Citibank 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

the counterparties. Therefore, the CVA (both counterparty and own-credit)

may not be realized upon a settlement or termination in the normal course

of business. In addition, all or a portion of the credit valuation adjustments

may be reversed or otherwise adjusted in future periods in the event of

changes in the credit risk of Citi or its counterparties, or changes in the credit

mitigants (collateral and netting agreements) associated with the derivative

instruments. Historically, Citigroup’s credit spreads have moved in tandem

with general counterparty credit spreads, thus providing offsetting CVAs

affecting revenue. However, in the fourth quarter of 2008, Citigroup’s credit

spreads generally narrowed and counterparty credit spreads widened, each

of which negatively affected revenues in 2008. During 2009, both Citigroup’s

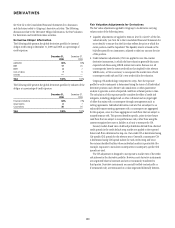

and counterparty credit spreads narrowed. The table below summarizes the

CVA applied to the fair value of derivative instruments as of December 31,

2009 and 2008.

Credit valuation adjustment

Contra-liability (contra-asset)

In millions of dollars

December 31,

2009

December 31,

2008

Non-monoline counterparties $(2,483) $(8,266)

Citigroup (own) 1,349 3,646

Net non-monoline CVA $(1,134) $(4,620)

Monoline counterparties (1) (5,580) (4,279)

Total CVA—derivative instruments $(6,714) $(8,899)

(1) Certain derivatives with monoline counterparties were terminated during 2008.

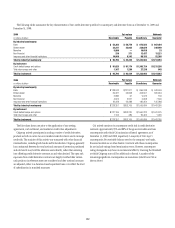

The table below summarizes pretax gains (losses) related to changes in

credit valuation adjustments on derivative instruments for the years ended

December 31, 2009 and 2008:

Credit valuation

adjustment gain

(loss)

In millions of dollars 2009 2008

Non-monoline counterparties $ 5,783 $ (6,653)

Citigroup (own) (2,297) 2,303

Net non-monoline CVA $ 3,486 $ (4,350)

Monoline counterparties (1,301) (5,736)

Total CVA—derivative instruments $ 2,185 $ (10,086)

The credit valuation adjustment amounts shown above relate solely to the

derivative portfolio, and do not include:

Own-credit adjustments for non-derivative liabilities measured at fair •

value under the fair value option. See Note 26 to the Consolidated

Financial Statements for further information.

The effect of counterparty credit risk embedded in non-derivative •

instruments. During 2008 and 2009 a range of financial instruments.

Losses on non-derivative instruments, such as bonds and loans, related to

counterparty credit risk are not included in the table above.

Credit Derivatives

Citigroup makes markets in and trades a range of credit derivatives, both

on behalf of clients as well as for its own account. Through these contracts

Citigroup either purchases or writes protection on either a single-name or

portfolio basis. Citi uses credit derivatives to help mitigate credit risk in its

corporate loan portfolio and other cash positions, to take proprietary trading

positions, and to facilitate client transactions.

Credit derivatives generally require that the seller of credit protection

make payments to the buyer upon the occurrence of predefined events

(settlement triggers). These settlement triggers, which are defined by the

form of the derivative and the referenced credit, are generally limited to

the market standard of failure to pay on indebtedness and bankruptcy (or

comparable events) of the reference credit and, in a more limited range of

transactions, debt restructuring.

Credit derivative transactions referring to emerging market reference

credits will also typically include additional settlement triggers to cover

the acceleration of indebtedness and the risk of repudiation or a payment

moratorium. In certain transactions on a portfolio of referenced credits

or asset-backed securities, the seller of protection may not be required

to make payment until a specified amount of losses has occurred with

respect to the portfolio and/or may only be required to pay for losses up to

a specified amount.