Citibank 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

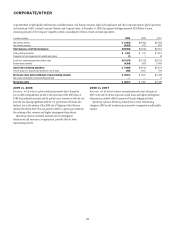

The following table presents the estimated sensitivity of Citigroup’s and

Citibank, N.A.’s capital ratios to changes of $100 million in Tier 1 Common,

Tier 1 Capital, or Total Capital (numerator), or changes of $1 billion in

risk-weighted assets or adjusted average total assets (denominator) based on

financial information as of December 31, 2009. This information is provided

for the purpose of analyzing the impact that a change in Citigroup’s and

Citibank, N.A.’s financial position or results of operations could have on these

ratios. These sensitivities only consider a single change to either a component

of capital, risk-weighted assets, or adjusted average total assets. Accordingly,

an event that affects more than one factor may have a larger basis point

impact than is reflected in this table.

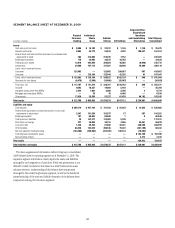

Tier 1 Common ratio Tier 1 Capital ratio Total Capital ratio Leverage ratio

Impact of $100

million change in

Tier 1 Common

Impact of $1

billion change in

risk-weighted

assets

Impact of $100

million change

in Tier 1 Capital

Impact of $1

billion change in

risk-weighted

assets

Impact of $100

million change

in Total Capital

Impact of $1

billion change in

risk-weighted

assets

Impact of $100

million change

in Tier 1 Capital

Impact of $1

billion change

in adjusted

average total

assets

Citigroup 0.9 bps 0.9 bps 0.9 bps 1.1 bps 0.9 bps 1.4 bps 0.5 bps 0.4 bps

Citibank, N.A. — — 1.4 bps 1.8 bps 1.4 bps 2.0 bps 0.9 bps 0.7 bps

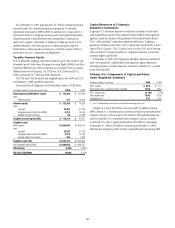

Broker-Dealer Subsidiaries

At December 31, 2009, Citigroup Global Markets Inc., a broker-dealer

registered with the SEC that is an indirect wholly owned subsidiary of

Citigroup Global Markets Holdings Inc., had net capital, computed in

accordance with the SEC’s net capital rule, of $10.9 billion, which exceeded

the minimum requirement by $10.2 billion.

In addition, certain of Citi’s broker-dealer subsidiaries are subject to

regulation in the other countries in which they do business, including

requirements to maintain specified levels of net capital or its equivalent.

Citigroup’s broker-dealer subsidiaries were in compliance with their capital

requirements at December 31, 2009. The requirements applicable to these

subsidiaries in the U.S. and other jurisdictions may be subject to political

uncertainty and potential change in light of the recent financial crisis and

regulatory reform proposals currently being considered at both the legislative

and regulatory levels.

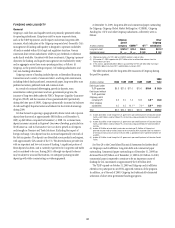

Regulatory Capital Standards Developments

Citigroup supports the move to a new set of risk-based capital standards,

published on June 26, 2004 (and subsequently amended in November 2005)

by the Basel Committee on Banking Supervision, consisting of central banks

and bank supervisors from 13 countries. The international version of the

Basel II framework will allow Citigroup to leverage internal risk models used

to measure credit, operational, and market risk exposures to drive regulatory

capital calculations.

On December 7, 2007, the U.S. banking regulators published the rules for

large banks to comply with Basel II in the U.S. These rules require Citigroup,

as a large and internationally active bank, to comply with the most advanced

Basel II approaches for calculating credit and operational risk capital

requirements. The U.S. implementation timetable consists of a parallel

calculation period under the current regulatory capital regime (Basel I) and

Basel II, starting anytime between April 1, 2008 and April 1, 2010, followed

by a three-year transition period, typically starting 12 months after the

beginning of parallel reporting. U.S. regulators have reserved the right to

change how Basel II is applied in the U.S. following a review at the end of

the second year of the transitional period, and to retain the existing prompt

corrective action and leverage capital requirements applicable to banking

organizations in the U.S. Citigroup intends to implement Basel II within

the timeframe required by the final rules. The Basel II (or its successor)

requirements are the subject of political uncertainty and potential tightening

or other change in light of the recent financial crisis and regulatory reform

proposals currently being considered at both the legislative and regulatory

levels. See also “Risk Factors.”