Citibank 2009 Annual Report Download - page 273

Download and view the complete annual report

Please find page 273 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.263

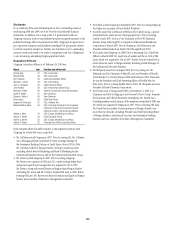

LEGAL PROCEEDINGS

In addition to the matters described below, in the ordinary course of business,

Citigroup and its affiliates and subsidiaries and current and former officers,

directors and employees (for purposes of this section, sometimes collectively

referred to as Citigroup and Related Parties) routinely are named as

defendants in, or as parties to, various legal actions and proceedings. Certain

of these actions and proceedings assert claims or seek relief in connection

with alleged violations of consumer protection, securities, banking,

antifraud, antitrust, employment and other statutory and common laws.

Certain of these actual or threatened legal actions and proceedings include

claims for substantial or indeterminate compensatory or punitive damages,

or for injunctive relief.

In the ordinary course of business, Citigroup and Related Parties also

are subject to governmental and regulatory examinations, information-

gathering requests, investigations and proceedings (both formal and

informal), certain of which may result in adverse judgments, settlements,

fines, penalties, injunctions or other relief. Certain affiliates and subsidiaries

of Citigroup are banks, registered broker-dealers or investment advisers and,

in those capacities, are subject to regulation by various U.S., state and foreign

securities and banking regulators. In connection with formal and informal

inquiries by these regulators, Citigroup and such affiliates and subsidiaries

receive numerous requests, subpoenas and orders seeking documents,

testimony and other information in connection with various aspects of their

regulated activities.

Because of the global scope of Citigroup’s operations, and its presence

in countries around the world, Citigroup and Related Parties are subject to

litigation, and governmental and regulatory examinations, information-

gathering requests, investigations and proceedings (both formal and

informal) in multiple jurisdictions with legal and regulatory regimes that

may differ substantially, and present substantially different risks, from those

Citigroup and Related Parties are subject to in the United States.

Citigroup seeks to resolve all litigation and regulatory matters in the

manner management believes is in the best interests of the Company and

contests liability, allegations of wrongdoing and, where applicable, the

amount of damages or scope of any penalties or other relief sought as

appropriate in each pending matter. In view of the inherent unpredictability

of litigation and regulatory matters, particularly where the damages sought

are substantial or indeterminate, the investigations or proceedings are in the

early stages, or the matters involve novel legal theories or a large number

of parties, Citigroup cannot state with certainty the timing or ultimate

resolution of litigations and regulatory matters or the eventual loss, fines,

penalties or business impact, if any, associated with each pending matter.

In accordance with ASC 450 (formerly SFAS 5), Citigroup establishes

reserves for litigation and regulatory matters when those matters present

loss contingencies that both are probable and can be reasonably estimated.

Once established, reserves are adjusted from time to time, as appropriate, in

light of additional information. The actual costs of resolving litigations and

regulatory matters, however, may be substantially higher or lower than the

amounts reserved for those matters.

Subject to the foregoing, it is the opinion of Citigroup’s management,

based on current knowledge and after taking into account available

insurance coverage and its current legal reserves, that the eventual outcome

of such matters, including the matters described below, would not be likely

to have a material adverse effect on the consolidated financial condition of

Citi. Nonetheless, given the substantial or indeterminate amounts sought in

certain of these matters, and the inherent unpredictability of such matters,

an adverse outcome in certain of these matters could, from time to time,

have a material adverse effect on Citi’s consolidated results of operations or

cash flows in particular quarterly or annual periods.

Credit-Crisis-Related Litigation and Other Matters

Citigroup and Related Parties have been named as defendants in numerous

legal actions and other proceedings asserting claims for damages and

related relief for losses arising from the global financial credit and

subprime-mortgage crisis that began in 2007. Such matters include, among

other types of proceedings, claims asserted by: (i) individual investors

and purported classes of investors in Citi’s common and preferred stock

and debt, alleging violations of the federal securities laws; (ii) individual

investors and purported classes of investors in, and issuers of, auction rate

securities alleging violations of the federal securities and antitrust laws; (iii)

shareholders alleging derivative claims related to subprime and auction-rate

securities activities; (iv) participants and purported classes of participants

in Citi’s retirement plans, alleging violations of ERISA; (v) counterparties to

significant transactions adversely affected by developments in the credit and

subprime markets; (vi) individual investors and purported classes of investors

in securities and other investments underwritten, issued or marketed by

Citigroup, and other strategic investments, that have suffered losses as a

result of the credit crisis; (vii) municipalities, related entities and individuals

asserting public nuisance claims; and (viii) individual borrowers asserting

claims related to their loans. These matters have been filed in state and

federal courts across the country, as well as in arbitrations before FINRA and

other arbitration associations.

In addition to these litigations and arbitrations, beginning in the fourth

quarter of 2007, certain of Citigroup’s regulators and other state and federal

government agencies commenced formal and informal investigations and

inquiries, and issued subpoenas and requested information, concerning

Citigroup’s subprime mortgage-related conduct and business activities.

Citigroup is involved in discussions with certain of its regulators to resolve

certain of these matters.

Certain of these litigation and regulatory matters assert claims for

substantial or indeterminate damages. Some of these matters already have

been resolved, either through settlements or court proceedings, including the

complete dismissal of certain complaints or the rejection of certain claims

following hearings.