Citibank 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

Citigroup’s businesses may be materially adversely affected

if it is unable to hire and retain qualified employees.

Citigroup’s performance is heavily dependent on the talents and efforts of the

highly skilled individuals that Citigroup is able to attract and retain. Competition

from within the financial services industry and from businesses outside of the

financial services industry for qualified employees has often been intense.

Citigroup is required to comply with the U.S. government’s standards for

executive compensation and related corporate governance set forth in the ARRA

generally for so long as the U.S. government holds certain Citigroup securities.

These standards generally apply to Citigroup’s senior-most executives and

certain other highly compensated employees. The incentive compensation

arrangements for Citigroup’s top 30 most highly compensated employees are

also subject to review under the incentive compensation principles set by the

Federal Reserve Board, in consultation with Citi’s other regulators. In addition,

the U.K. recently imposed a one-time 50% tax on bonuses above a certain

amount paid to employees of banks operating in the country.

Furthermore, the market price of Citigroup common stock has declined

significantly from a closing price of $55.12 on May 25, 2007. Because a

substantial portion of Citigroup’s annual bonus compensation paid to its

senior employees has been paid in the form of equity, such awards may not

be as valuable from a compensatory or retention perspective.

There can be no assurance that, as a result of these restrictions, or

any potential future compensation restrictions or guidelines imposed on

Citigroup, Citigroup will be able to attract new employees and retain and

motivate its existing employees, which may in turn affect its ability to

compete effectively in its businesses, manage its businesses effectively and

expand into new businesses and geographic regions.

Failure to maintain the value of the Citigroup brand may

adversely affect its businesses.

Citigroup’s success depends on the continued strength and recognition of the

Citigroup brand on a global basis. The Citi name is integral to its business

as well as to the implementation of its strategy for expanding its businesses,

including outside the U.S. Maintaining, promoting and positioning the

Citigroup brand will depend largely on the success of its ability to provide

consistent, high-quality financial services and products to its clients around

the world. Citigroup’s brand could be adversely affected if it fails to achieve

these objectives or if its public image or reputation were to be tarnished by

negative views about Citigroup or the financial services industry in general,

or by a negative perception of Citigroup’s short-term or long-term financial

prospects. Any of these events could have a material adverse effect on

Citigroup’s businesses.

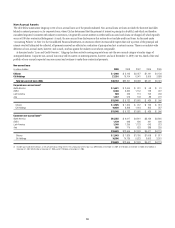

Although Citigroup currently believes it is “well

capitalized,” its capitalization may not prove to be

sufficiently consistent with its risk profile or sufficiently

robust relative to future capital requirements.

Citigroup’s capital management framework is designed to ensure that Citigroup

and its principal subsidiaries maintain sufficient capital consistent with

Citigroup’s risk profile, all applicable regulatory standards and guidelines as

well as external rating agency conditions. Citigroup is subject to the risk based

capital guidelines issued by the Federal Reserve Board. Capital adequacy is

measured, in part, based on two risk based capital ratios, the Tier 1 Capital

and Total Capital (Tier 1 Capital plus Tier 2 Capital) ratios. In conjunction

with the conclusion of the Supervisory Capital Assessment Program (SCAP),

U.S. banking regulators developed a new measure of capital called Tier 1

Common. While Tier 1 Common and related ratios are measures used and

relied on by U.S. banking regulators, they are non-GAAP financial measures

for SEC purposes. See “Capital Resources and Liquidity” above for additional

information on these metrics. Citigroup is also subject to a Leverage ratio

requirement, a non-risk-based measure of capital adequacy. For additional

information on these capital adequacy metrics, including the estimated impact

to Citi’s capital ratios of adopting SFAS 166 and SFAS 167 as of January 1, 2010,

see “Capital Resources and Liquidity—Capital Resources.”

To be “well capitalized” under U.S. federal bank regulatory agency

definitions, a bank holding company must have a Tier 1 Capital ratio of at

least 6%, a Total Capital ratio of at least 10% and a Leverage ratio of at least

3%, and not be subject to a Federal Reserve Board directive to maintain higher

capital levels. As of December 31, 2009, Citigroup was “well capitalized,” with

a Tier 1 Capital ratio of 11.7%, a Total Capital ratio of 15.2% and a Leverage

ratio of 6.9%, as well as a Tier 1 Common ratio of 9.6%. There can be no

assurance, however, that Citigroup will be able to maintain sufficient capital

consistent with its risk profile or remain “well capitalized.” Moreover, the

various regulators in the U.S. and abroad have not reached consensus as to

the appropriate level of capitalization for financial services institutions such

as Citigroup. These regulators, including the Federal Reserve Board, may alter

the current regulatory capital requirements to which Citigroup is subject and

thereby necessitate equity increases that could dilute existing stockholders,

lead to required asset sales or adversely impact the availability of Citi’s DTAs, as

described above, among other issues.

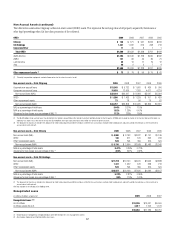

In addition, Citigroup could adopt the provisions of the Basel II regulatory

capital framework as early as April 1, 2011. This new regulatory capital

framework is likely to result in a need for Citigroup to hold additional

regulatory capital. If market conditions do not improve, the capital

requirements of Basel II could increase prior to scheduled implementation in

2011, further increasing the amount of capital needed by Citi. The new rules

could also result in changes in Citigroup’s funding mix, resulting in lower

net income and/or continued shrinking of the balance sheet. Separate from

the above Basel II rules for credit and operational risk, the Basel Committee

on Banking Supervision has also proposed revisions to the market risk

framework that could also lead to additional capital requirements. Although

not yet ratified by the U.S. regulators, the Basel II rules for market risk are

currently scheduled for January 1, 2011, one quarter ahead of Citigroup’s

earliest date for Basel II implementation for credit and operational risk.