Citibank 2009 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142

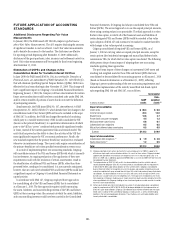

The preceding table reflects: (i) the estimated portion of the assets of

former QSPEs to which Citigroup, acting as principal, had transferred

assets and received sales treatment as of December 31, 2009 (totaling

approximately $712.0 billion), and (ii) the estimated assets of significant

unconsolidated VIEs as of December 31, 2009 with which Citigroup is

involved (totaling approximately $219.2 billion) that are required to be

consolidated under the new accounting standards. Due to the variety of

transaction structures and the level of Citigroup involvement in individual

former QSPEs and VIEs, only a portion of the former QSPEs and VIEs with

which the Company is involved are to be consolidated.

In addition, the cumulative effect of adopting these new accounting

standards as of January 1, 2010, based on financial information as of

December 31, 2009, would result in an estimated aggregate after-tax charge

to Retained earnings of approximately $8.3 billion, reflecting the net effect

of an overall pretax charge to Retained earnings (primarily relating to the

establishment of loan loss reserves and the reversal of residual interests held)

of approximately $13.4 billion and the recognition of related deferred tax

assets amounting to approximately $5.1 billion.

The pro forma impact on certain of Citigroup’s regulatory capital ratios of

adopting these new accounting standards (based on financial information as

of December 31, 2009), reflecting immediate implementation of the recently

issued final risk-based capital rules regarding SFAS 166 and SFAS 167, would

be as follows:

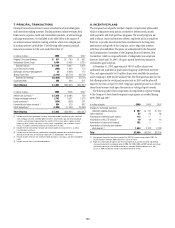

As of December 31, 2009

As reported Pro forma Impact

Tier 1 Capital 11.67% 10.26% (141) bps

Total Capital 15.25% 13.82% (143) bps

The actual impact of adopting the new accounting standards on

January 1, 2010 could differ, as financial information changes from the

December 31, 2009 estimates and as several uncertainties in the application

of these new standards are resolved.

Among these uncertainties, the FASB has proposed an indefinite deferral

of the requirements of SFAS 167 for certain investment companies. Without

the proposed deferral, the Company had most recently estimated that

approximately $3.3 billion of assets held by investment funds managed

by Citigroup would be newly consolidated upon the adoption of SFAS 167.

If the proposed deferral were to be finalized as currently contemplated,

the Company expects that many, if not all, of the investment vehicles

managed by Citigroup would not be subject to the requirements of SFAS

167. Nevertheless, Citigroup is continuing to evaluate the potential impacts

of the proposed requirements and, depending upon the eventual resolution

of specific implementation matters, may be required to consolidate certain

investment vehicles, the aggregate assets of which could range up to a total

of approximately $1.2 billion. The effect on the Company’s regulatory capital

ratios, should consolidation of any or all such noted investment vehicles be

required, is not expected to be significant. The preceding tables reflect the

Company’s view that none of the investment vehicles managed by Citigroup

will be required to be consolidated under SFAS 167.

Loss-Contingency Disclosures

In June 2008, the FASB issued an exposure draft proposing expanded

disclosures regarding loss contingencies. This proposal increases the

number of loss contingencies subject to disclosure and requires substantial

quantitative and qualitative information to be provided about those

loss contingencies. The proposal will have no impact on the Company’s

accounting for loss contingencies.

Investment Company Audit Guide (SOP 07-1)

In July 2007, the AICPA issued Statement of Position 07-1, “Clarification

of the Scope of the Audit and Accounting Guide for Investment Companies

and Accounting by Parent Companies and Equity Method Investors for

Investments in Investment Companies” (SOP 07-1) (now incorporated

into ASC 946-10, Financial Services-Investment Companies), which

was expected to be effective for fiscal years beginning on or after

December 15, 2007. However, in February 2008, the FASB delayed the

effective date indefinitely by issuing an FSP SOP 07-1-1, “Effective Date of

AICPA Statement of Position 07-1.” This statement sets forth more stringent

criteria for qualifying as an investment company than does the predecessor

Audit Guide. In addition, ASC 946-10 (SOP 07-1) establishes new criteria for

a parent company or equity method investor to retain investment company

accounting in their consolidated financial statements. Investment companies

record all their investments at fair value with changes in value reflected

in earnings. The Company is currently evaluating the potential impact of

adopting the SOP.