Citibank 2009 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

199

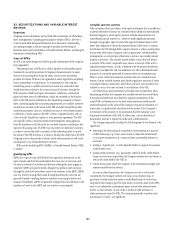

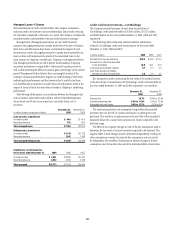

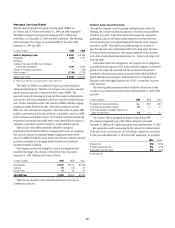

Citicorp’s Consolidated VIEs—Balance Sheet Classification

The following table presents the carrying amounts and classifications of

consolidated assets that are collateral for consolidated VIE obligations:

In billions of dollars

December 31,

2009

December 31,

2008

Cash $ — $ 0.7

Trading account assets 3.7 4.3

Investments 9.8 12.5

Loans 0.1 0.5

Other assets 1.9 1.7

Total assets of consolidated VIEs $15.5 $19.7

The following table presents the carrying amounts and classification of the

third-party liabilities of the consolidated VIEs:

In billions of dollars

December 31,

2009

December 31,

2008

Short-term borrowings $ 9.5 $14.2

Long-term debt 4.6 5.6

Other liabilities 0.1 0.9

Total liabilities of consolidated VIEs $14.2 $20.7

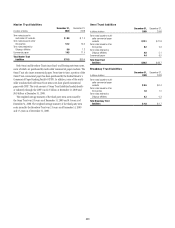

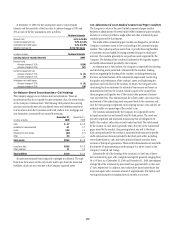

Citi Holdings’ Consolidated VIEs—Balance Sheet

Classification

The following table presents the carrying amounts and classifications of

consolidated assets that are collateral for consolidated VIE obligations:

In billions of dollars

December 31,

2009

December 31,

2008

Cash $ 0.7 $ 1.2

Trading account assets 9.5 16.6

Investments 2.7 3.3

Loans 0.4 2.1

Other assets 0.5 0.7

Total assets of consolidated VIEs $13.8 $23.9

The following table presents the carrying amounts and classification of the

third-party liabilities of the consolidated VIEs:

In billions of dollars

December 31,

2009

December 31,

2008

Trading account liabilities $0.2 $0.5

Short-term borrowings 2.6 2.8

Long-term debt 0.3 1.2

Other liabilities 1.3 2.1

Total liabilities of consolidated VIEs $4.4 $6.6

The consolidated VIEs included in the tables above represent hundreds of

separate entities with which the Company is involved. In general, the third-

party investors in the obligations of consolidated VIEs have legal recourse

only to the assets of the VIEs and do not have such recourse to the Company,

except where the Company has provided a guarantee to the investors or is

the counterparty to certain derivative transactions involving the VIE. In

addition, the assets are generally restricted only to pay such liabilities. Thus,

the Company’s maximum legal exposure to loss related to consolidated VIEs

is significantly less than the carrying value of the consolidated VIE assets due

to outstanding third-party financing. Intercompany assets and liabilities are

excluded from the table.

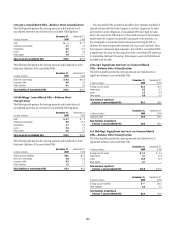

Citicorp’s Significant Interests in Unconsolidated

VIEs—Balance Sheet Classification

The following tables present the carrying amounts and classification of

significant interests in unconsolidated VIEs:

In billions of dollars

December 31,

2009

December 31,

2008

Trading account assets $3.2 $1.9

Investments 0.2 0.2

Loans 2.3 3.5

Other assets 0.5 0.4

Total assets of significant

interests in unconsolidated VIEs $6.2 $6.0

In billions of dollars

December 31,

2009

December 31,

2008

Long-term debt $0.5 $0.4

Total liabilities of significant

interests in unconsolidated VIEs $0.5 $0.4

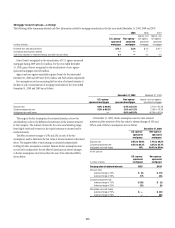

Citi Holdings’ Significant Interests in Unconsolidated

VIEs—Balance Sheet Classification

The following tables present the carrying amounts and classification of

significant interests in unconsolidated VIEs:

In billions of dollars

December 31,

2009

December 31,

2008

Trading account assets $ 3.1 $ 4.4

Investments 9.1 10.8

Loans 10.5 12.4

Other assets 0.1 —

Total assets of significant

interests in unconsolidated VIEs $22.8 $ 27.6

In billions of dollars

December 31,

2009

December 31,

2008

Trading account liabilities $ — $0.2

Other liabilities 0.4 0.6

Total liabilities of significant

interests in unconsolidated VIEs $0.4 $0.8