Citibank 2009 Annual Report Download - page 258

Download and view the complete annual report

Please find page 258 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.248

32. SUBSEQUENT EVENTS

LQIF Acquisition

On January 31, 2010 Citigroup elected to exercise its option to acquire

approximately 8.5% of LQIF for approximately $500 million. The acquisition

of the additional shares is expected to close on April 30, 2010 and will

increase Citigroup’s ownership in LQIF to approximately 41.5%. Citigroup

retains an option to increase its ownership an additional 8.5% of LQIF in

2010 for an additional $500 million.

Venezuelan Bolivar Devaluation

The Venezuelan government enacted currency restrictions in 2003 that

have restricted Citigroup’s ability to obtain foreign currency in Venezuela

at the official foreign currency rate. Citigroup uses the official rate to re-

measure the foreign currency transactions in the financial statements of

our Venezuelan subsidiaries, which have U.S. dollar functional currencies,

into U.S. dollars. At December 31, 2009, Citigroup had net monetary assets

denominated in bolivars and subject to the official rate of approximately

$290 million.

On January 8, 2010, the Venezuelan government announced the

devaluation of the official foreign currency exchange rate from 2.15 bolivars

per dollar to 4.3 bolivars per dollar and the creation of a dual, subsidized

exchange rate of 2.6 bolivars per dollar for the importation of certain

essential goods. The devaluation in the rate is expected to result in a pretax

loss to the Company of approximately $170 million in the first quarter of

2010. Additionally, revenue and net operating profit in U.S. dollar terms will

be reduced on an ongoing basis.

The Company has evaluated subsequent events through February 26,

2010, which is the date its Consolidated Financial Statements were issued.

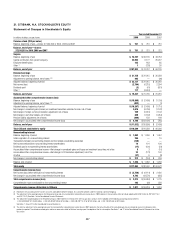

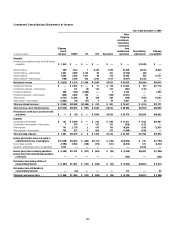

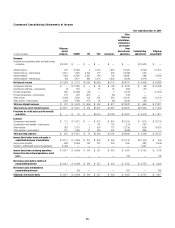

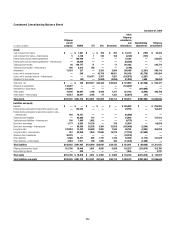

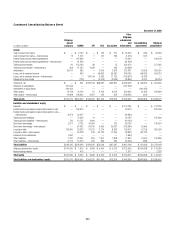

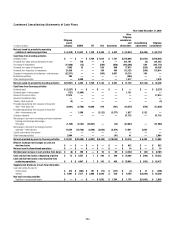

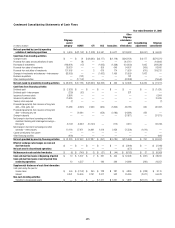

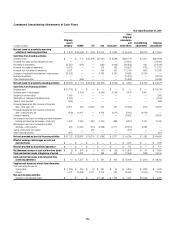

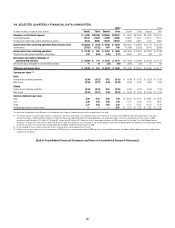

33. CONDENSED CONSOLIDATING FINANCIAL

STATEMENTS SCHEDULES

These condensed Consolidating Financial Statements schedules are presented

for purposes of additional analysis but should be considered in relation to the

Consolidated Financial Statements of Citigroup taken as a whole.

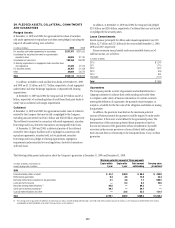

Citigroup Parent Company

The holding company, Citigroup Inc.

Citigroup Global Markets Holdings Inc. (CGMHI)

Citigroup guarantees various debt obligations of CGMHI as well as all of the

outstanding debt obligations under CGMHI’s publicly issued debt.

Citigroup Funding Inc. (CFI)

CFI is a first-tier subsidiary of Citigroup, which issues commercial paper,

medium-term notes and structured equity-linked and credit-linked notes, all

of which are guaranteed by Citigroup.

CitiFinancial Credit Company (CCC)

An indirect wholly owned subsidiary of Citigroup. CCC is a wholly owned

subsidiary of Associates. Citigroup has issued a full and unconditional

guarantee of the outstanding indebtedness of CCC.

Associates First Capital Corporation (Associates)

A wholly owned subsidiary of Citigroup. Citigroup has issued a full and

unconditional guarantee of the outstanding long-term debt securities and

commercial paper of Associates. In addition, Citigroup guaranteed various

debt obligations of Citigroup Finance Canada Inc. (CFCI), a wholly owned

subsidiary of Associates. CFCI continues to issue debt in the Canadian market

supported by a Citigroup guarantee. Associates is the immediate parent

company of CCC.

Other Citigroup Subsidiaries

Includes all other subsidiaries of Citigroup, intercompany eliminations, and

income/loss from discontinued operations.

Consolidating Adjustments

Includes Citigroup parent company elimination of distributed and

undistributed income of subsidiaries, investment in subsidiaries and the

elimination of CCC, which is included in the Associates column.