Citibank 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

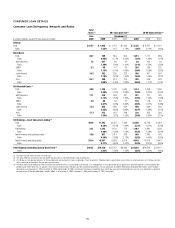

65

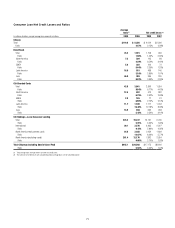

Details of Credit Loss Experience

In millions of dollars at year end 2009 2008 2007 2006 2005

Allowance for loan losses at beginning of year $29,616 $16,117 $ 8,940 $ 9,782 $11,269

Provision for loan losses

Consumer $32,418 $27,942 $15,660 $ 6,129 $ 7,149

Corporate 6,342 5,732 1,172 191 (295)

$38,760 $33,674 $16,832 $ 6,320 $ 6,854

Gross credit losses

Consumer

In U.S. offices $17,637 $11,624 $ 5,765 $ 4,413 $ 5,829

In offices outside the U.S. 8,834 7,172 5,165 3,932 2,964

Corporate

Mortgage and real estate

In U.S. offices 592 56 1 — —

In offices outside the U.S. 151 37 3 1 —

Governments and official institutions outside the U.S. —3 — — —

Loans to financial institutions

In U.S. offices 274 ————

In offices outside the U.S. 246 463 69 6 10

Commercial and industrial

In U.S. offices 3,299 627 635 85 78

In offices outside the U.S. 1,751 778 226 203 287

$32,784 $20,760 $11,864 $ 8,640 $ 9,168

Credit recoveries

Consumer

In U.S. offices $ 576 $ 585 $ 695 $ 646 $ 1,007

In offices outside the U.S. 1,089 1,050 966 897 693

Corporate

Mortgage and real estate

In U.S. offices 3— 3 5 —

In offices outside the U.S. 11 — 18 5

Governments and official institutions outside the U.S. —— 4 7 55

Loans to financial institutions

In U.S. offices —————

In offices outside the U.S. 11 2 1 4 15

Commercial and industrial

In U.S. offices 276 6 49 20 104

In offices outside the U.S. 87 105 220 182 473

$ 2,043 $ 1,749 $ 1,938 $ 1,779 $ 2,352

Net credit losses

In U.S. offices $20,947 $11,716 $ 5,654 $ 3,827 $ 4,796

In offices outside the U.S. 9,794 7,295 4,272 3,034 2,020

Total $30,741 $19,011 $ 9,926 $ 6,861 $ 6,816

Other—net (1) $ (1,602) $ (1,164) $ 271 $ (301) $ (1,525)

Allowance for loan losses at end of year $36,033 $29,616 $16,117 $ 8,940 $ 9,782

Allowance for unfunded lending commitments (2) $ 1,157 $ 887 $ 1,250 $ 1,100 $ 850

Total allowance for loans, leases and unfunded lending commitments $37,190 $30,503 $17,367 $10,040 $10,632

Net consumer credit losses $24,806 $17,161 $ 9,269 $ 6,802 $ 7,093

As a percentage of average consumer loans 5.44% 3.34% 1.87% 1.52% 1.76%

Net corporate credit losses (recoveries) $ 5,935 $ 1,850 $ 657 $ 59 $ (277)

As a percentage of average corporate loans 3.12% 0.84% 0.30% 0.05% NM

Allowance for loan losses at end of period (3)

Citicorp $10,066 $ 7,684 $ 4,910

Citi Holdings 25,967 21,932 11,207

Total Citigroup $36,033 $29,616 $16,117

(1) 2009 primarily includes reductions to the loan loss reserve of approximately $543 million related to securitizations, approximately $402 million related to the sale or transfers to held-for-sale of U.S. real estate lending

loans, and $562 million related to the transfer of the U.K. cards portfolio to held-for-sale. 2008 primarily includes reductions to the loan loss reserve of approximately $800 million related to FX translation, $102

million related to securitizations, $244 million for the sale of the German retail banking operation, $156 million for the sale of CitiCapital, partially offset by additions of $106 million related to the Cuscatlán and Bank

of Overseas Chinese acquisitions. 2007 primarily includes reductions to the loan loss reserve of $475 million related to securitizations and transfers to loans held-for-sale, and reductions of $83 million related to

the transfer of the U.K. CitiFinancial portfolio to held-for-sale, offset by additions of $610 million related to the acquisitions of Egg, Nikko Cordial, Grupo Cuscatlán and Grupo Financiero Uno. 2006 primarily includes

reductions to the loan-loss reserve of $429 million related to securitizations and portfolio sales and the addition of $84 million related to the acquisition of the CrediCard portfolio. 2005 primarily includes reductions

to the loan loss reserve of $584 million related to securitizations and portfolio sales, a reduction of $110 million related to purchase accounting adjustments from the KorAm acquisition, and a reduction of $90 million

from the sale of CitiCapital’s transportation portfolio.

(2) Represents additional credit loss reserves for unfunded lending commitments and letters of credit recorded in Other Liabilities on the Consolidated Balance Sheet.

(3) Allowance for loan losses represents management’s best estimate of probable losses inherent in the portfolio, as well as probable losses related to large individually evaluated impaired loans and troubled debt

restructurings. See “Significant Accounting Policies and Significant Estimates.” Attribution of the allowance is made for analytical purposes only, and the entire allowance is available to absorb probable credit losses

inherent in the overall portfolio.