Citibank 2009 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.232

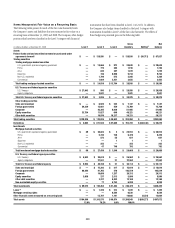

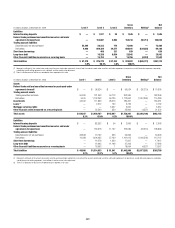

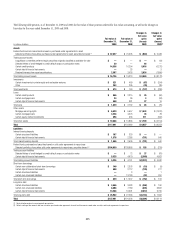

The following is a discussion of the changes to the Level 3 balances for

each of the roll-forward tables presented above.

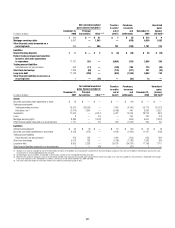

The significant changes from December 31, 2008 to December 31, 2009 in

Level 3 assets and liabilities are due to:

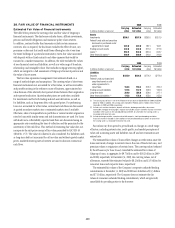

A net decrease in trading securities of $10.8 billion that was driven by: •

Net transfers of $6.5 billion, due mainly to the transfer of debt –

securities from Level 3 to Level 2 due to increased liquidity and

pricing transparency; and

Net settlements of $5. – 8 billion, due primarily to the liquidations of

subprime securities of $4.1 billion.

The change in net trading derivatives driven by: •

A net loss of $4. – 9 billion relating to complex derivative contracts,

such as those linked to credit, equity and commodity exposures.

These losses include both realized and unrealized losses during 2009

and are partially offset by gains recognized in instruments that have

been classified in Levels 1 and 2; and

– Net increase in derivative assets of $4.3 billion, which includes cash

settlements of derivative contracts in an unrealized loss position,

notably those linked to subprime exposures.

The decrease in Level 3 Investments of $6.9 billion primarily resulted •

from:

A reduction of $ – 5.0 billion, due mainly to paydowns on debt

securities and sales of private equity investments;

The net transfer of investment securities from Level 3 to Level 2 –

of $1.5 billion, due to increased availability of observable pricing

inputs; and

Net losses recognized of $ – 0.4 billion due mainly to losses on non-

marketable equity securities including write-downs on private equity

investments.

The decrease in securities sold under agreements to repurchase of $9.1 •

billion is driven by a $8.6 billion net transfers from Level 3 to Level 2 as

effective maturity dates on structured repos have shortened.

The decrease in long-term debt of $1.5 billion is driven mainly by • $1.3

billion of net terminations of structured notes.

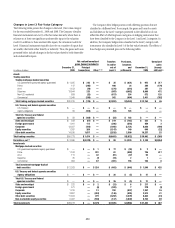

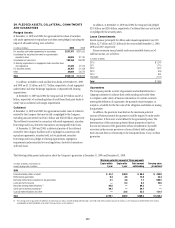

The significant changes from December 31, 2007 to December 31, 2008 in

Level 3 are due to:

A net decrease in trading securities and loans of $24.8 billion that was •

driven by:

Net realized and unrealized losses of $28.1 billion recorded in –

Principal transactions, which was composed mostly of write-downs

recognized on various trading securities including ABCP of $9

billion;

Net transfers in of $7.4 billion, which consisted of approximately –

$26 billion of net transfers in from Level 2 as the availability of

observable pricing inputs continued to decline due to the current

credit crisis, offset by transfers out of Level 3 of approximately

$19 billion primarily related to Level 3 trading inventory being

reclassified to held-to-maturity investments during the fourth quarter

of 2008; and

Net settlements of trading securities of $4.2 billion. –

The shift in the net unrealized gains/(losses) from trading derivatives •

driven by:

A net gain of $7.8 billion relating to complex derivative contracts, –

such as those linked to credit, equity and commodity exposures.

These gains include both realized and unrealized gains and are

partially offset by losses recognized in instruments that have been

classified in Levels 1 and 2; and

$2.2 billion in net transfers in. –

The increase in Investments of $11.2 billion primarily resulted from: •

The addition of $10.3 billion from net purchases, issuances and –

settlements, which included $8.7 billion in senior debt securities

retained by the Company from its sale of a corporate loan portfolio

that included highly leveraged loans during the second quarter of

2008, plus $3 billion of ARS securities purchased from GWM clients,

in accordance with the Auction Rate Securities settlement agreement;

The net transfer in of investment securities from Level 2 of $5.8 –

billion, as the availability of observable pricing inputs continued to

decline due to the current credit crisis; and

Net losses recognized of $4.9 billion which was recorded in –

Accumulated other comprehensive income (loss) primarily related to

Alt-A MBS classified as available-for-sale investments.