Citibank 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11

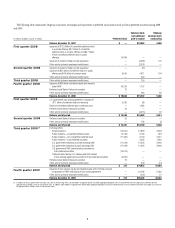

Citigroup strengthened its balance sheet.

Citi increased its common capital ratios. •

Citi significantly increased its Tier 1 Common and Tangible Common

Equity (TCE) ratios during 2009, primarily as a result of its exchange

offers completed in the third quarter of 2009. At December 31, 2009, Citi’s

Tier 1 Common ratio was 9.6% and its TCE ratio was 10.9%, compared

to 2.3% and 3.1% at December 31, 2008, respectively. In addition, Citi’s

Tier 1 Capital ratio was 11.7% at December 31, 2009. Tier 1 Common and

related ratios are measures used and relied on by U.S. banking regulators;

however, Tier 1 Common, TCE and related ratios are non-GAAP financial

measures for SEC purposes. See “Capital Resources and Liquidity—

Capital Resources” for additional information on these measures.

Citi improved its liquidity position. •

Citigroup lengthened the maturity structure of its liabilities, increased

balances of cash and highly liquid securities, continued to grow its

deposit base, raised substantial equity capital and reduced illiquid assets,

primarily in Citi Holdings. As a result, structural liquidity (defined as

deposits, long-term debt and equity as a percentage of total assets) grew

to 73% as of December 31, 2009, compared to 66% at December 31, 2008

and 63% at December 31, 2007. Citigroup had $193 billion of cash and

deposits with banks as of December 31, 2009. Citi currently anticipates

issuing less than $15 billion of Citigroup-level long-term debt in 2010

(down from $85 billion in 2009) due to its current strong liquidity

position and anticipated asset reductions within Citi Holdings.

Citi continued to de-risk and decrease the amount of its total assets. •

Citi’s total assets were approximately $1.86 trillion as of December 31,

2009, down from approximately $1.94 trillion at December 31, 2008

and $2.19 trillion at December 31, 2007. Consistent with Citi’s strategy,

Citi Holdings now represents less than 30% of Citi’s total assets as of

December 31, 2009, compared to 41% at the start of 2008. While Citi made

progress in de-risking and decreasing total assets, particularly in Citi

Holdings, these actions, together with an expansion of the Company’s loss

mitigation efforts and declining yields in the trading book, resulted in a

9% reduction in net interest revenue in 2009 versus 2008 and a decrease in

Citi’s net interest margin (NIM) to 2.65% at December 31, 2009 compared

to 3.26% at December 31, 2008.

Citigroup increased its allowance for loan losses.

During 2009, Citi added a net build of $8.0 billion to its allowance for loan

losses. The allowance for loan losses was $36 billion at December 31, 2009, or

6.1% of loans, compared to $29.6 billion, or 4.3% of loans, at year-end 2008.

With the adoption of SFAS 166 and 167 in the first quarter of 2010, loan loss

reserves would have been $49.4 billion, or 6.6% of loans, each as of December

31, 2009 and based on current estimates. The consumer loan loss reserve was

$28.4 billion at December 31, 2009, representing 14.1 months of concurrent

charge-off coverage, versus 13.1 months at December 31, 2008.

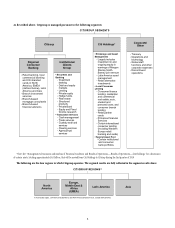

Citi began to make selected investments in its core

businesses.

Within Regional Consumer Banking, Citi began making selected

investments in its core businesses in the latter part of 2009. For example,

in Asia, Citi invested in new customer acquisition in the emerging affluent

segment and in card usage promotion. In Latin America, Citi invested in

card account acquisition, with a focus on higher-quality new accounts,

consistent with portfolio repositioning objectives. Citigroup also continued to

invest in consumer banking technology, for example, in banking products

in markets such as Singapore, Hong Kong and South Korea, where mobile

phones and mobile banking have intersected in ways not yet seen in the

U.S. Within Transaction Services, Citi continued to invest in technology to

support its global network, including its investor services suite of products,

prepaid and commercial cards offerings and launch of a new front end

online banking technology that provides a diverse set of functionality beyond

traditional transaction management and reporting. These and similar

investments have increased, and will likely continue to increase, Citi’s

operating expenses.

2010 BUSINESS OUTLOOK

While showing signs of improvement, the macroeconomic environment

going into 2010 remains challenging, with U.S. unemployment still elevated.

The U.S. government has indicated its intention to continue scaling back

programs put in place to support the market during 2008 and 2009. The

impact of the U.S. government’s exit from many of these programs is a

source of uncertainty in 2010, as is the future course of monetary policy.

In addition, the potential impact of new laws and regulations (e.g., The

Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD

Act)), potential new capital standards, and other legislative and regulatory

initiatives is a source of significant additional uncertainty regarding the

business and market environment.