Citibank 2009 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.209

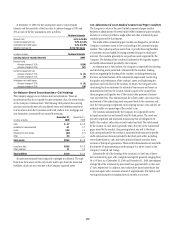

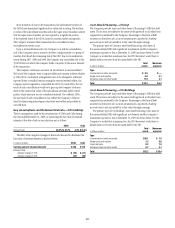

The primary credit enhancement provided to the conduit investors is in

the form of transaction-specific credit enhancement described above. In

addition, there are generally two additional forms of credit enhancement

that protect the commercial paper investors from defaulting assets. First, the

subordinate loss notes issued by each conduit absorb any credit losses up

to their full notional amount. It is expected that the subordinate loss notes

issued by each unconsolidated conduit are sufficient to absorb a majority of

the expected losses from each conduit, thereby making the single investor

in the subordinate loss note the primary beneficiary. Second, each conduit

has obtained a letter of credit from the Company, which is generally 8–10%

of the conduit’s assets. The letters of credit provided by the Company total

approximately $3.4 billion and are included in the Company’s maximum

exposure to loss. The net result across all multi-seller conduits administered

by the Company is that, in the event defaulted assets exceed the transaction-

specific credit enhancement described above, any losses in each conduit are

allocated in the following order:

subordinate loss note holders, •

the Company, and •

the commercial paper investors.•

The Company also provides the conduits with two forms of liquidity

agreements that are used to provide funding to the conduits in the event

of a market disruption, among other events. Each asset of the conduit is

supported by a transaction-specific liquidity facility in the form of an asset

purchase agreement (APA). Under the APA, the Company has agreed to

purchase non-defaulted eligible receivables from the conduit at par. Any

assets purchased under the APA are subject to increased pricing. The APA is

not designed to provide credit support to the conduit, as it generally does not

permit the purchase of defaulted or impaired assets and generally reprices the

assets purchased to consider potential increased credit risk. The APA covers

all assets in the conduits and is considered in the Company’s maximum

exposure to loss. In addition, the Company provides the conduits with

program-wide liquidity in the form of short-term lending commitments.

Under these commitments, the Company has agreed to lend to the conduits

in the event of a short-term disruption in the commercial paper market,

subject to specified conditions. The total notional exposure under the

program-wide liquidity agreement is $11.3 billion and is considered in

the Company’s maximum exposure to loss. The Company receives fees for

providing both types of liquidity agreement and considers these fees to be on

fair market terms.

Finally, the Company is one of several named dealers in the commercial

paper issued by the conduits and earns a market-based fee for providing such

services. Along with third-party dealers, the Company makes a market in

the commercial paper and may from time to time fund commercial paper

pending sale to a third party. On specific dates with less liquidity in the

market, the Company may hold in inventory commercial paper issued by

conduits administered by the Company, as well as conduits administered by

third parties. The amount of commercial paper issued by its administered

conduits held in inventory fluctuates based on market conditions and

activity. As of December 31, 2009, the Company owned $70 million of the

commercial paper issued by its administered conduits.

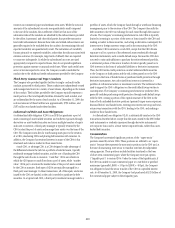

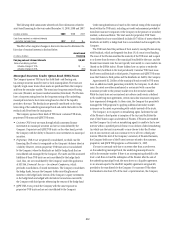

The Company is required to analyze the expected variability of the conduit

quantitatively to determine whether the Company is the primary beneficiary

of the conduit. The Company performs this analysis on a quarterly basis.

For conduits where the subordinate loss notes or third-party guarantees

are sufficient to absorb a majority of the expected loss of the conduit, the

Company does not consolidate. In circumstances where the subordinate

loss notes or third-party guarantees are insufficient to absorb a majority

of the expected loss, the Company consolidates the conduit as its primary

beneficiary due to the additional credit enhancement provided by the

Company. In conducting this analysis, the Company considers three primary

sources of variability in the conduit: credit risk, interest rate risk and fee

variability.

The Company models the credit risk of the conduit’s assets using a

Credit Value at Risk (C-VAR) model. The C-VAR model considers changes in

credit spreads (both within a rating class as well as due to rating upgrades

and downgrades), name-specific changes in credit spreads, credit defaults

and recovery rates and diversification effects of pools of financial assets.

The model incorporates data from independent rating agencies as well as

the Company’s own proprietary information regarding spread changes,

ratings transitions and losses given default. Using this credit data, a Monte

Carlo simulation is performed to develop a distribution of credit risk for

the portfolio of assets owned by each conduit, which is then applied on

a probability-weighted basis to determine expected losses due to credit

risk. In addition, the Company continuously monitors the specific credit

characteristics of the conduit’s assets and the current credit environment to

confirm that the C-VAR model used continues to incorporate the Company’s

best information regarding the expected credit risk of the conduit’s assets.

The Company also analyzes the variability in the fees that it earns from

the conduit using monthly actual historical cash flow data to determine

average fee and standard deviation measures for each conduit. Because any

unhedged interest rate and foreign-currency risk not contractually passed

on to customers is absorbed by the fees earned by the Company, the fee

variability analysis incorporates those risks.

The fee variability and credit risk variability are then combined into a

single distribution of the conduit’s overall returns. This return distribution is

updated and analyzed on at least a quarterly basis to ensure that the amount

of the subordinate loss notes issued to third parties is sufficient to absorb

greater than 50% of the total expected variability in the conduit’s returns.

The expected variability absorbed by the subordinate loss note investors is

therefore measured to be greater than the expected variability absorbed by the

Company through its liquidity arrangements and other fees earned, and the