Citibank 2009 Annual Report Download - page 249

Download and view the complete annual report

Please find page 249 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

239

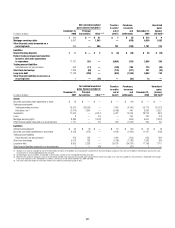

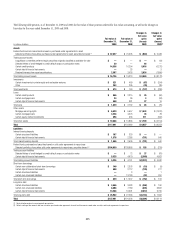

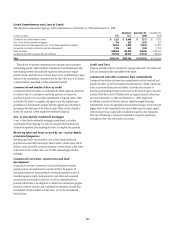

28. FAIR VALUE OF FINANCIAL INSTRUMENTS

Estimated Fair Value of Financial Instruments

The table below presents the carrying value and fair value of Citigroup’s

financial instruments. The disclosure excludes leases, affiliate investments,

pension and benefit obligations and insurance policy claim reserves.

In addition, contract-holder fund amounts exclude certain insurance

contracts. Also as required, the disclosure excludes the effect of taxes, any

premium or discount that could result from offering for sale at one time

the entire holdings of a particular instrument, excess fair value associated

with deposits with no fixed maturity and other expenses that would be

incurred in a market transaction. In addition, the table excludes the values

of non-financial assets and liabilities, as well as a wide range of franchise,

relationship and intangible values (but includes mortgage servicing rights),

which are integral to a full assessment of Citigroup’s financial position and

the value of its net assets.

The fair value represents management’s best estimates based on a

range of methodologies and assumptions. The carrying value of short-term

financial instruments not accounted for at fair value, as well as receivables

and payables arising in the ordinary course of business, approximates fair

value because of the relatively short period of time between their origination

and expected realization. Quoted market prices are used when available

for investments and for both trading and end-user derivatives, as well as

for liabilities, such as long-term debt, with quoted prices. For performing

loans not accounted for at fair value, contractual cash flows are discounted

at quoted secondary market rates or estimated market rates if available.

Otherwise, sales of comparable loan portfolios or current market origination

rates for loans with similar terms and risk characteristics are used. For loans

with doubt as to collectability, expected cash flows are discounted using an

appropriate rate considering the time of collection and the premium for the

uncertainty of the cash flows. This method of estimating fair value does not

incorporate the exit-price concept of fair value prescribed by ASC 820-10

(SFAS No. 157). The value of collateral is also considered. For liabilities such

as long-term debt not accounted for at fair value and without quoted market

prices, market borrowing rates of interest are used to discount contractual

cash flows.

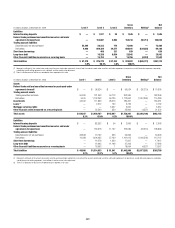

2009 2008

In billions of dollars at year end

Carrying

value

Estimated

fair value

Carrying

value

Estimated

fair value

Assets

Investments $306.1 $307.6 $256.0 $251.9

Federal funds sold and securities

borrowed or purchased under

agreements to resell 222.0 222.0 184.1 184.1

Trading account assets 342.8 342.8 377.6 377.6

Loans (1) 552.5 542.8 660.9 642.7

Other financial assets (2) 290.9 290.9 316.6 316.6

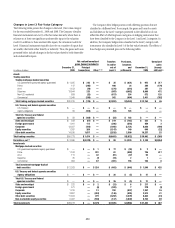

2009 2008

In billions of dollars at year end

Carrying

value

Estimated

fair value

Carrying

value

Estimated

fair value

Liabilities

Deposits $835.9 $834.5 $774.2 $772.9

Federal funds purchased and

securities loaned or sold

under agreements to

repurchase 154.3 154.3 205.3 205.3

Trading account liabilities 137.5 137.5 165.8 165.8

Long-term debt 364.0 354.8 359.6 317.1

Other financial liabilities (3) 175.8 175.8 255.6 255.6

(1) The carrying value of loans is net of the Allowance for loan losses of $36.0 billion for 2009 and $29.6

billion for 2008. In addition, the carrying values exclude $2.9 billion and $3.7 billion of lease finance

receivables in 2009 and 2008, respectively.

(2) Includes cash and due from banks, deposits with banks, brokerage receivables, reinsurance

recoverable, mortgage servicing rights, separate and variable accounts and other financial instruments

included in Other assets on the Consolidated Balance Sheet, for all of which the carrying value is a

reasonable estimate of fair value.

(3) Includes brokerage payables, separate and variable accounts, short-term borrowings and other

financial instruments included in Other liabilities on the Consolidated Balance Sheet, for all of which

the carrying value is a reasonable estimate of fair value.

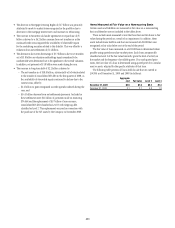

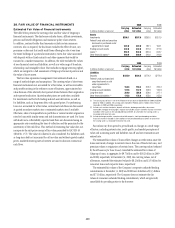

Fair values vary from period to period based on changes in a wide range

of factors, including interest rates, credit quality, and market perceptions of

value and as existing assets and liabilities run off and new transactions are

entered into.

The estimated fair values of loans reflect changes in credit status since the

loans were made, changes in interest rates in the case of fixed-rate loans, and

premium values at origination of certain loans. The carrying values (reduced

by the Allowance for loan losses) exceeded the estimated fair values of

Citigroup’s loans, in aggregate, by $9.7 billion and by $18.2 billion in 2009

and 2008, respectively. At December 31, 2009, the carrying values, net of

allowances, exceeded the estimated values by $8.2 billion and $1.5 billion for

consumer loans and corporate loans, respectively.

The estimated fair values of the Company’s corporate unfunded lending

commitments at December 31, 2009 and 2008 were liabilities of $3.3 billion

and $7.1 billion, respectively. The Company does not estimate the fair

values of consumer unfunded lending commitments, which are generally

cancellable by providing notice to the borrower.