Citibank 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

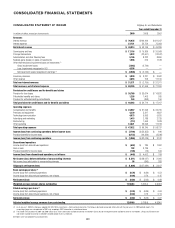

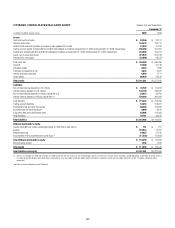

CONSOLIDATED FINANCIAL STATEMENTS

CONSOLIDATED STATEMENT OF INCOME Citigroup Inc. and Subsidiaries

Year ended December 31

In millions of dollars, except per-share amounts 2009 2008 2007

Revenues

Interest revenue $ 76,635 $106,499 $121,347

Interest expense 27,721 52,750 75,958

Net interest revenue $ 48,914 $ 53,749 $ 45,389

Commissions and fees $ 17,116 $ 10,366 $ 20,068

Principal transactions 3,932 (22,601) (12,347)

Administration and other fiduciary fees 5,195 8,222 8,860

Realized gains (losses) on sales of investments 1,996 679 1,168

Other than temporary impairment losses on investments (1)

Gross impairment losses (7,262) (2,740) —

Less: Impairments recognized in OCI 4,356 — —

Net impairment losses recognized in earnings (1) $ (2,906) $ (2,740) $ —

Insurance premiums $ 3,020 $ 3,221 $ 3,062

Other revenue 3,018 703 11,100

Total non-interest revenues $ 31,371 $ (2,150) $ 31,911

Total revenues, net of interest expense $ 80,285 $ 51,599 $ 77,300

Provisions for credit losses and for benefits and claims

Provision for loan losses $ 38,760 $ 33,674 $ 16,832

Policyholder benefits and claims 1,258 1,403 935

Provision for unfunded lending commitments 244 (363) 150

Total provisions for credit losses and for benefits and claims $ 40,262 $ 34,714 $ 17,917

Operating expenses

Compensation and benefits $ 24,987 $ 31,096 $ 32,705

Premises and equipment 4,339 5,317 4,837

Technology/communication 4,573 5,993 5,620

Advertising and marketing 1,415 2,188 2,729

Restructuring (113) 1,550 1,528

Other operating 12,621 23,096 11,318

Total operating expenses $ 47,822 $ 69,240 $ 58,737

Income (loss) from continuing operations before income taxes $ (7,799) $ (52,355) $ 646

Provision (benefit) for income taxes (6,733) (20,326) (2,546)

Income (loss) from continuing operations $ (1,066) $ (32,029) $ 3,192

Discontinued operations

Income (loss) from discontinued operations $ (653) $ 784 $ 1,052

Gain on sale 102 3,139 —

Provision (benefit) for income taxes (106) (79) 344

Income (loss) from discontinued operations, net of taxes $ (445) $ 4,002 $ 708

Net income (loss) before attribution of noncontrolling interests $ (1,511) $ (28,027) $ 3,900

Net income (loss) attributable to noncontrolling interests 95 (343) 283

Citigroup’s net income (loss) $ (1,606) $ (27,684) $ 3,617

Basic earnings per share (2)

Income (loss) from continuing operations $ (0.76) $ (6.39) $ 0.53

Income (loss) from discontinued operations, net of taxes (0.04) 0.76 0.15

Net income (loss) $ (0.80) $ (5.63) $ 0.68

Weighted average common shares outstanding 11,568.3 5,265.4 4,905.8

Diluted earnings per share (2)

Income (loss) from continuing operations $ (0.76) $ (6.39) $ 0.53

Income (loss) from discontinued operations, net of taxes (0.04) 0.76 0.14

Net income (loss) $ (0.80) $ (5.63) $ 0.67

Adjusted weighted average common shares outstanding 12,099.0 5,768.9 4,924.0

(1) As of January 1, 2009, the Company adopted ASC 320-10-65, Investments—Debt and Equity Securities. The Company disclosed comparable information with the prior year in its 2009 periodic reports. This

accounting change was not applicable to 2007 and, accordingly, 2007 information is not disclosed above.

(2) The Diluted EPS calculation for 2009 and 2008 utilizes Basic shares and Income available to common shareholders (Basic) due to the negative Income available to common shareholders. Using actual Diluted shares

and Income available to common shareholders (Diluted) would result in anti-dilution.

See Notes to the Consolidated Financial Statements.