Citibank 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.56

In addition, the emerging markets in which Citigroup operates or invests,

or in which it may do so in the future, particularly as a result of its overall

strategy, may be more volatile than the U.S. markets or other developed

markets outside the U.S. and are subject to changing political, economic,

financial and social factors. Among other factors, these include the possibility

of recent or future changes in political leadership and economic and fiscal

policies and the possible imposition of, or changes in, currency exchange

laws or other laws or restrictions applicable to companies or investments in

these countries. Citigroup’s inability to remain in compliance with local laws

in a particular market could have a materially adverse effect not only on its

business in that market but also on its reputation generally.

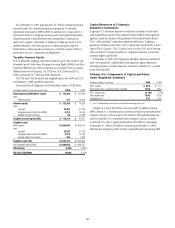

Future issuances of Citigroup common stock and preferred

stock may reduce any earnings available to Citi’s common

stockholders and the return on the company’s equity.

During 2009, Citigroup raised a total of approximately $79 billion in private

and public offerings of common stock in connection with its exchange offers

and as required by the U.S. government pursuant to Citigroup’s repayment of

TARP. This amount does not include approximately $3.5 billion of tangible

equity units issued in December 2009 that will be settled for additional shares

of Citigroup common stock that may be issued over a three-year period but in

no event later than December 2012.

In addition, in January 2010, Citigroup issued $1.7 billion of common

stock equivalents to its employees in lieu of cash compensation they would

have otherwise received. Subject to shareholder approval at Citi’s annual

shareholder meeting scheduled to be held on April 20, 2010, such amount

of common stock equivalents will be converted to common stock. Further,

pursuant to its agreement with the Abu Dhabi Investment Authority (ADIA),

entered into in November 2007, Citi will issue an aggregate of $7.5 billion

of common stock, at a price per share of $31.83, over an approximately

two-year period beginning in March 2010.

While this additional capital has provided, or will provide, funding to

Citigroup’s businesses and has improved, or will improve, Citigroup’s financial

position and capital strength, it has increased, or will increase, Citigroup’s

equity and the number of actual and diluted shares of Citigroup common stock.

Such increases in the outstanding shares of common stock reduce Citigroup’s

earnings per share and the return on Citigroup’s equity, unless Citigroup’s

earnings increase correspondingly. In addition, any additional future issuances

of common stock, including without limitation pursuant to U.S. governmental

requirements or programs, could further dilute the existing common

stockholders and any earnings available to the common stockholders.

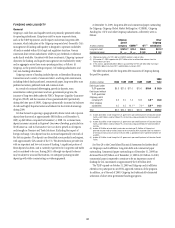

The sale by the U.S. Treasury of its stake in Citigroup will

result in a substantial amount of Citigroup common stock

entering the market, which could adversely affect the

market price of Citigroup common stock.

As of December 31, 2009, the U.S. Treasury held a 27.0% ownership stake in

Citigroup. In December 2009, the U.S. Treasury announced that it planned

to divest its stake during 2010, subject to market conditions and following

a 90-day lockup period that will expire on March 16, 2010, resulting in

approximately 7.7 billion shares of Citigroup common stock being sold into

the market. The divestiture of such a large number of shares of Citigroup

common stock within the announced timeframe could adversely affect the

market price of Citigroup common stock.

Citigroup’s ability to utilize its deferred tax assets (DTAs)

to offset future taxable income may be significantly

limited if it experiences an “ownership change” under the

Internal Revenue Code.

As of December 31, 2009, Citigroup had recognized net DTAs of

approximately $46.1 billion, which are included in its tangible common

equity. Citigroup’s ability to utilize its DTAs to offset future taxable income

may be significantly limited if Citigroup experiences an “ownership

change” as defined in Section 382 of the Internal Revenue Code of 1986, as

amended (the Code). In general, an ownership change will occur if there is

a cumulative change in Citigroup’s ownership by “5-percent shareholders”

(as defined in the Code) that exceeds 50 percentage points over a rolling

three-year period.

The common stock issued pursuant to the exchange offers in July 2009, and

the common stock and tangible equity units issued in December 2009 as part of

Citigroup’s TARP repayment, did not result in an ownership change under the

Code. However, these common stock issuances have materially increased the

risk that Citigroup will experience an ownership change in the future.

On June 9, 2009, the Board of Directors of Citigroup adopted a Tax Benefits

Preservation Plan. This Plan is subject to shareholders’ approval at the 2010

Annual Meeting. The purpose of the Plan is to minimize the likelihood of an

ownership change occurring for Section 382 purposes. Despite adoption of the

Plan, future transactions in Citigroup stock that may not be in its control may

cause Citigroup to experience an ownership change and thus limit its ability to

utilize its DTAs, as well as cause a reduction in Citigroup’s tangible common

equity and stockholders’ equity.

Increases in FDIC insurance premiums and other proposed

fees on banks may adversely affect Citigroup’s earnings.

During 2008 and continuing in 2009, higher levels of bank failures have

dramatically increased resolution costs of the FDIC and depleted the deposit

insurance fund. In order to maintain a strong funding position and restore

reserve ratios of the deposit insurance fund, the FDIC has increased, and

may further increase in the future, assessment rates of insured institutions.

In November 2009, the FDIC adopted a rule requiring banks to prepay three

years of estimated premiums to replenish the depleted insurance fund, which

Citigroup paid in the fourth quarter of 2009. There have also been proposals

to change the basis on which these assessment rates are determined.

Moreover, the Obama Administration has recently suggested the imposition

of other fees on banking institutions.

Citigroup is generally unable to control the basis or the amount of

premiums that it is required to pay for FDIC insurance or the levying of

other fees or assessments on financial institutions. If there are additional

bank or financial institution failures, Citigroup may be required to pay even

higher FDIC premiums than the recently increased levels. These announced

increases and prepayments, and any future increases or other required fees,

could adversely impact Citigroup’s earnings.