Citibank 2009 Annual Report Download - page 257

Download and view the complete annual report

Please find page 257 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

247

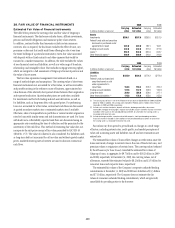

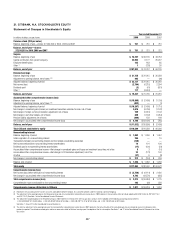

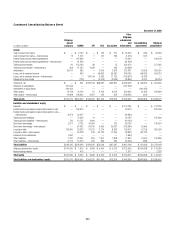

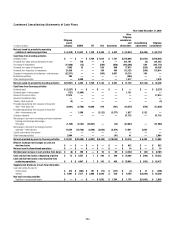

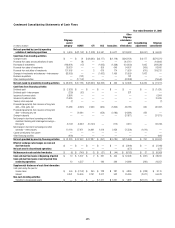

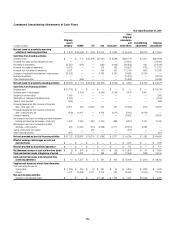

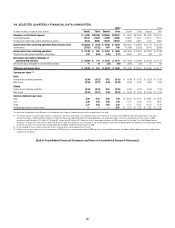

31. CITIBANK, N.A. STOCKHOLDER’S EQUITY

Statement of Changes in Stockholder’s Equity

Year ended December 31

In millions of dollars, except shares 2009 2008 2007

Common stock ($20 par value)

Balance, beginning of year—shares: 37,534,553 in 2009, 2008 and 2007 $ 751 $ 751 $ 751

Balance, end of year—shares:

37,534,553 in 2009, 2008 and 2007 $ 751 $ 751 $ 751

Surplus

Balance, beginning of year $ 74,767 $ 69,135 $ 43,753

Capital contribution from parent company 32,992 6,177 25,267

Employee benefit plans 163 183 85

Other (1) 1(728) 30

Balance, end of year $107,923 $ 74,767 $ 69,135

Retained earnings

Balance, beginning of year $ 21,735 $ 31,915 $ 30,358

Adjustment to opening balance, net of taxes (2)(3) 402 — (96)

Adjusted balance, beginning of period $ 22,137 $ 31,915 $ 30,262

Net income (loss) (2,794) (6,215) 2,304

Dividends paid (3) (41) (651)

Other (1) 117 (3,924) —

Balance, end of year $ 19,457 $ 21,735 $ 31,915

Accumulated other comprehensive income (loss)

Balance, beginning of year $ (15,895) $ (2,495) $ (1,709)

Adjustment to opening balance, net of taxes (2)(4) (402) — (1)

Adjusted balance, beginning of period $ (16,297) $ (2,495) $ (1,710)

Net change in unrealized gains (losses) on investment securities available-for-sale, net of taxes 3,675 (6,746) (1,142)

Net change in foreign currency translation adjustment, net of taxes 709 (5,651) 2,143

Net change in cash flow hedges, net of taxes 880 (1,162) (1,954)

Pension liability adjustment, net of taxes (499) 159 168

Net change in accumulated other comprehensive income (loss) $ 4,765 $ (13,400) $ (785)

Balance, end of year $ (11,532) $ (15,895) $ (2,495)

Total Citibank stockholder’s equity $116,599 $ 81,358 $ 99,306

Noncontrolling interest

Balance, beginning of period $ 1,082 $ 1,266 $ 1,057

Initial origination of a noncontrolling interest 284 — 15

Transactions between noncontrolling interest and the related consolidating subsidiary (130) — —

Net income attributable to noncontrolling interest shareholders 74 101 126

Dividends paid to noncontrolling interest shareholders (17) (120) (54)

Accumulated other comprehensive income—Net change in unrealized gains and losses on investment securities, net of tax 53 (10)

Accumulated other comprehensive income—Net change in FX translation adjustment, net of tax 23 (173) 140

All other (27) 5 (8)

Net change in noncontrolling interest $ 212 $ (184) $ 209

Balance, end of period $ 1,294 $ 1,082 $ 1,266

Total equity $117,893 $ 82,440 $100,572

Comprehensive income (loss)

Net income (loss) before attribution of noncontrolling interest $ (2,720) $ (6,114) $ 2,430

Net change in accumulated other comprehensive income (loss) 4,793 (13,570) (655)

Total comprehensive income (loss) $ 2,073 $ (19,684) $ 1,775

Comprehensive income attributable to the noncontrolling interest 102 (69) 256

Comprehensive income attributable to Citibank $ 1,971 $ (19,615) $ 1,519

(1) Represents the accounting for the transfers of assets and liabilities between Citibank, N.A. and other affiliates under the common control of Citigroup.

(2) The adjustment to the opening balances for Retained earnings and Accumulated other comprehensive income (loss) in 2009 represents the cumulative effect of initially adopting ASC 320-10-35-34 (FSP FAS 115-2

and FAS 124-2). See Note 1 to the Consolidated Financial Statements.

(3) The adjustment to opening balance for Retained earnings in 2007 represents the total of the after-tax gain (loss) amounts for the adoption of the following accounting pronouncements:

• ASC 820 (SFAS 157) for $9 million, • ASC 825 (SFAS 159) for $15 million, • ASC 840 (FSP 13-2) for $(142) million, and • ASC 740 (FIN 48) for $22 million.

See Notes 1, 26 and 27 to the Consolidated Financial Statements.

(4) The after-tax adjustment to the opening balance of Accumulated other comprehensive income (loss) in 2007 represents the reclassification of the unrealized gains (losses) related to several miscellaneous items

previously reported. The related unrealized gains and losses were reclassified to Retained earnings upon the adoption of the fair-value option. See Notes 1 and 27 to the Consolidated Financial Statements for further

discussions.