Citibank 2009 Annual Report Download - page 274

Download and view the complete annual report

Please find page 274 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.264

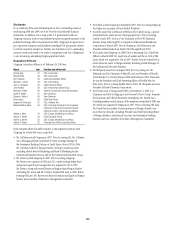

Subprime Mortgage-Related Litigation and Other Matters

Beginning in November 2007, Citigroup and Related Parties have been

named as defendants in numerous legal actions and other proceedings

brought by Citigroup shareholders, investors, counterparties and others

concerning Citigroup’s activities relating to subprime mortgages, including

Citigroup’s exposure to collateralized debt obligations (CDOs), mortgage-

backed securities (MBS), and structured investment vehicles (SIVs),

Citigroup’s underwriting activity for subprime mortgage lenders, and

Citigroup’s more general involvement in subprime- and credit-related

activities.

Securities Actions: Several putative class actions were filed in the

Southern District of New York by Citigroup shareholders alleging violations

of Sections 10 and 20 of the Securities Exchange Act of 1934. On August 19,

2008, these actions were consolidated under the caption IN RE CITIGROUP

SECURITIES LITIGATION, and lead plaintiff and counsel were appointed.

Plaintiffs’ consolidated amended class action complaint alleges, among

other things, that Citigroup’s stock price was artificially inflated as a result

of purportedly misleading disclosures concerning Citigroup’s subprime

mortgage–related exposures. A motion to dismiss the consolidated class

action complaint is pending.

In addition, Citigroup and Related Parties were named as defendants in

two putative class actions filed in New York state court but since removed to

the Southern District of New York. These actions allege violations of Sections

11, 12, and 15 of the Securities Act of 1933, arising out of various offerings of

Citigroup notes during 2006, 2007 and 2008. On December 10, 2008, these

actions were consolidated under the caption IN RE CITIGROUP INC. BOND

LITIGATION. A motion to dismiss the consolidated class action complaint is

pending.

ERISA Actions: Numerous class actions were filed in the Southern District

of New York asserting claims under the Employee Retirement Income

Security Act (ERISA) against Citigroup and certain Citigroup employees

alleged to have served as ERISA plan fiduciaries. On August 31, 2009, the

court granted defendants’ motion to dismiss the consolidated class action

complaint, captioned IN RE CITIGROUP ERISA LITIGATION. Plaintiffs have

appealed the dismissal.

Derivative Actions and Related Proceedings: Numerous derivative

actions have been filed in federal and state courts against various current

and former officers and directors of Citigroup alleging mismanagement in

connection with subprime mortgage–related exposures. Citigroup is named

as a nominal defendant in these actions. Certain of these actions have been

dismissed either in their entirety or in large part. In addition, a committee of

Citi’s Board of Directors is reviewing certain shareholder demands that raise

subprime-related issues.

Underwriting Matters: Certain Citigroup affiliates and subsidiaries have

been named as defendants for their activities as underwriters of securities in

actions brought by investors in securities of issuers adversely affected by the

credit crisis, including AIG, Fannie Mae, Freddie Mac, Ambac and Lehman,

among many others. These matters are in various stages of litigation.

Subprime Counterparty and Investor Actions: Citigroup and Related

Parties have been named as defendants in actions brought in various state

and federal courts, as well as in arbitrations, by counterparties and investors

that have suffered losses as a result of the credit crisis, including: Ambac

Credit Products, LLC, which alleges various claims including fraud and

breach of fiduciary duty in connection with Citigroup’s purchase of credit

protection from Ambac for a $1.95 billion super-senior tranche of a CDO

structured by Citigroup subsidiaries; investors and purported classes of

investors in the Falcon and ASTA/MAT funds, alleging violations of federal

securities and state laws arising out of Citigroup’s sale and marketing

of shares in certain of these funds; and Abu Dhabi Investment Authority,

alleging statutory and common law claims in connection with its $7.5 billion

investment in Citigroup. These matters are in various procedural stages.

Auction Rate Securities-Related Litigation and Other Matters

Beginning in March 2008, Citigroup and Related Parties have been

named as defendants in numerous actions and proceedings brought by

Citigroup shareholders and customers concerning auction rate securities

(ARS). In addition to those matters described below, these have included,

among others, numerous arbitrations filed by customers of Citigroup and

its subsidiaries seeking damages in connection with investments in ARS,

which are in various stages of proceedings, and a derivative action filed

against certain Citigroup officers and directors, which has been dismissed.

A committee of Citi’s Board of Directors is reviewing a demand sent to the

Board following the dismissal of the derivative action.

Securities Actions: Beginning in March 2008, Citigroup and Related

Parties were named as defendants in a series of putative class action

lawsuits related to ARS. These actions have been consolidated into a single

action pending in the Southern District of New York, captioned IN RE

CITIGROUP AUCTION RATE SECURITIES LITIGATION, asserting claims

for federal securities and other statutory and common law violations. On

September 11, 2009, the court granted defendants’ motion to dismiss the

consolidated amended complaint. On October 15, 2009, plaintiffs filed a

further amended complaint, which defendants also have moved to dismiss.