Citibank 2009 Annual Report Download - page 247

Download and view the complete annual report

Please find page 247 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

237

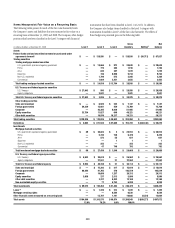

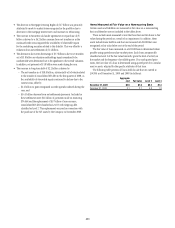

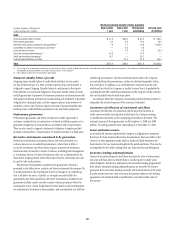

The following table provides information about certain credit products carried at fair value:

December 31, 2009 December 31, 2008(1)

In millions of dollars Trading assets Loans Trading assets Loans

Carrying amount reported on the Consolidated Balance Sheet $14,338 $945 $16,254 $2,315

Aggregate unpaid principal balance in excess of fair value 390 (44) 6,501 3

Balance of non-accrual loans or loans more than 90 days past due 312 — 77 —

Aggregate unpaid principal balance in excess of fair value for non-accrual loans or loans more than 90 days past due 267 — 190 —

(1) Reclassified to conform to current period’s presentation.

In addition to the amounts reported above, $200 million and $72 million

of unfunded loan commitments related to certain credit products selected for

fair value accounting were outstanding as of December 31, 2009 and 2008,

respectively.

Changes in fair value of funded and unfunded credit products are

classified in Principal transactions in the Company’s Consolidated

Statement of Income. Related interest revenue is measured based on the

contractual interest rates and reported as Interest revenue on trading

account assets or loans depending on their balance sheet classifications.

The changes in fair value for the years ended December 31, 2009 and 2008

due to instrument-specific credit risk totaled to a gain of $5.9 billion and

a loss of $6.0 billion, respectively.

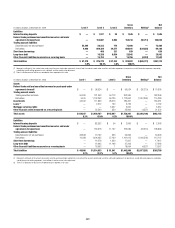

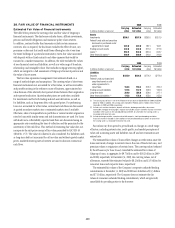

Certain hybrid financial instruments

The Company has elected to apply fair value accounting for certain hybrid

financial assets and liabilities whose performance is linked to risks other than

interest rate, foreign exchange or inflation (e.g., equity, credit or commodity

risks). In addition, the Company has elected fair value accounting for

residual interests retained from securitizing certain financial assets.

The Company has elected fair value accounting for these instruments

because these exposures are considered to be trading-related positions and,

therefore, are managed on a fair value basis. In addition, the accounting for

these instruments is simplified under a fair value approach as it eliminates

the complicated operational requirements of bifurcating the embedded

derivatives from the host contracts and accounting for each separately. The

hybrid financial instruments are classified as Trading account assets,

Loans, Deposits, Trading account liabilities (for prepaid derivatives),

Short-term borrowings or Long-term debt on the Company’s Consolidated

Balance Sheet according to their legal form, while residual interests in

certain securitizations are classified as Trading account assets.

For hybrid financial instruments for which fair value accounting has

been elected and that are classified as Long-term debt, the aggregate unpaid

principal exceeded the aggregate fair value by $3.4 billion and $4.1 billion

as of December 31, 2009 and 2008, respectively. The difference for those

instruments classified as Loans is immaterial.

Changes in fair value for hybrid financial instruments, which in most

cases includes a component for accrued interest, are recorded in Principal

transactions in the Company’s Consolidated Statement of Income. Interest

accruals for certain hybrid instruments classified as trading assets are

recorded separately from the change in fair value as Interest revenue in the

Company’s Consolidated Statement of Income.

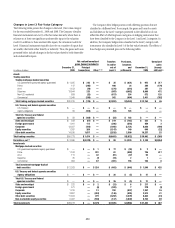

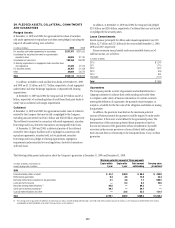

Certain investments in private equity and real estate

ventures and certain equity method investments

Citigroup invests in private equity and real estate ventures for the purpose

of earning investment returns and for capital appreciation. The Company

has elected the fair value option for certain of these ventures, because such

investments are considered similar to many private equity or hedge fund

activities in our investment companies, which are reported at fair value.

The fair value option brings consistency in the accounting and evaluation

of certain of these investments. All investments (debt and equity) in such

private equity and real estate entities are accounted for at fair value. These

investments are classified as Investments on Citigroup’s Consolidated

Balance Sheet.

Citigroup also holds various non-strategic investments in leveraged

buyout funds and other hedge funds that previously were required to be

accounted for under the equity method. The Company elected fair value

accounting to reduce operational and accounting complexity. Since the

funds account for all of their underlying assets at fair value, the impact of

applying the equity method to Citigroup’s investment in these funds was

equivalent to fair value accounting. Thus, this fair value election had no

impact on opening Retained earnings. These investments are classified as

Other assets on Citigroup’s Consolidated Balance Sheet.

Changes in the fair values of these investments are classified in Other

revenue in the Company’s Consolidated Statement of Income.