Citibank 2009 Annual Report Download - page 250

Download and view the complete annual report

Please find page 250 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

240

29. PLEDGED ASSETS, COLLATERAL, COMMITMENTS

AND GUARANTEES

Pledged Assets

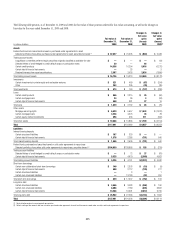

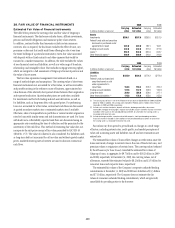

At December 31, 2009 and 2008, the approximate fair values of securities

sold under agreements to repurchase and other assets pledged, excluding the

impact of allowable netting, were as follows:

In millions of dollars 2009 2008

For securities sold under agreements to repurchase $237,707 $237,055

As collateral for securities borrowed for approximately

equivalent value 44,095 81,740

As collateral on bank loans 188,160 144,982

To clearing organizations or segregated under securities laws

and regulations 21,385 41,312

For securities loaned 36,767 51,158

Other 30,000 52,576

Total $558,114 $608,823

In addition, included in cash and due from banks at December 31, 2009

and 2008 are $11.2 billion and $11.7 billion, respectively, of cash segregated

under federal and other brokerage regulations or deposited with clearing

organizations.

At December 31, 2009 and 2008, the Company had $1.9 billion and $3.1

billion, respectively, of outstanding letters of credit from third-party banks to

satisfy various collateral and margin requirements.

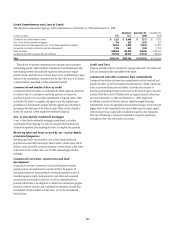

Collateral

At December 31, 2009 and 2008, the approximate market value of collateral

received by the Company that may be sold or repledged by the Company,

excluding amounts netted was $346.2 billion and $340.2 billion, respectively.

This collateral was received in connection with resale agreements, securities

borrowings and loans, derivative transactions and margined broker loans.

At December 31, 2009 and 2008, a substantial portion of the collateral

received by the Company had been sold or repledged in connection with

repurchase agreements, securities sold, not yet purchased, securities

borrowings and loans, pledges to clearing organizations, segregation

requirements under securities laws and regulations, derivative transactions

and bank loans.

In addition, at December 31, 2009 and 2008, the Company had pledged

$253 billion and $236 billion, respectively, of collateral that may not be sold

or repledged by the secured parties.

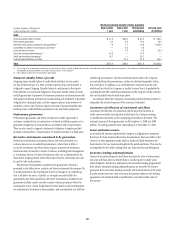

Lease Commitments

Rental expense (principally for offices and computer equipment) was $2.0

billion, $2.7 billion and $2.3 billion for the years ended December 31, 2009,

2008 and 2007, respectively.

Future minimum annual rentals under noncancelable leases, net of

sublease income, are as follows:

In millions of dollars

2010 $ 1,247

2011 1,110

2012 1,007

2013 900

2014 851

Thereafter 2,770

Total $ 7,885

Guarantees

The Company provides a variety of guarantees and indemnifications to

Citigroup customers to enhance their credit standing and enable them

to complete a wide variety of business transactions. For certain contracts

meeting the definition of a guarantee, the guarantor must recognize, at

inception, a liability for the fair value of the obligation undertaken in issuing

the guarantee.

In addition, the guarantor must disclose the maximum potential

amount of future payments the guarantor could be required to make under

the guarantee, if there were a total default by the guaranteed parties. The

determination of the maximum potential future payments is based on

the notional amount of the guarantees without consideration of possible

recoveries under recourse provisions or from collateral held or pledged.

Such amounts bear no relationship to the anticipated losses, if any, on these

guarantees.

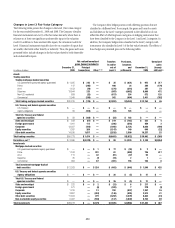

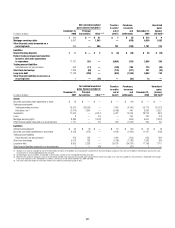

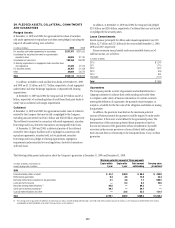

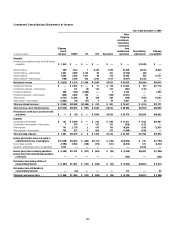

The following tables present information about the Company’s guarantees at December 31, 2009 and December 31, 2008:

Maximum potential amount of future payments

In billions of dollars at December 31,

except carrying value in millions

Expire within

1 year

Expire after

1 year

Total amount

outstanding

Carrying value

(in millions)

2009

Financial standby letters of credit $ 41.4 $48.0 $ 89.4 $ 438.8

Performance guarantees 9.4 4.5 13.9 32.4

Derivative instruments considered to be guarantees 4.1 3.6 7.7 569.2

Loans sold with recourse — 0.3 0.3 76.6

Securities lending indemnifications (1) 64.5 — 64.5 —

Credit card merchant processing (1) 59.7 — 59.7 —

Custody indemnifications and other — 33.5 33.5 121.4

Total $ 179.1 $89.9 $ 269.0 $1,238.4

(1) The carrying values of guarantees of collections of contractual cash flows, securities lending indemnifications and credit card merchant processing are not material, as the Company has determined that the amount

and probability of potential liabilities arising from these guarantees are not significant.