Citibank 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

Business Environment

The business environment for financial services firms continued to be

challenging in 2009, particularly for firms with significant exposure to

consumer credit. U.S. unemployment reached 10.1%, GDP continued to

contract through the second quarter, housing markets remained weak, and

personal and business bankruptcies increased. These factors drove substantial

increases in credit costs across consumer and corporate portfolios. Credit

spreads continued to widen earlier in the year, driving further declines in the

value of credit-sensitive financial instruments. Equity markets were also very

weak during early 2009. At its low point in March 2009, the S&P 500 had

declined 55% from December 31, 2007 levels.

While these trends were negative for the economy and the financial

services industry as a whole, they were accompanied by very high levels of

volatility and wide spreads within fixed income markets during the first

quarter of 2009, which provided substantial trading opportunities. As a result,

fixed income capital markets businesses achieved high levels of revenue and

profitability during the first quarter, offsetting some of the substantial credit

losses incurred in consumer-oriented businesses, including mortgages and

cards.

Beginning in late 2008, significant U.S. government actions were

implemented to help stabilize the U.S. economy and restore confidence in

the capital markets. The U.S. government had available over $700 billion to

invest in financial institutions, including $45 billion in Citi, through TARP.

In early 2009, a $787 billion stimulus bill was signed into law. A number of

additional programs helped further stimulate demand in 2009, including

the U.S. government’s first-time home buyer credit programs. The U.S.

government also directly supported the capital markets through various

programs, including the Term Asset-Backed Securities Loan Facility (TALF)

and the Temporary Liquidity Guarantee Program (TLGP), and through

substantial direct purchases of mortgage-backed securities. These actions,

combined with continued accommodative monetary policy on the part of the

Federal Reserve Board, helped keep home mortgage rates near historic lows

and worked to facilitate the continued flow of credit to consumers.

Late in 2009, some early positive economic signs were observed. U.S. GDP

growth was positive in the third and fourth quarters. The S&P 500 finished

the year up 23% from December 31, 2008, and up 67% from the trough

level in March 2009, though still down 24% from December 31, 2007. Credit

spreads, while still elevated, tightened significantly from peak levels in the

early part of 2009. In the second half of the year, Citi began to observe some

very early signs of stabilization and, in some areas, moderation in U.S.

consumer credit trends as net credit losses declined sequentially during the

third and fourth quarters, though remaining quite elevated. In addition,

improving economic and market trends led to relatively stronger advisory

and equity underwriting volumes in the fourth quarter. On the other hand,

lower levels of market volatility and volumes resulted in diminished trading

opportunities, which led to significant sequential declines in S&B revenues in

the second half of the year. In certain key markets in Asia and Latin America,

improvement in the labor markets and overall economic recovery was earlier,

and somewhat stronger, than that observed in the U.S. Citi observed improving

credit trends in key markets including South Korea, Mexico, Australia,

Singapore and India, driven by improving economic conditions as well as

Citi’s loss mitigation efforts. Further, while EMEA continued to be affected by

a challenging economic environment, labor markets began to show some

improvement, particularly in Russia and Turkey, and there were some early

signs of financial stability returning to some of Citi’s key markets in the region.

While some economic and market improvements were observed in late

2009, Citi remains cautious, particularly with respect to its North American

businesses, as U.S. unemployment remains high at 10.0% as of December 31,

2009, and housing markets remain relatively weak. In addition, there remains

significant uncertainty regarding the pace of economic recovery and the impact

of the U.S. government’s unwinding of its extensive economic and market

supports, which may accelerate in 2010. See “2010 Business Outlook” below.

Citigroup’s Actions in Response to Market Challenges

During 2009, Citigroup sought to respond to market challenges and the

profound changes in the market environment—changes in funding

markets, operating models and client needs—including:

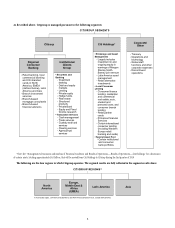

Citi restructured into two primary operating segments—

Citicorp and Citi Holdings.

As described above, Citicorp comprises Citi’s core franchise, while Citi

Holdings consists of non-core businesses and assets that Citi intends to exit as

quickly as practicable while seeking to optimize value for shareholders.

Citigroup continued to reduce operating expenses and

headcount.

Citi’s ongoing operating expenses in the fourth quarter of 2009 totaled

$12.3 billion, down from $15.1 billion (excluding the goodwill impairment

charge) in the fourth quarter of 2008 and $15.7 billion in the fourth quarter

of 2007. The decline in expenses was primarily driven by divestitures and

re-engineering efforts. In addition, Citi reduced headcount by over 100,000 to

approximately 265,000 at December 31, 2009, compared to 375,000 at peak

levels in 2007.