Citibank 2009 Annual Report Download - page 271

Download and view the complete annual report

Please find page 271 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.261

Citigroup’s securities operations abroad are conducted through various

subsidiaries and affiliates, principally Citigroup Global Markets Limited in

London and Citigroup Global Markets Japan Inc. in Tokyo. Its securities

activities in the United Kingdom, which include investment banking, trading,

and brokerage services, are subject to the Financial Services and Markets Act

of 2000, which regulates organizations that conduct investment businesses in

the United Kingdom including capital and liquidity requirements, and to the

rules of the Financial Services Authority. Citigroup Global Markets Japan Inc.

is a registered securities company in Japan, and as such its activities in Japan

are regulated principally by the Financial Services Agency of Japan. These

and other subsidiaries of Citigroup are also members of various securities

and commodities exchanges and are subject to the rules and regulations

of those exchanges. Citigroup’s other offices abroad are also subject to the

jurisdiction of foreign financial services regulatory authorities.

CGMI is a member of the Securities Investor Protection Corporation

(SIPC), which provides protection for customers of a broker-dealer against

losses in the event of the liquidation of a broker-dealer. SIPC protects

customers’ securities accounts held by a broker-dealer up to $500,000 for

each eligible customer, subject to a limitation of $100,000 for claims for cash

balances. To supplement this SIPC coverage, CGMI has purchased additional

protection for the benefit of its customers, subject to an aggregate loss limit of

$600 million and a per client cash loss limit of up to $1.9 million.

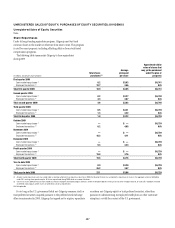

Capital Requirements

As a registered broker-dealer, CGMI is subject to Rule 15c3-1 of the SEC (the

Net Capital Rule). Under the Net Capital Rule, CGMI is required to maintain

minimum net capital based on the greater of the SEC or CFTC minimum net

capital requirement equal to 2% of aggregate debit items, as defined. Under

NYSE regulations, CGMI may be required to reduce its business if its net

capital is less than 4% of aggregate debit items and may also be prohibited

from expanding its business or paying cash dividends if resulting net capital

would be less than 5% of aggregate debit items. Furthermore, the Net Capital

Rule does not permit withdrawal of equity or subordinated capital if the

resulting net capital would be less than 5% of aggregate debit items.

CGMI was approved by the SEC to compute net capital in accordance with

the provisions of Appendix E of Rule 15c3-1. This methodology allows CGMI

to compute market risk capital charges using internal value-at-risk models.

Under Appendix E, CGMI is also required to hold tentative net capital in

excess of $1 billion and net capital in excess of $500 million. The firm is also

required to notify the SEC in the event that its tentative net capital is less than

$5 billion.

Compliance with the Net Capital Rule could limit those operations of

CGMI that require the intensive use of capital, such as underwriting and

trading activities and the financing of customer account balances, and also

limits the ability of broker-dealers to transfer large amounts of capital to

parent companies and other affiliates.

CUSTOMERS

In Citigroup’s judgment, no material part of Citigroup’s business depends

upon a single customer or group of customers, the loss of which would have

a materially adverse effect on Citi, and no one customer or group of affiliated

customers accounts for as much as 10% of Citigroup’s consolidated revenues.