Citibank 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

70

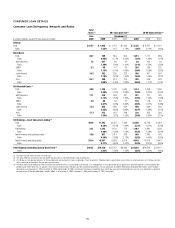

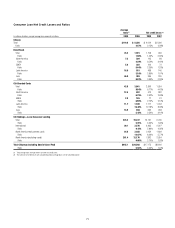

Consumer Loan Delinquency Amounts and Ratios

Total

loans (1) 90+ days past due (2) 30-89 days past due (2)

Dec. December 31,

In millions of dollars, except EOP loan amounts in billions 2009 2009 2008 2007 2009 2008 2007

Citicorp

Total $124.7 $ 1,935 $ 1,710 $1,545 $ 2,325 $ 2,567 $ 2,151

Ratio 1.55% 1.41 1.19% 1.86% 2.11% 1.65%

Retail Bank

Total 80.7 789 584 500 1,011 1,111 856

Ratio 0.98% 0.77% 0.62% 1.25% 1.46% 1.07%

North America 7.2 107 84 31 82 100 34

Ratio 1.49% 1.29% 1.41% 1.14% 1.54% 1.55%

EMEA 5.2 60 47 30 203 194 122

Ratio 1.15% 0.75% 0.45% 3.90% 3.08% 1.82%

Latin America 18.2 382 239 229 300 261 297

Ratio 2.10% 1.52% 1.44% 1.65% 1.66% 1.87%

Asia 50.1 240 214 210 426 556 403

Ratio 0.48% 0.45% 0.38% 0.85% 1.17% 0.73%

Citi-Branded Cards (3)

Total 44.0 1,146 1,126 1,045 1,314 1,456 1,295

Ratio 2.60% 2.47% 2.09% 2.98% 3.20% 2.59%

North America 11.1 238 263 221 251 277 242

Ratio 2.14% 1.84% 1.33% 2.26% 1.94% 1.46%

EMEA 3.0 80 36 21 135 118 87

Ratio 2.67% 1.28% 0.84% 4.50% 4.21% 3.48%

Latin America 12.2 555 566 554 558 636 606

Ratio 4.55% 4.80% 3.85% 4.57% 5.39% 4.21%

Asia 17.7 273 261 249 370 425 360

Ratio 1.54% 1.57% 1.50% 2.09% 2.56% 2.17%

Citi Holdings—Local Consumer Lending (4)

Total 293.4 17,793 12,027 7,439 12,258 13,743 10,961

Ratio 6.26% 3.51% 1.99% 4.31% 4.01% 2.93%

International 33.1 1,345 1,152 773 1,467 1,830 1,539

Ratio 4.06% 2.68% 1.56% 4.43% 4.26% 3.10%

North America retail partners cards (3) 18.9 851 1,017 656 948 1,343 975

Ratio 4.50% 3.38% 2.19% 5.02% 4.46% 3.26%

North America (excluding cards) 241.4 15,597 9,858 6,010 9,843 10,570 8,447

Ratio 6.71% 3.65% 2.02% 4.24% 3.91% 2.84%

Total Citigroup (excluding Special Asset Pool) (4) $418.1 $19,728 $13,737 $8,984 $14,583 $16,310 $13,112

Ratio 4.82% 2.96% 1.78% 3.56% 3.51% 2.60%

(1) Total loans exclude interest and fees on credit cards.

(2) The ratios of 90 days or more past due and 30-89 days past due are calculated based on end-of-period loans.

(3) The 90 days or more past due balances for Citi-branded cards and retail partners cards are generally still accruing interest. Citigroup’s policy is generally to accrue interest on credit card loans until 180 days past due,

unless notification of bankruptcy filing has been received earlier.

(4) The 90 or more and 30-89 days past due and related ratio for North America LCL (excluding cards) excludes U.S. mortgage loans that are guaranteed by U.S. government-sponsored agencies since the potential loss

predominantly resides within the U.S. agencies. The amounts excluded for loans 90+days past due and (end-of-period loans) for each period are: $5.4 billion ($9.0 billion), $3.0 billion ($6.2 billion), and $1.8 billion

($3.3 billion) as of December 31, 2009, December 31, 2008 and December 31, 2007, respectively. The amounts excluded for loans 30-89 days past due (end-of-period loans have the same adjustment as above) for

each period are: $1.0 billion, $0.6 billion, and $0.4 billion, as of December 31, 2009, December 31, 2008, and December 31, 2007, respectively.

CONSUMER LOAN DETAILS