Citibank 2009 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

183

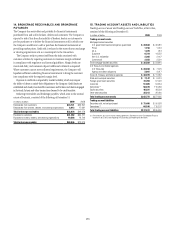

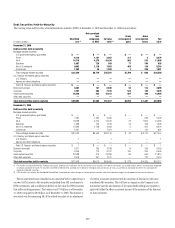

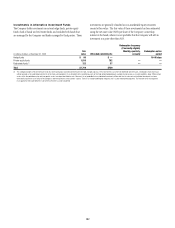

17. LOANS

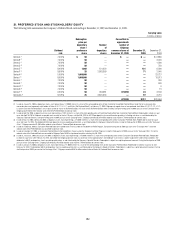

In millions of dollars at year end 2009 (1) 2008 (1)

Consumer

In U.S. offices

Mortgage and real estate (2) $183,842 $219,482

Installment and other 58,099 64,319

Cards 28,951 44,418

Commercial and industrial 5,640 7,041

Lease financing 11 31

$276,543 $335,291

In offices outside the U.S.

Mortgage and real estate (2) $ 47,297 $ 44,382

Installment, revolving credit and other 42,805 41,272

Cards 41,493 42,586

Commercial and industrial 14,780 16,814

Lease financing 331 304

$146,706 $145,358

Total consumer loans $423,249 $480,649

Net unearned income 808 738

Consumer loans, net of unearned income $424,057 $481,387

Corporate

In U.S. offices

Commercial and industrial $ 15,614 $ 26,447

Loans to financial institutions 6,947 10,200

Mortgage and real estate (2) 22,560 28,043

Installment, revolving credit and other (3) 17,737 22,050

Lease financing 1,297 1,476

$ 64,155 $ 88,216

In offices outside the U.S.

Commercial and industrial $ 68,467 $ 79,809

Installment and other 9,683 17,441

Mortgage and real estate (2) 9,779 11,375

Loans to financial institutions 15,113 18,413

Lease financing 1,295 1,850

Governments and official institutions 1,229 385

$105,566 $129,273

Total corporate loans $169,721 $217,489

Net unearned income (4) (2,274) (4,660)

Corporate loans, net of unearned income $167,447 $212,829

(1) The Company classifies consumer and corporate loans based on the segment and sub-segment that

manages the loans. See Note 1 to the Consolidated Financial Statements.

(2) Loans secured primarily by real estate.

(3) Includes loans not otherwise separately categorized.

(4) The unearned income in 2008 includes loans that were transferred in that period from the held-for-sale

category to the held-for-investment category at a discount to par.

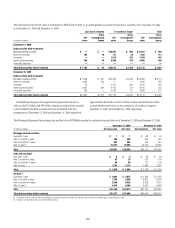

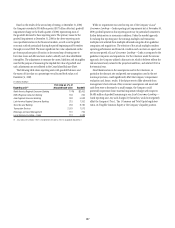

Included in the previous loan table are lending products whose terms

may give rise to additional credit issues. Credit cards with below-market

introductory interest rates, multiple loans supported by the same collateral

(e.g., home equity loans), and interest-only loans are examples of such

products. However, these products are not material to Citigroup’s financial

position and are closely managed via credit controls that mitigate their

additional inherent risk.

Impaired loans are those where Citigroup believes it is probable that it

will not collect all amounts due according to the original contractual terms

of the loan. Impaired loans include corporate non-accrual loans as well as

smaller-balance homogeneous loans whose terms have been modified due

to the borrower’s financial difficulties and Citigroup granted a concession to

the borrower. Such modifications may include interest rate reductions and/

or principal forgiveness. Valuation allowances for these loans are estimated

considering all available evidence including, as appropriate, the present

value of the expected future cash flows discounted at the loan’s original

contractual effective rate, the secondary market value of the loan and the fair

value of collateral less disposal costs. These totals exclude smaller-balance

homogeneous loans that have not been modified and are carried on a non-

accrual basis, as well as substantially all loans modified for periods of 12

months or less. At December 31, 2009, loans included in those short-term

programs amounted to $10.1 billion.

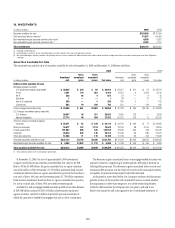

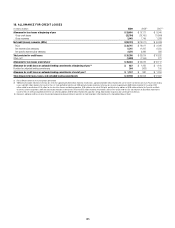

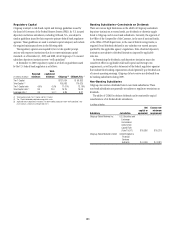

The following table presents information about impaired loans:

In millions of dollars at year end 2009 2008 2007

Impaired corporate loans

Commercial and industrial $ 6,413 $ 6,327 $ 246

Loans to financial institutions 1,794 2,635 1,122

Mortgage and real estate 4,051 407 59

Lease financing —35 —

Other 1,287 328 238

Total impaired corporate loans $13,545 $ 9,732 $ 1,665

Impaired consumer loans (1)

Mortgage and real estate $10,629 $ 5,023 $ 201

Installment and other 3,853 2,903 40

Cards 2,453 1,085 —

Total impaired consumer loans $16,935 $ 9,011 $ 241

Total (2) $30,480 $18,743 $ 1,906

Impaired corporate loans with valuation allowances $ 8,578 $ 7,300 $ 1,314

Impaired consumer loans with valuation allowances 16,453 8,573 —

Impaired corporate valuation allowance $ 2,480 $ 2,698 $ 388

Impaired consumer valuation allowance 4,977 2,373 —

Total valuation allowances (3) $ 7,457 $ 5,071 $ 388

During the year

Average balance of impaired corporate loans $12,990 $ 4,157 $ 967

Average balance of impaired consumer loans 14,049 5,266 —

Interest income recognized on

Impaired corporate loans $ 21 $ 49 $ 101

Impaired consumer loans 792 $ 276 —

(1) Prior to 2008, the Company’s financial accounting systems did not separately track impaired smaller-

balance, homogeneous consumer loans whose terms were modified due to the borrowers’ financial

difficulties and it was determined that a concession was granted to the borrower. At December 31,

2009 and 2008, such modified impaired consumer loans amounted to $15.899 and $8.151 billion,

respectively. However, information derived from the Company’s risk management systems indicates

that the amounts of such outstanding modified loans, including those modified prior to 2008,

approximated $18.1 billion, $12.3 billion and $7.0 billion at December 31, 2009, 2008 and 2007,

respectively.

(2) Excludes loans purchased for investment purposes.

(3) Included in the Allowance for loan losses.