Citibank 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

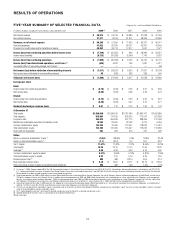

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

EXECUTIVE SUMMARY

Introduction

Citigroup is a global diversified financial services holding company

whose businesses provide consumers, corporations, governments and

institutions with a broad range of financial products and services, including

consumer banking, credit cards, corporate and investment banking,

securities brokerage and wealth management. Citigroup has approximately

200 million customer accounts and does business in more than 140

countries.

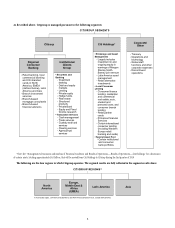

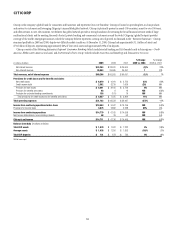

In response to the dramatic and profound changes in the market

environment that became increasingly apparent through 2008, in early 2009,

Citigroup decided to increase the focus on its core businesses and reorganized

into three business segments for management and reporting purposes:

Citicorp (Regional Consumer Banking and Institutional Clients Group);

Citi Holdings (Brokerage and Asset Management, Local Consumer

Lending, and Special Asset Pool); and Corporate/Other (Treasury, corporate

expenses). Citi believes the realignment allows it to enhance the capabilities

and performance of Citigroup’s core assets, through Citicorp, as well as to

tighten its focus on risk management and reduce and realize value from its

non-core assets, through Citi Holdings.

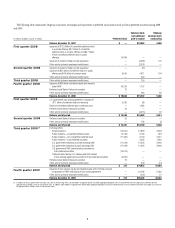

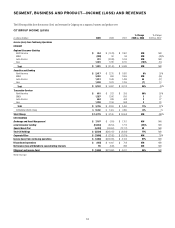

Citigroup reported a net loss for 2009 of $1.6 billion, as compared to a $27.7

billion loss in 2008. Diluted EPS was a loss of $0.80 per share in 2009, versus

a loss of $5.63 per share in 2008, and net revenue was $80.3 billion in 2009,

versus $51.6 billion in 2008. Net interest revenue declined by $4.8 billion to

$48.9 billion in 2009, generally as a result of lower average interest-earning

assets, as the company continued its focus on de-risking its balance sheet and

decreasing its total assets. Non-interest revenues improved by approximately

$33.5 billion to $31.4 billion in 2009, primarily due to lower negative revenue

marks in 2009. The decrease in net loss from year to year was primarily

attributable to lower revenue marks in 2009 compared with 2008 (a pretax loss

of $3.4 billion in 2009 versus a pretax loss of $38.5 billion in 2008), the $11.1

billion pretax Smith Barney gain on sale recorded in the second quarter of

2009 and a $1.4 billion pretax gain related to the exchange offers recognized

in the third quarter of 2009. Partially offsetting these items were increasing

credit loss provisions during the year and a $10.1 billion pretax loss associated

with the repayment of TARP and the exit from the loss-sharing agreement

with the U.S. government. Additionally, 2008 included a $9.6 billion pretax

goodwill impairment, a $0.9 billion pretax impairment related to Nikko

Asset Management, and $3.3 billion pretax of restructuring/repositioning

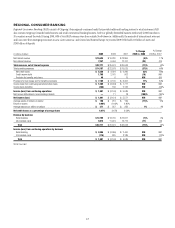

charges. Continued strength of the core Citi franchise was demonstrated by

strong revenues in Securities and Banking (S&B) (up 23% from 2008 levels,

excluding credit value adjustments (CVA)) and continued stability in both the

retail and institutional deposit bases. At December 31, 2009, total deposits were

$836 billion, up 8% from December 31, 2008.

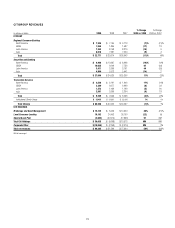

Despite very difficult market and economic conditions, Citicorp remained

profitable with $14.8 billion in income from continuing operations in

2009 versus $6.2 billion in 2008, reflecting the strength of the underlying

franchise, continued client focus, cost management and strengthened risk

management. Citi Holdings recorded a loss of $8.2 billion in 2009 versus

a $36.0 billion loss in 2008 as substantial reductions in negative revenue

marks, cost cuts and the Smith Barney gain more than offset continued

increases in credit costs within Local Consumer Lending. The gain related

to the exchange offers and loss associated with TARP repayment and exiting

the loss-sharing agreement was recorded in Corporate/Other.

Citigroup’s 2009 financial results include the impact of 18 divestitures

completed in 2009, including Smith Barney, Nikko Cordial Securities and

Nikko Asset Management, and 19 divestitures completed in 2008, including

Citi’s German retail banking operations, CitiCapital and Redecard. These

divestitures were completed in accordance with Citi’s strategy of exiting non-

core businesses, while optimizing value for shareholders.

Citi’s effective tax rate on continuing operations in 2009 was 86%, versus

39% in 2008. The tax provision reflected a benefit arising from a higher

proportion of income earned and indefinitely reinvested in countries with

relatively lower tax rates, which accounted for 26 percentage points of

the differential between the federal statutory tax rate and Citi’s effective

tax rate in 2009, as well as a higher proportion of income from tax-

advantaged sources.

Repayment of TARP and Exit from Loss-Sharing

Agreement; Common and Preferred Stock

Activities

Background

In October and December 2008, Citigroup raised $25 billion and $20 billion,

respectively, through the sale of preferred stock and warrants to purchase

common stock to the U.S. Treasury as part of TARP. In January 2009, Citi

issued approximately $7.1 billion of preferred stock to the U.S. Treasury and

FDIC, as well as a warrant to purchase common stock to the U.S. Treasury,

as consideration for the loss-sharing agreement with the U.S. Treasury,

FDIC and the Federal Reserve Bank of New York covering a specified pool of

Citigroup assets.

Pursuant to Citigroup’s exchange offers consummated in July 2009, the

$25 billion of TARP preferred stock issued to the U.S. Treasury in October 2008

was exchanged for approximately 7.7 billion shares of Citigroup common

stock. At the same time, the $20 billion of TARP preferred stock issued to

the U.S. Treasury in December 2008 and the approximately $7.1 billion of