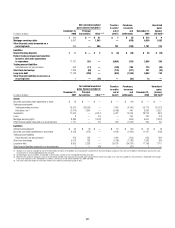

Trading account assets and liabilities—derivatives

Exchange-traded derivatives are generally fair valued using quoted market

(i.e., exchange) prices and so are classified as Level 1 of the fair value

hierarchy.

The majority of derivatives entered into by the Company are executed

over the counter and so are valued using internal valuation techniques as no

quoted market prices exist for such instruments. The valuation techniques

and inputs depend on the type of derivative and the nature of the underlying

instrument. The principal techniques used to value these instruments are

discounted cash flows, Black-Scholes and Monte Carlo simulation. The fair

values of derivative contracts reflect cash the Company has paid or received

(for example, option premiums paid and received).

The key inputs depend upon the type of derivative and the nature of

the underlying instrument and include interest rate yield curves, foreign-

exchange rates, the spot price of the underlying volatility and correlation.

The item is placed in either Level 2 or Level 3 depending on the observability

of the significant inputs to the model. Correlation and items with longer

tenors are generally less observable.

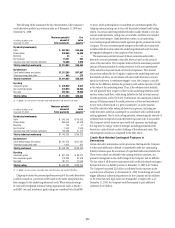

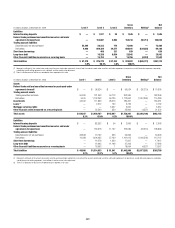

Subprime-related direct exposures in CDOs

The Company accounts for its CDO super-senior subprime direct exposures

and the underlying securities on a fair-value basis with all changes in fair

value recorded in earnings. Citigroup’s CDO super-senior subprime direct

exposures are not subject to valuation based on observable transactions.

Accordingly, the fair value of these exposures is based on management’s

best estimates based on facts and circumstances as of the date of these

Consolidated Financial Statements.

Citigroup’s CDO super-senior subprime direct exposures are Level 3

assets. The valuation of the high-grade and mezzanine ABS CDO positions

uses trader prices based on the underlying assets of each high-grade and

mezzanine ABS CDO. Unlike the ABCP positions, the high-grade and

mezzanine positions are now largely hedged through the ABX and bond short

positions, which are trader priced. This results in closer symmetry in the way

these long and short positions are valued by the Company. Citigroup intends

to use trader marks to value this portion of the portfolio going forward so

long as it remains largely hedged.

The fair values of ABCP positions are based on significant unobservable

inputs. Fair value of these exposures are based on estimates of future cash

flows from the mortgage loans underlying the assets of the ABS CDOs. To

determine the performance of the underlying mortgage loan portfolios,

the Company estimates the prepayments, defaults and loss severities

based on a number of macroeconomic factors, including housing price

changes, unemployment rates, interest rates and borrower and loan

attributes, such as age, credit scores, documentation status, loan-to-value

(LTV) ratios and debt-to-income (DTI) ratios. The model is calibrated

using available mortgage loan information including historical loan

performance. In addition, the methodology estimates the impact of

geographic concentration of mortgages and the impact of reported fraud

in the origination of subprime mortgages. An appropriate discount rate is

then applied to the cash flows generated for each ABCP tranche, in order to

estimate its fair value under current market conditions.

When necessary, the valuation methodology used by Citigroup is refined

and the inputs used for the purposes of estimation are modified, in part,

to reflect ongoing market developments. More specifically, the inputs of

home price appreciation (HPA) assumptions and delinquency data were

updated along with discount rates that are based upon a weighted average

combination of implied spreads from single name ABS bond prices and ABX

indices, as well as CLO spreads under current market conditions.

The housing-price changes were estimated using a forward-looking

projection, which incorporated the Loan Performance Index. In addition, the

Company’s mortgage default model also uses recent mortgage performance

data, a period of sharp home price declines and high levels of mortgage

foreclosures.

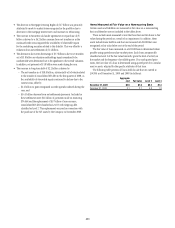

The valuation as of December 31, 2009 assumes that U.S. housing prices

are unchanged in 2010, increase 1.1% in 2011, increase 1.4% in 2012, and

increase 3% from 2013 onwards.

In addition, the discount rates were based on a weighted average

combination of the implied spreads from single name ABS bond prices, ABX

indices and CLO spreads, depending on vintage and asset types. To determine

the discount margin, the Company applies the mortgage default model to the

bonds underlying the ABX indices and other referenced cash bonds and solves

for the discount margin that produces the current market prices of those

instruments.

The primary drivers that currently impact the model valuations are the

discount rates used to calculate the present value of projected cash flows and

projected mortgage loan performance.

For most of the lending and structuring direct subprime exposures

(excluding super seniors), fair value is determined utilizing observable

transactions where available, other market data for similar assets in markets

that are not active and other internal valuation techniques.

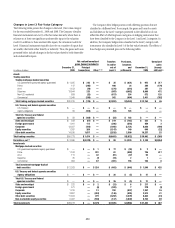

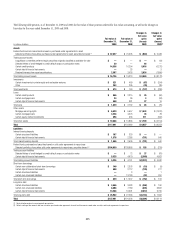

Investments

The investments category includes available-for-sale debt and marketable

equity securities, whose fair value is determined using the same procedures

described for trading securities above or, in some cases, using vendor prices

as the primary source.

Also included in investments are nonpublic investments in private equity

and real estate entities held by the S&B business. Determining the fair

value of nonpublic securities involves a significant degree of management

resources and judgment as no quoted prices exist and such securities are

generally very thinly traded. In addition, there may be transfer restrictions

on private equity securities. The Company uses an established process for

determining the fair value of such securities, using commonly accepted

valuation techniques, including the use of earnings multiples based on

comparable public securities, industry-specific non-earnings-based multiples

and discounted cash flow models. In determining the fair value of nonpublic

securities, the Company also considers events such as a proposed sale of

the investee company, initial public offerings, equity issuances, or other

observable transactions.

Private equity securities are generally classified as Level 3 of the fair value

hierarchy.