Citibank 2009 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

191

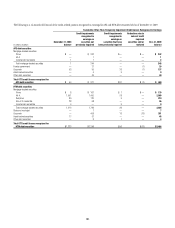

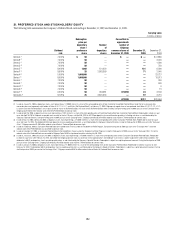

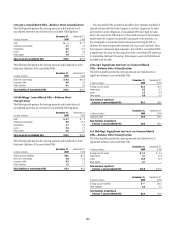

The following table summarizes the financial structure of each of the Company’s subsidiary trusts at December 31, 2009:

Trust securities

with distributions

guaranteed by

Citigroup

Issuance

date

Securities

issued

Liquidation

value

Coupon

rate

Common

shares

issued

to parent

Junior subordinated debentures owned by trust

Amount (1) Maturity

Redeemable

by issuer

beginning

In millions of dollars, except share amounts

Citigroup Capital III Dec. 1996 194,053 $ 194 7.625% 6,003 $ 200 Dec. 1, 2036 Not redeemable

Citigroup Capital VII July 2001 35,885,898 897 7.125% 1,109,874 925 July 31, 2031 July 31, 2006

Citigroup Capital VIII Sept. 2001 43,651,597 1,091 6.950% 1,350,050 1,125 Sept. 15, 2031 Sept. 17, 2006

Citigroup Capital IX Feb. 2003 33,874,813 847 6.000% 1,047,675 873 Feb. 14, 2033 Feb. 13, 2008

Citigroup Capital X Sept. 2003 14,757,823 369 6.100% 456,428 380 Sept. 30, 2033 Sept. 30, 2008

Citigroup Capital XI Sept. 2004 18,387,128 460 6.000% 568,675 474 Sept. 27, 2034 Sept. 27, 2009

Citigroup Capital XIV June 2006 12,227,281 306 6.875% 40,000 307 June 30, 2066 June 30, 2011

Citigroup Capital XV Sept. 2006 25,210,733 630 6.500% 40,000 631 Sept. 15, 2066 Sept. 15, 2011

Citigroup Capital XVI Nov. 2006 38,148,947 954 6.450% 20,000 954 Dec. 31, 2066 Dec. 31, 2011

Citigroup Capital XVII Mar. 2007 28,047,927 701 6.350% 20,000 702 Mar. 15, 2067 Mar. 15, 2012

Citigroup Capital XVIII June 2007 99,901 162 6.829% 50 162 June 28, 2067 June 28, 2017

Citigroup Capital XIX Aug. 2007 22,771,968 569 7.250% 20,000 570 Aug. 15, 2067 Aug. 15, 2012

Citigroup Capital XX Nov. 2007 17,709,814 443 7.875% 20,000 443 Dec. 15, 2067 Dec. 15, 2012

Citigroup Capital XXI Dec. 2007 2,345,801 2,346 8.300% 500 2,346 Dec. 21, 2077 Dec. 21, 2037

Citigroup Capital XXX Nov. 2007 1,875,000 1,875 6.455% 10 1,875 Sept. 15, 2041 Sept. 15, 2013

Citigroup Capital XXXI Nov. 2007 1,875,000 1,875 6.700% 10 1,875 Mar. 15, 2042 Mar. 15, 2014

Citigroup Capital XXXII Nov. 2007 1,875,000 1,875 6.935% 10 1,875 Sept. 15, 2042 Sept. 15, 2014

Citigroup Capital XXXIII July 2009 5,259,000 5,259 8.000% 100 5,259 July 30, 2039 July 30, 2014

Adam Capital Trust III Dec. 2002 17,500 18

3 mo. LIB

+335 bp. 542 18 Jan. 7, 2033 Jan. 7, 2008

Adam Statutory Trust III Dec. 2002 25,000 25

3 mo. LIB

+325 bp. 774 26 Dec. 26, 2032 Dec. 26, 2007

Adam Statutory Trust IV Sept. 2003 40,000 40

3 mo. LIB

+295 bp. 1,238 41 Sept. 17, 2033 Sept. 17, 2008

Adam Statutory Trust V Mar. 2004 35,000 35

3 mo. LIB

+279 bp. 1,083 36 Mar. 17, 2034 Mar. 17, 2009

Total obligated $20,971 $21,097

(1) Represents the proceeds received from the Trust at the date of issuance.

In each case, the coupon rate on the debentures is the same as that on the

trust securities. Distributions on the trust securities and interest on the debentures

are payable quarterly, except for Citigroup Capital III, Citigroup Capital XVIII

and Citigroup Capital XXI on which distributions are payable semiannually.

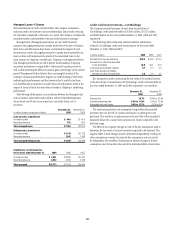

During the third quarter of 2009, pursuant to the “Exchange Offers,”

Citigroup converted $5.8 billion liquidation value of trust preferred securities

across Citigroup Capital III, Citigroup Capital VII, Citigroup Capital VIII,

Citigroup Capital IX, Citigroup Capital X, Citigroup Capital XI, Citigroup

Capital XIV, Citigroup Capital XV, Citigroup Capital XVI, Citigroup Capital

XVII, Citigroup Capital XVIII, Citigroup Capital XIX, Citigroup Capital XX and

Citigroup Capital XXI to common stock and issued $27.1 billion of Citigroup

Capital XXXIII trust preferred securities to the U.S. government in exchange

for the Series G and I of preferred stock.