Citibank 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

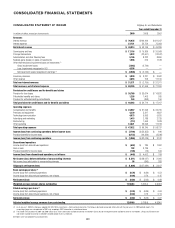

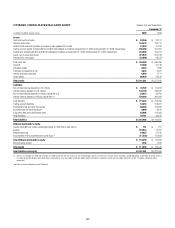

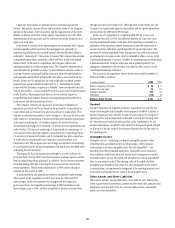

CONSOLIDATED BALANCE SHEET Citigroup Inc. and Subsidiaries

December 31

In millions of dollars, except shares 2009 2008

Assets

Cash and due from banks (including segregated cash and other deposits) $ 25,472 $ 29,253

Deposits with banks 167,414 170,331

Federal funds sold and securities borrowed or purchased under agreements to resell (including $87,837 and $70,305 as of December 31, 2009 and

December 31, 2008, respectively, at fair value) 222,022 184,133

Brokerage receivables 33,634 44,278

Trading account assets (including $111,219 and $148,703 pledged to creditors at December 31, 2009 and December 31, 2008, respectively) 342,773 377,635

Investments (including $15,154 and $14,875 pledged to creditors at December 31, 2009 and December 31, 2008, respectively and $246,429

and $184,451 at December 31, 2009 and December 31, 2008, respectively, at fair value) 306,119 256,020

Loans, net of unearned income

Consumer (including $34 and $36 at fair value as of December 31, 2009 and December 31, 2008, respectively) 424,057 481,387

Corporate (including $1,405 and $2,696 at December 31, 2009 and December 31, 2008, respectively, at fair value) 167,447 212,829

Loans, net of unearned income $ 591,504 $ 694,216

Allowance for loan losses (36,033) (29,616)

Total loans, net $ 555,471 $ 664,600

Goodwill 25,392 27,132

Intangible assets (other than MSRs) 8,714 14,159

Mortgage servicing rights (MSRs) 6,530 5,657

Other assets (including $12,664 and $21,372 as of December 31, 2009 and December 31, 2008 respectively, at fair value) 163,105 165,272

Total assets $1,856,646 $1,938,470

Liabilities

Non-interest-bearing deposits in U.S. offices $ 71,325 $ 55,485

Interest-bearing deposits in U.S. offices (including $700 and $1,335 at December 31, 2009 and December 31, 2008, respectively, at fair value) 232,093 234,491

Non-interest-bearing deposits in offices outside the U.S. 44,904 37,412

Interest-bearing deposits in offices outside the U.S. (including $845 and $1,271 at December 31, 2009 and December 31, 2008,

respectively, at fair value) 487,581 446,797

Total deposits $ 835,903 $ 774,185

Federal funds purchased and securities loaned or sold under agreements to repurchase (including $104,030 and $138,866 as of

December 31, 2009 and December 31, 2008, respectively, at fair value) 154,281 205,293

Brokerage payables 60,846 70,916

Trading account liabilities 137,512 165,800

Short-term borrowings (including $639 and $17,607 at December 31, 2009 and December 31, 2008, respectively, at fair value) 68,879 126,691

Long-term debt (including $25,942 and $27,263 at December 31, 2009 and December 31, 2008, respectively, at fair value) 364,019 359,593

Other liabilities (including $11,542 and $13,567 as of December 31, 2009 and December 31, 2008, respectively, at fair value) 80,233 91,970

Total liabilities $1,701,673 $1,794,448

Stockholders’ equity

Preferred stock ($1.00 par value; authorized shares: 30 million), issued shares: 12,038 at December 31, 2009, at aggregate liquidation value $ 312 $ 70,664

Common stock ($0.01 par value; authorized shares: 60 billion), issued shares: 28,626,100,389 at December 31, 2009

and 5,671,743,807 at December 31, 2008 286 57

Additional paid-in capital 98,142 19,165

Retained earnings 77,440 86,521

Treasury stock, at cost: 2009—142,833,099 shares and 2008—221,675,719 shares (4,543) (9,582)

Accumulated other comprehensive income (loss) (18,937) (25,195)

Total Citigroup stockholders’ equity $ 152,700 $ 141,630

Noncontrolling interest 2,273 2,392

Total equity $ 154,973 $ 144,022

Total liabilities and equity $1,856,646 $1,938,470

See Notes to the Consolidated Financial Statements.