Citibank 2009 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

192

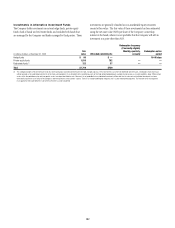

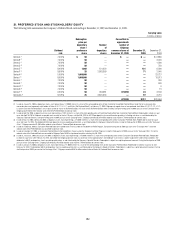

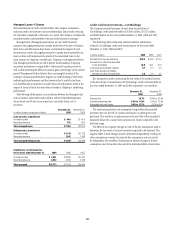

21. PREFERRED STOCK AND STOCKHOLDERS’ EQUITY

The following table summarizes the Company’s Preferred Stock outstanding at December 31, 2009 and December 31, 2008:

Carrying value

in millions of dollars

Dividend

rate

Redemption

price per

depositary

share /

preference

share

Number

of

depositary

shares

Convertible to

approximate

number of

Citigroup

common shares at

December 31, 2009

December 31,

2009

December 31,

2008

Series A (1) 7.000% $ 50 —$ — $ — $ 6,880

Series B (1) 7.000% 50 —— — 3,000

Series C (1) 7.000% 50 —— — 1,000

Series D (1) 7.000% 50 —— — 750

Series E (2) 8.400% 1,000 121,254 — 121 6,000

Series F (3) 8.500% 25 2,863,369 — 71 2,040

Series H (4) 5.000% 1,000,000 —— — 23,727

Series I (5) 8.000% 1,000,000 —— — 19,513

Series J (1) 7.000% 50 —— — 450

Series K (1) 7.000% 50 —— — 400

Series L1 (1) 7.000% 50 —— — 5

Series N (1) 7.000% 50 —— — 15

Series T (6) 6.500% 50 453,981 672,959 23 3,169

Series AA (7) 8.125% 25 3,870,330 — 97 3,715

672,959 $ 312 $70,664

(1) Issued on January 23, 2008 as depositary shares, each representing a 1/1,000th interest in a share of the corresponding series of Non-Cumulative Convertible Preferred Stock. Under the terms of pre-existing

conversion price reset agreements with holders of Series A, B, C, D, J, K, L1 and N (the “Old Preferred Stock”), on February 17, 2009, Citigroup exchanged shares of new preferred stock Series A1, B1, C1, D1, J1, K1,

L2 and N1 (the “New Preferred Stock”) for an equal number of shares of Old Preferred Stock. All shares of the Old Preferred Stock were canceled. During the third quarter of 2009, pursuant to the “Exchange Offers”,

Citigroup converted the entire notional value of the New Preferred Stock to common stock.

(2) Issued on April 28, 2008 as depositary shares, each representing a 1/25th interest in a share of the corresponding series of Fixed Rate/Floating Rate Non-Cumulative Preferred Stock. Redeemable in whole or in part

on or after April 30, 2018. Dividends are payable semi-annually for the first 10 years until April 30, 2018 at $42.70 per depositary share and thereafter quarterly at a floating rate when, as and if declared by the

Company’s Board of Directors. During the third quarter of 2009, pursuant to the “Exchange Offers”, Citigroup converted $5,879 million notional value of Series E Preferred Stock to common stock.

(3) Issued on May 13, 2008 and May 28, 2008 as depositary shares, each representing a 1/1,000th interest in a share of the corresponding series of Non-Cumulative Preferred Stock. Redeemable in whole or in part

on or after June 15, 2013. The dividend of $0.53 per depositary share is payable quarterly when, as and if declared by the Company’s Board of Directors. During the third quarter of 2009, pursuant to the “Exchange

Offers”, Citigroup converted $1,969 million notional value of Series F Preferred Stock to common stock.

(4) Issued on October 28, 2008 as Cumulative Preferred Stock to the United States Treasury under the Troubled Asset Relief Program. During the third quarter of 2009, pursuant to the “Exchange Offers”, the entire

notional value of the Preferred Stock was converted to common stock.

(5) Issued on December 31, 2008 as Cumulative Preferred Stock to the United States Treasury under the Troubled Asset Relief Program. During the third quarter of 2009, pursuant to the “Exchange Offers”, the entire

notional value of the Preferred Stock was converted to Citigroup Capital XXXIII trust preferred securities maturing July 30, 2039.

(6) Issued on January 23, 2008 and January 29, 2008 as depositary shares, each representing a 1/1,000th interest in a share of the corresponding series of Non-Cumulative Convertible Preferred Stock. Redeemable

in whole or in part on or after February 15, 2015. Convertible into Citigroup common stock at a conversion rate of approximately 1,482.3503 per share, which is subject to adjustment under certain conditions. The

dividend or in $0.81 per depositary share is payable quarterly when, as and if declared by the Company’s Board of Directors. Redemption is subject to a capital replacement covenant. During the third quarter of 2009,

pursuant to the “Exchange Offers”, Citigroup converted $3,146 million notional value of Series T Preferred Stock to common stock.

(7) Issued on January 25, 2008 as depositary shares, each representing a 1/1,000th interest in a share of the corresponding series of Non-Cumulative Preferred Stock. Redeemable in whole or in part on or after

February 15, 2018. The dividend of $0.51 per depositary share is payable quarterly when, as and if declared by the Company’s Board of Directors. Redemption is subject to a capital replacement covenant. During

the third quarter of 2009, pursuant to the “Exchange Offers”, Citigroup converted $3,618 million notional value of Series AA Preferred Stock to common stock.