Citibank 2009 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

220

Cash Flow Hedges

Hedging of benchmark interest rate risk

Citigroup hedges variable cash flows resulting from floating-rate liabilities

and roll-over (re-issuance) of short-term liabilities. Variable cash flows

from those liabilities are converted to fixed-rate cash flows by entering into

receive-variable, pay-fixed interest-rate swaps and receive-variable, pay-fixed

forward-starting interest-rate swaps. These cash-flow hedging relationships

use either regression analysis or dollar-offset ratio analysis to assess whether

the hedging relationships are highly effective at inception and on an ongoing

basis. Since efforts are made to match the terms of the derivatives to those of

the hedged forecasted cash flows as closely as possible, the amount of hedge

ineffectiveness is not significant.

Hedging of foreign exchange risk

Citigroup locks in the functional currency equivalent of cash flows of various

balance sheet liability exposures, including short-term borrowings and

long-term debt (and the forecasted issuances or rollover of such items) that

are denominated in a currency other than the functional currency of the

issuing entity. Depending on the risk-management objectives, these types of

hedges are designated as either cash-flow hedges of only foreign exchange

risk or cash-flow hedges of both foreign-exchange and interest rate risk, and

the hedging instruments used are foreign-exchange forward contracts, cross-

currency swaps and foreign-currency options. For some hedges, Citigroup

matches all terms of the hedged item and the hedging derivative at inception

and on an ongoing basis to eliminate hedge ineffectiveness. Citigroup does

not exclude any terms from consideration when applying the matched terms

method. To the extent all terms are not perfectly matched, any ineffectiveness

is measured using the “hypothetical derivative method” from FASB

Derivative Implementation Group Issue G7 (now ASC 815-30-35-12 through

35-32). Efforts are made to match up the terms of the hypothetical and

actual derivatives used as closely as possible. As a result, the amount of hedge

ineffectiveness is not significant even when the terms do not match perfectly.

Hedging total return

Citigroup generally manages the risk associated with highly leveraged

financing it has entered into by seeking to sell a majority of its exposures

to the market prior to or shortly after funding. The portion of the highly

leveraged financing that is retained by Citigroup is hedged with a total return

swap.

The hedge ineffectiveness on the cash flow hedges recognized in earnings

totals $16 million for the 12 months ended December 31, 2009.

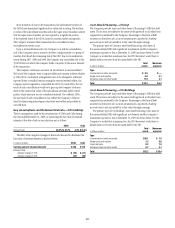

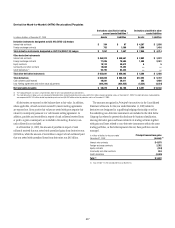

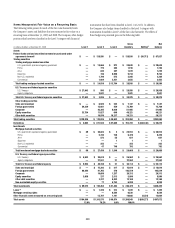

The pretax change in Accumulated other comprehensive income (loss)

from cash flow hedges for year ended December 31, 2009 is presented below:

In millions of dollars 2009

Effective portion of cash flow

hedges included in AOCI

Interest rate contracts $ 488

Foreign exchange contracts 689

Total effective portion of cash flow

hedges included in AOCI $ 1,177

Effective portion of cash flow

hedges reclassified from AOCI to

earnings

Interest rate contracts $(1,687)

Foreign exchange contracts (308)

Total effective portion of cash flow

hedges reclassified from AOCI to

earnings (1) $(1,995)

(1) Included primarily in Other revenue and Net interest revenue on the Consolidated Income Statement.

For cash flow hedges, any changes in the fair value of the end-user

derivative remaining in Accumulated other comprehensive income (loss)

on the Consolidated Balance Sheet will be included in earnings of future

periods to offset the variability of the hedged cash flows when such cash flows

affect earnings. The net loss associated with cash flow hedges expected to

be reclassified from Accumulated other comprehensive income within 12

months of December 31, 2009 is approximately $2.1 billion. The maximum

length of time over which forecasted cash flows are hedged is 10 years.

The impact of cash flow hedges on AOCI is also shown in Note 22 to the

Consolidated Financial Statements.

Net Investment Hedges

Consistent with ASC 830-20, Foreign Currency Matters — Foreign

Currency Transactions (formerly SFAS 52, Foreign Currency

Translation), ASC 815 allows hedging of the foreign-currency risk of a

net investment in a foreign operation. Citigroup uses foreign-currency

forwards, options and swaps and foreign-currency-denominated debt

instruments to manage the foreign-exchange risk associated with Citigroup’s

equity investments in several non-U.S. dollar functional currency foreign

subsidiaries. Citigroup records the change in the carrying amount of these

investments in the Cumulative translation adjustment account within

Accumulated other comprehensive income (loss). Simultaneously,

the effective portion of the hedge of this exposure is also recorded in the

Cumulative translation adjustment account and the ineffective portion, if

any, is immediately recorded in earnings.

For derivatives used in net investment hedges, Citigroup follows the

forward-rate method from FASB Derivative Implementation Group Issue

H8 (now ASC 815-35-35-16 through 35-26), “Foreign Currency Hedges:

Measuring the Amount of Ineffectiveness in a Net Investment Hedge.”

According to that method, all changes in fair value, including changes