Citibank 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

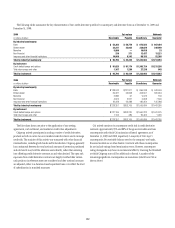

The preceding table reflects (i) the estimated portion of the assets of

former QSPEs to which Citigroup, acting as principal, had transferred

assets and received sales treatment as of December 31, 2009 (totaling

approximately $712.0 billion), and (ii) the estimated assets of significant

unconsolidated VIEs as of December 31, 2009 with which Citigroup is

involved (totaling approximately $219.2 billion) that are required to be

consolidated under the new accounting standards. Due to the variety of

transaction structures and the level of Citigroup involvement in individual

former QSPEs and VIEs, only a portion of the former QSPEs and VIEs with

which Citi is involved are to be consolidated.

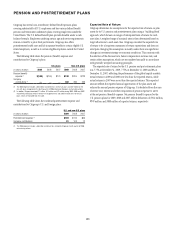

In addition, the cumulative effect of adopting these new accounting

standards as of January 1, 2010, based on financial information as of

December 31, 2009, would result in an estimated aggregate after-tax charge

to Retained earnings of approximately $8.3 billion, reflecting the net effect

of an overall pretax charge to Retained earnings (primarily relating to the

establishment of loan loss reserves and the reversal of residual interests held)

of approximately $13.4 billion and the recognition of related deferred tax

assets amounting to approximately $5.1 billion.

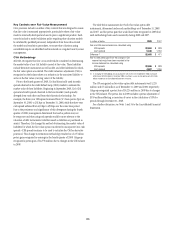

The pro forma impact on certain of Citigroup’s regulatory capital

ratios of adopting these new accounting standards (based on financial

information as of December 31, 2009), reflecting immediate implementation

of the recently issued final risk-based capital rules regarding SFAS 166 and

SFAS 167, would be as follows:

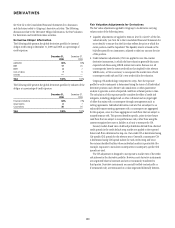

As of December 31, 2009

As reported Pro forma Impact

Tier 1 Capital 11.67% 10.26% (141) bps

Total Capital 15.25% 13.82% (143) bps

The actual impact of adopting the new accounting standards on January

1, 2010 could differ, as financial information changes from the December 31,

2009 estimates and as several uncertainties in the application of these new

standards are resolved.

Among these uncertainties, the FASB has proposed an indefinite deferral

of the requirements of SFAS 167 for certain investment companies. Without

the proposed deferral, Citi had most recently estimated that approximately

$3.3 billion of assets held by investment funds managed by Citigroup would

be newly consolidated upon the adoption of SFAS 167. If the proposed deferral

were to be finalized as currently contemplated, Citi expects that many, if not

all, of the investment vehicles managed by Citigroup would not be subject

to the requirements of SFAS 167. Nevertheless, Citigroup is continuing to

evaluate the potential impacts of the proposed requirements and, depending

upon the eventual resolution of specific implementation matters, may be

required to consolidate certain investment vehicles, the aggregate assets of

which could range up to a total of approximately $1.2 billion. The effect

on Citi’s regulatory capital ratios, should consolidation of any or all such

noted investment vehicles be required, is not expected to be significant.

The preceding tables reflect Citi’s view that none of the investment vehicles

managed by Citigroup will be required to be consolidated under SFAS 167.

Proposed Changes to FDIC “Safe Harbor” Securitization

Rule

As described above, FASB’s issuance of SFAS Nos. 166 and 167, effective

starting in the first quarter of 2010, will result in the loss of GAAP sale

treatment in certain credit card and other securitization transactions and

the consolidation of the assets of such transactions into the assets of the

sponsoring entity. This development has raised concerns regarding effects

under the FDIC’s current “safe harbor” securitization rule. Under the current

rule, if a securitization is accounted for as a sale for GAAP purposes and

certain other conditions are satisfied, the FDIC, as conservator or receiver

of an insolvent bank, will treat the transferred assets as sold and surrender

any right to reclaim the assets transferred in the securitization. If securitized

assets are at risk of seizure by the FDIC in cases of conservatorship or

receivership, the credit treatment of the securitized transactions would be

impacted by the credit status of the sponsoring bank; for example, the highest

credit rating for a securitization transaction may be limited by the credit

rating of the sponsoring bank.

On November 12, 2009, the FDIC amended its securitization rule on an

interim basis so that it will continue to apply to assets transferred in securities

transactions completed on or prior to March 31, 2010 if the transfers would

have satisfied the conditions for GAAP sale treatment in effect for reporting

periods prior to November 15, 2009. The FDIC is currently engaged in

a rulemaking process regarding this issue, and the ultimate outcome is

unknown. If Citi is unwilling or unable to meet the conditions of any final

rule, the highest credit rating of securities issued in its credit card and certain

other securitization transactions may be limited to its then-current rating,

and Citi may engage in a reduced level of such transactions.