Citibank 2009 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

211

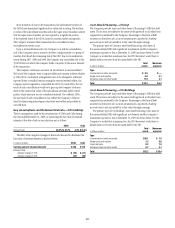

Since inception of many CDO transactions, the subordinate tranches of

the CDOs have diminished significantly in value and in rating. The declines

in value of the subordinate tranches and in the super senior tranches indicate

that the super-senior tranches are now exposed to a significant portion

of the expected losses of the CDOs, based on current market assumptions.

The Company evaluates these transactions for consolidation when

reconsideration events occur.

Upon a reconsideration event, the Company is at risk for consolidation

only if the Company owns a majority of either a single tranche or a group of

tranches that absorb the remaining risk of the CDO. Due to reconsideration

events during 2007, 2008 and 2009, the Company has consolidated 24 of the

39 CDOs/CLOs in which the Company holds a majority of the senior interests

of the transaction.

The Company continues to monitor its involvement in unconsolidated

VIEs and if the Company were to acquire additional interests in these vehicles

or if the CDOs’ contractual arrangements were to be changed to reallocate

expected losses or residual returns among the various interest holders, the

Company may be required to consolidate the CDOs. For cash CDOs, the net

result of such consolidation would be to gross up the Company’s balance

sheet by the current fair value of the subordinate securities held by third

parties, which amounts are not considered material. For synthetic CDOs,

the net result of such consolidation may reduce the Company’s balance

sheet by eliminating intercompany derivative receivables and payables in

consolidation.

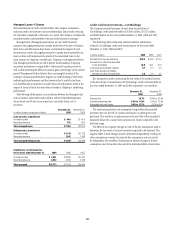

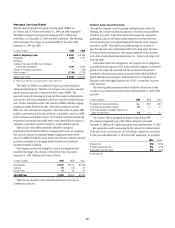

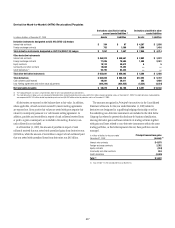

Key Assumptions and Retained Interests—Citi Holdings

The key assumptions, used for the securitization of CDOs and CLOs during

the year ended December 31, 2009, in measuring the fair value of retained

interests at the date of sale or securitization are as follows:

CDOs CLOs

Discount rate 36.4% to 47.2% 4.3% to 6.3%

The effect of two negative changes in discount rates used to determine the

fair value of retained interests is disclosed below.

In millions of dollars CDOs CLOs

Carrying value of retained interests $186 $ 714

Discount rates

Adverse change of 10% $ (25) $ (11)

Adverse change of 20% (47) (22)

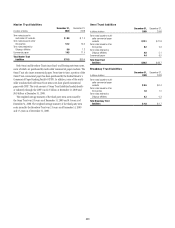

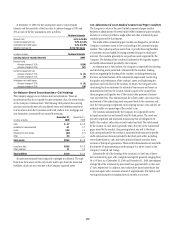

Asset-Based Financing—Citicorp

The Company provides loans and other forms of financing to VIEs that hold

assets. Those loans are subject to the same credit approvals as all other loans

originated or purchased by the Company. Financings in the form of debt

securities or derivatives are, in most circumstances, reported in Trading

account assets and accounted for at fair value through earnings.

The primary types of Citicorp’s asset-based financing, total assets of

the unconsolidated VIEs with significant involvement and the Company’s

maximum exposure to loss at December 31, 2009 are shown below. For the

Company to realize that maximum loss, the VIE (borrower) would have to

default with no recovery from the assets held by the VIE.

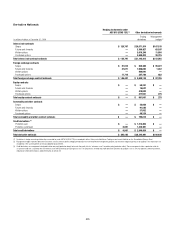

In billions of dollars

Total

assets

Maximum

exposure

Type

Commercial and other real estate $ 0.5 $ —

Hedge funds and equities 5.9 3.1

Airplanes, ships and other assets 11.9 2.1

Total $18.3 $ 5.2

Asset-Based Financing—Citi Holdings

The Company provides loans and other forms of financing to VIEs that hold

assets. Those loans are subject to the same credit approvals as all other loans

originated or purchased by the Company. Financings in the form of debt

securities or derivatives are, in most circumstances, reported in Trading

account assets and accounted for at fair value through earnings.

The primary types of Citi Holdings’ asset-based financing, total assets of

the unconsolidated VIEs with significant involvement and the Company’s

maximum exposure to loss at December 31, 2009 are shown below. For the

Company to realize that maximum loss, the VIE (borrower) would have to

default with no recovery from the assets held by the VIE.

In billions of dollars

Total

assets

Maximum

exposure

Type

Commercial and other real estate $36.1 $ 7.5

Hedge funds and equities 2.2 0.8

Corporate loans 8.2 7.0

Airplanes, ships and other assets 5.7 3.1

Total $52.2 $18.4