Citibank 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Stress Testing

Simulated liquidity stress testing is periodically performed for each major

operating subsidiary and/or country. Stress testing / scenario analyses are

intended to quantify the likely impact of an event on the balance sheet and

liquidity position and to identify viable funding alternatives that can be

utilized in a liquidity event. A variety of firm-specific and market-related

scenarios are used at the consolidated level and in individual countries.

These scenarios include assumptions about significant changes in key

funding sources, credit ratings, contingent uses of funding, and political

and economic conditions in certain countries. The results of stress tests of

individual countries and operating subsidiaries are reviewed to ensure that

each individual major operating subsidiary or country is either self-funded

or a net provider of liquidity. In addition, a Contingency Funding Plan is

prepared on a periodic basis for Citigroup. The plan includes detailed policies,

procedures, roles and responsibilities, and the results of corporate stress tests.

The product of these stress tests is a series of alternatives that can be used by

the Treasurer in a liquidity event.

As a result of the recent financial crisis, Citigroup increased the frequency,

duration, and severity of certain stress testing, particularly related to the

interconnection of idiosyncratic and systemic risk. Citigroup, the parent

holding company, CGMHI and Citigroup’s largest bank entities perform their

key stress tests at a minimum on a monthly basis. In addition, in conformity

with recommendations made by the Credit Risk Management Policy Group,

Citigroup calculates a stressed 30-day maximum cash outflow compared

with its liquidity resources for some of its key operating entities. This 30-day

maximum cash outflow is performed on a daily basis. For other entities, stress

testing is performed at a minimum on a quarterly basis.

Market Triggers

Market triggers are internal or external market or economic factors that

may imply a change to market liquidity or Citigroup’s access to the markets.

Citigroup market triggers are monitored by the Treasurer and the head of risk

architecture and are presented to the FinALCO.

Appropriate market triggers are also established and monitored for each

major operating subsidiary and/or country. Local triggers are reviewed with

the local country or business Asset and Liability Committee and independent

risk management.

Credit Ratings

Citigroup’s ability to access the capital markets and other sources of funds, as

well as the cost of these funds and its ability to maintain certain deposits, is

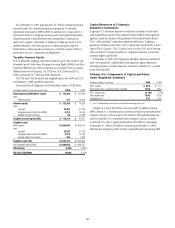

dependent on its credit ratings. The table below indicates the current ratings

for Citigroup.

As a result of the Citigroup guarantee, changes in ratings for Citigroup

Funding Inc. are the same as those of Citigroup noted above.

Citigroup’s Debt Ratings as of December 31, 2009 Citigroup Inc. Citigroup Funding Inc. Citibank, N.A.

Senior

debt

Commercial

paper

Senior

debt

Commercial

paper

Long-

Term

Short-

Term

Fitch Ratings A+ F1+ A+ F1+ A+ F1+

Moody’s Investors Service A3 P-1 A3 P-1 A1 P-1

Standard & Poor’s A A-1 A A-1 A+ A-1

On February 9, 2010, S&P affirmed the counterparty credit and debt

ratings of Citi. At the same time, S&P revised its outlook on Citi to negative

from stable. This action was the result of S&P’s view that there is increased

uncertainty about the U.S. government’s willingness to provide extraordinary

support to a number of systematically important financial institutions.

Outlooks from both Moody’s and Fitch remained stable.

Ratings downgrades by Fitch Ratings, Moody’s Investors Service or

Standard & Poor’s have had and could continue to have material impacts on

funding and liquidity, and could also have further explicit material impact

on liquidity due to collateral triggers and other cash requirements. Because

of the current credit ratings of Citigroup Inc., a one-notch downgrade of

its senior debt/long-term rating could impact Citigroup Inc.’s commercial

paper/short-term rating. As of December 31, 2009, a one-notch downgrade

of the senior debt/long-term rating of Citigroup Inc., accompanied by a one-

notch downgrade of Citigroup Inc.’s commercial paper/short-term rating,

would result in an approximate $4.2 billion funding requirement in the

form of collateral and cash obligations. Further, as of December 31, 2009, a

one-notch downgrade of the senior debt/long-term ratings of Citibank, N.A.

would result in an approximate $4.2 billion funding requirement in the form

of collateral and cash obligations. Because of the current credit ratings of

Citibank, N.A., a one-notch downgrade of its senior debt/long-term rating is

unlikely to have any impact on its commercial paper/short-term rating.