Citibank 2009 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

177

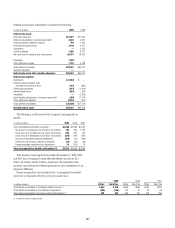

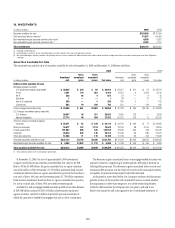

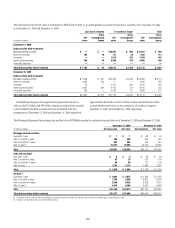

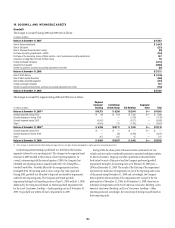

Debt Securities Held-to-Maturity

The carrying value and fair value of securities held-to-maturity (HTM) at December 31, 2009 and December 31, 2008 were as follows:

In millions of dollars

Amortized

cost (1)

Net unrealized

loss

recognized

in AOCI

Carrying

value (2)

Gross

unrecognized

gains

Gross

unrecognized

losses

Fair

value

December 31, 2009

Debt securities held-to-maturity

Mortgage-backed securities

U.S. government-agency guaranteed $ — $ — $ — $ — $ — $ —

Prime 6,118 1,151 4,967 317 5 5,279

Alt-A 14,710 4,276 10,434 905 243 11,096

Subprime 1,087 128 959 77 100 936

Non-U.S. residential 9,002 1,119 7,883 469 134 8,218

Commercial 1,303 45 1,258 1 208 1,051

Total mortgage-backed securities $ 32,220 $6,719 $25,501 $1,769 $ 690 $ 26,580

U.S. Treasury and federal agency securities

U.S. Treasury — — — — — —

Agency and direct obligations — — — — — —

Total U.S. Treasury and federal agency securities $ — $ — $ — $ — $ — $ —

State and municipal 3,067 147 2,920 92 113 2,899

Corporate 7,457 264 7,193 524 182 7,535

Asset-backed securities 16,348 435 15,913 567 496 15,984

Other debt securities — — — — — —

Total debt securities held-to-maturity $59,092 $7,565 $51,527 $2,952 $ 1,481 $ 52,998

December 31, 2008

Debt securities held-to-maturity

Mortgage-backed securities

U.S. government-agency guaranteed $ — $ — $ — $ — $ — $ —

Prime 7,481 1,436 6,045 — 623 5,422

Alt-A 16,658 4,216 12,442 23 1,802 10,663

Subprime 1,368 125 1,243 15 163 1,095

Non-U.S. residential 10,496 1,128 9,368 5 397 8,976

Commercial 1,021 — 1,021 — 130 891

Total mortgage-backed securities $ 37,024 $6,905 $30,119 $ 43 $ 3,115 $ 27,047

U.S. Treasury and federal agency securities

U.S. Treasury 1 — 1 — — 1

Agency and direct obligations — — — — — —

Total U.S. Treasury and federal agency securities $ 1 $ — $ 1 $ — $ — $ 1

State and municipal 3,371 183 3,188 14 253 2,949

Corporate 6,906 175 6,731 130 305 6,556

Asset-backed securities 22,698 415 22,283 86 555 21,814

Other debt securities 2,478 341 2,137 — 127 2,010

Total debt securities held-to-maturity $ 72,478 $8,019 $64,459 $ 273 $ 4,355 $ 60,377

(1) For securities transferred to HTM from Trading account assets, amortized cost is defined as the fair value amount of the securities at the date of transfer plus any accretion income and less any impairments recognized

in earnings subsequent to transfer. For securities transferred to HTM from AFS, amortized cost is defined as the original purchase cost, plus or minus any accretion or amortization of interest, less any impairment

previously recognized in earnings.

(2) HTM securities are carried on the Consolidated Balance Sheet at amortized cost and the changes in the value of these securities, other than impairment charges, are not reported on the financial statements.

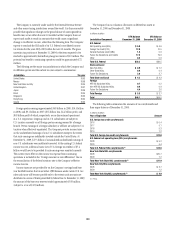

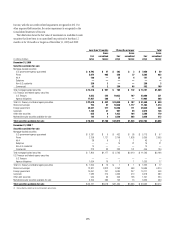

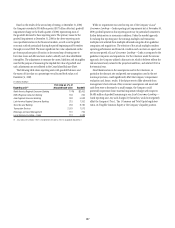

The net unrealized losses classified in Accumulated other comprehensive

income (AOCI) relate to debt securities reclassified from AFS investments to

HTM investments, and to additional declines in fair value for HTM securities

that suffer credit impairment. The balance was $7.6 billion as of December

31, 2009, compared to $8.0 billion as of December 31, 2008. This balance is

amortized over the remaining life of the related securities as an adjustment

of yield in a manner consistent with the accretion of discount on the same

transferred debt securities. This will have no impact on the Company’s net

income because the amortization of the unrealized holding loss reported in

equity will offset the effect on interest income of the accretion of the discount

on these securities.