Citibank 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

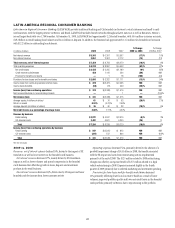

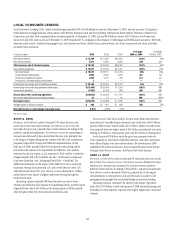

LATIN AMERICA REGIONAL CONSUMER BANKING

Latin America Regional Consumer Banking (LATAM RCB) provides traditional banking and Citi-branded card services to retail customers and small to mid-

size businesses, with the largest presence in Mexico and Brazil. LATAM RCB includes branch networks throughout Latin America as well as Banamex, Mexico’s

second largest bank with over 1,700 branches. At December 31, 2009, LATAM RCB had approximately 2,216 retail branches, with 16.6 million customer accounts,

$18.2 billion in retail banking loan balances and $41.4 billion in deposits. In addition, the business had approximately 12.2 million Citi-branded card accounts

with $12.2 billion in outstanding loan balances.

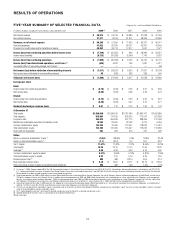

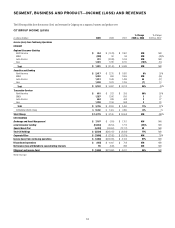

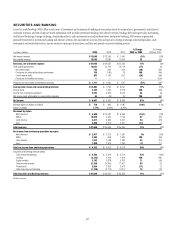

In millions of dollars 2009 2008 2007

% Change

2009 vs. 2008

% Change

2008 vs. 2007

Net interest revenue $5,303 $ 6,391 $ 5,567 (17)% 15%

Non-interest revenue 2,051 2,367 2,712 (13) (13)

Total revenues, net of interest expense $7,354 $ 8,758 $ 8,279 (16)% 6%

Total operating expenses $4,232 $ 8,857 $ 4,503 (52)% 97%

Net credit losses $2,435 $ 2,205 $ 1,189 10% 85%

Credit reserve build/(release) 458 1,116 504 (59) NM

Provision for benefits and claims —1 18 (100) (94)

Provisions for loan losses and for benefits and claims $2,893 $ 3,322 $ 1,711 (13)% 94%

Income (loss) from continuing operations before taxes $ 229 $(3,421) $ 2,065 NM NM

Income taxes (benefits) (94) (73) 449 (29)% NM

Income (loss) from continuing operations $ 323 $(3,348) $ 1,616 NM NM

Net income attributable to noncontrolling interests —— 1 —(100)%

Net income (loss) $ 323 $(3,348) $ 1,615 NM NM

Average assets (in billions of dollars) 61 $ 76 $ 63 (20)% 21%

Return on assets 0.53% (4.41)% 2.56%

Average deposits (in billions of dollars) $ 36 $ 40 $ 38 (10)% 5%

Net credit losses as a percentage of average loans 8.60% 7.11% 4.57%

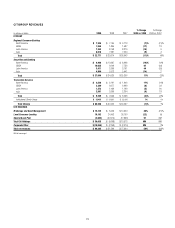

Revenue by business

Retail banking $3,872 $ 4,097 $ 3,979 (5)% 3%

Citi-branded cards 3,482 4,661 4,300 (25) 8

Total $ 7,354 $ 8,758 $ 8,279 (16)% 6%

Income (loss) from continuing operations by business

Retail banking $ 547 $(3,500) $ 812 NM NM

Citi-branded cards (224) 152 804 NM (81)%

Total $ 323 $(3,348) $ 1,616 NM NM

NM Not meaningful

2009 vs. 2008

Revenues, net of interest expense declined 16%, driven by the impact of FX

translation as well as lower activity in the branded cards business.

Net interest revenue decreased 17%, mainly driven by FX translation

impact as well as lower volumes and spread compression in the branded

cards business that offset the growth in loans, deposits and investment

products in the retail business.

Non interest revenue decreased 13%, driven also by FX impact and lower

branded cards fee income from lower customer activity.

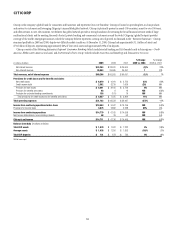

Operating expenses decreased 52%, primarily driven by the absence of a

goodwill impairment charge of $4.3 billion in 2008, the benefit associated

with the FX impact and saves from restructuring actions implemented

primarily at the end of 2008. The $125 million related to 2008 restructuring

charges was offset by an expense benefit of $257 million related to a legal

vehicle restructuring in 2008. Expenses increased slightly in the fourth

quarter of 2009 primarily due to selected marketing and investment spending.

Provisions for loan losses and for benefits and claims decreased

13% primarily reflecting lower loan loss reserve builds as a result of lower

volumes, improved portfolio quality and lower net credit losses in the branded

cards portfolio primarily in Mexico due to repositioning in the portfolio.