Citibank 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

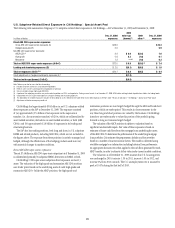

Direct Exposure to Monolines

Citi Holdings has exposure, via the SAP, to various monoline bond insurers

(Monolines), listed in the table below, from hedges on certain investments

and from trading positions. The hedges are composed of credit default

swaps and other hedge instruments. Citi Holdings recorded $1.3 billion

in downward credit valuation adjustments (CVA) related to exposure to

Monolines during 2009, bringing the total CVA balance to $5.6 billion.

The following table summarizes the market value of Citi Holdings’ direct

exposures to and the corresponding notional amounts of transactions with

the various Monolines, as well as the aggregate credit valuation adjustment

associated with these exposures as of December 31, 2009 and 2008.

December 31, 2009 December 31, 2008

In millions of dollars

Fair

value

exposure

Notional

amount

of

transactions

Fair

value

exposure

Notional

amount

of

transactions

Direct subprime ABS CDO super senior—Ambac $ 4,468 $ 5,295 $ 4,461 $ 5,357

Trading assets—non-subprime:

MBIA $ 1,939 $ 3,828 $ 1,924 $ 4,040

FSA 52 835 204 1,126

Assured 81 452 141 465

Radian 3 150 58 150

Ambac — 178 21 1,106

Subtotal trading assets—non-subprime $ 2,075 $ 5,443 $ 2,348 $ 6,887

Total gross fair value direct exposure $ 6,543 $ 6,809

Credit valuation adjustment (5,580) (4,279)

Total net fair value direct exposure $ 963 $ 2,530

The fair value exposure, net of payable and receivable positions,

represents the market value of the contract as of December 31, 2009

and 2008, respectively, excluding the CVA. The notional amount of

the transactions, including both long and short positions, is used as a

reference value to calculate payments. The CVA is a downward adjustment

to the fair value exposure to a counterparty to reflect the counterparty’s

creditworthiness in respect of the obligations in question.

Credit valuation adjustments are based on credit spreads and on estimates

of the terms and timing of the payment obligations of the Monolines. Timing

in turn depends on estimates of the performance of the transactions to which

Citi’s exposure relates, estimates of whether and when liquidation of such

transactions may occur and other factors, each considered in the context of

the terms of the Monolines’ obligations.

As of December 31, 2009 and 2008, SAP had $5.9 billion and $6.9 billion,

respectively, in notional amount of hedges against its direct subprime ABS

CDO super-senior positions. Of those amounts, $5.3 billion and $5.4 billion,

respectively, were purchased from Monolines and are included in the notional

amount of transactions in the table above.

With respect to SAP’s trading assets, there were $2.1 billion and $2.3

billion of fair value exposure to Monolines as of December 31, 2009 and

2008, respectively. Trading assets include trading positions, both long and

short, in U.S. subprime RMBS and related products, including ABS CDOs.

The notional amount of transactions related to the remaining non-

subprime trading assets as of December 31, 2009 was $5.4 billion. Of the

$5.4 billion, $4.7 billion was in the form of credit default swaps and total

return swaps with a fair value exposure of $2.1 billion. The remaining

notional amount comprised $0.7 billion, primarily in interest-rate swaps,

with a corresponding fair value exposure of $12 million net payable.

The notional amount of transactions related to the remaining non-

subprime trading assets at December 31, 2008 was $6.9 billion, with a

corresponding fair value exposure of $2.3 billion. Of the $6.9 billion,

$5.1 billion was in the form of credit default swaps and total return swaps

with a fair value of $2.3 billion. The remaining notional amount comprised

$1.8 billion, primarily in interest-rate swaps with a corresponding fair value

exposure of $3.9 million.

Citigroup has purchased mortgage insurance from various Monoline

mortgage insurers on first-mortgage loans. The notional amount of this

insurance protection was approximately $230 million and $400 million as

of December 31, 2009 and 2008, respectively, with nominal pending claims

against this notional amount.

In addition, Citigroup has indirect exposure to Monolines in various

other parts of its businesses. Indirect exposure includes circumstances in

which Citigroup is not a contractual counterparty to the Monolines, but

instead owns securities that may benefit from embedded credit enhancements

provided by a Monoline. For example, corporate or municipal bonds in the

trading business may be insured by the Monolines. The table and discussion

above do not reflect this type of indirect exposure to the Monolines.