Citibank 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

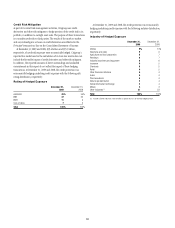

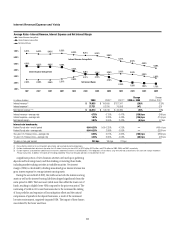

The following tables represent the corporate credit portfolio (excluding

Private Banking), before consideration of collateral, by maturity at

December 31, 2009. The corporate portfolio is broken out by direct

outstandings that include drawn loans, overdrafts, interbank placements,

bankers’ acceptances, certain investment securities and leases and unfunded

commitments that include unused commitments to lend, letters of credit and

financial guarantees.

At December 31, 2009

In billions of dollars

Due

within

1 year

Greater

than 1 year

but within

5 years

Greater

than

5 years

Total

exposure

Direct outstandings $213 $ 66 $ 7 $286

Unfunded lending commitments 182 120 10 312

Total $395 $186 $17 $598

At December 31, 2008

In billions of dollars

Due

within

1 year

Greater

than 1 year

but within

5 years

Greater

than

5 years

Total

exposure

Direct outstandings $161 $100 $ 9 $270

Unfunded lending commitments 206 141 12 359

Total $367 $241 $21 $629

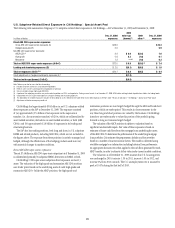

Portfolio Mix

The corporate credit portfolio is diverse across counterparty and industry,

and geography. The following table shows direct outstandings and unfunded

commitments by region:

December 31,

2009

December 31,

2008

North America 51% 49%

EMEA 27 29

Latin America 98

Asia 13 14

Total 100% 100%

The maintenance of accurate and consistent risk ratings across the

corporate credit portfolio facilitates the comparison of credit exposure across

all lines of business, geographic regions and products.

Obligor risk ratings reflect an estimated probability of default for an

obligor and are derived primarily through the use of statistical models

(which are validated periodically), external rating agencies (under defined

circumstances) or approved scoring methodologies. Facility risk ratings

are assigned, using the obligor risk rating, and then factors that affect the

loss-given default of the facility, such as support or collateral, are taken

into account. With regard to climate change risk, factors evaluated include

consideration of the business impact, impact of regulatory requirements,

or lack thereof, and impact of physical effects on obligors and their assets.

These factors may adversely affect the ability of some obligors to perform

and thus increase the risk of lending activities to these obligors. Citigroup

also has incorporated climate risk assessment criteria for certain obligors, as

necessary.

Internal obligor ratings equivalent to BBB and above are considered

investment grade. Ratings below the equivalent of the BBB category are

considered non-investment grade.

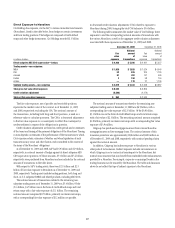

The following table presents the corporate credit portfolio by facility risk

rating at December 31, 2009 and 2008, as a percentage of the total portfolio:

Direct outstandings and

unfunded commitments

December 31,

2009

December 31,

2008

AAA/AA/A 58% 58%

BBB 24 24

BB/B 11 13

CCC or below 75

Unrated ——

Total 100% 100%

The corporate credit portfolio is diversified by industry, with a

concentration only in the financial sector, including banks, other financial

institutions, insurance companies, investment banks and government and

central banks. The following table shows the allocation of direct outstandings

and unfunded commitments to industries as a percentage of the total

corporate portfolio:

Direct outstandings and

unfunded commitments

December 31,

2009

December 31,

2008

Government and central banks 12% 11%

Investment banks 57

Banks 96

Other financial institutions 12 5

Utilities 44

Insurance 44

Petroleum 44

Agriculture and food preparation 44

Telephone and cable 33

Industrial machinery and equipment 23

Global information technology 22

Chemicals 22

Real estate 33

Other industries (1) 34 42

Total 100% 100%

(1) Includes all other industries, none of which exceeds 2% of total outstandings.