Citibank 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

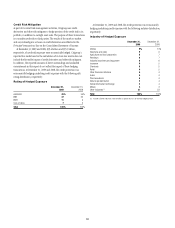

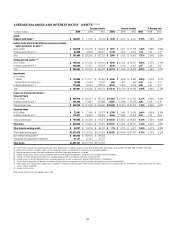

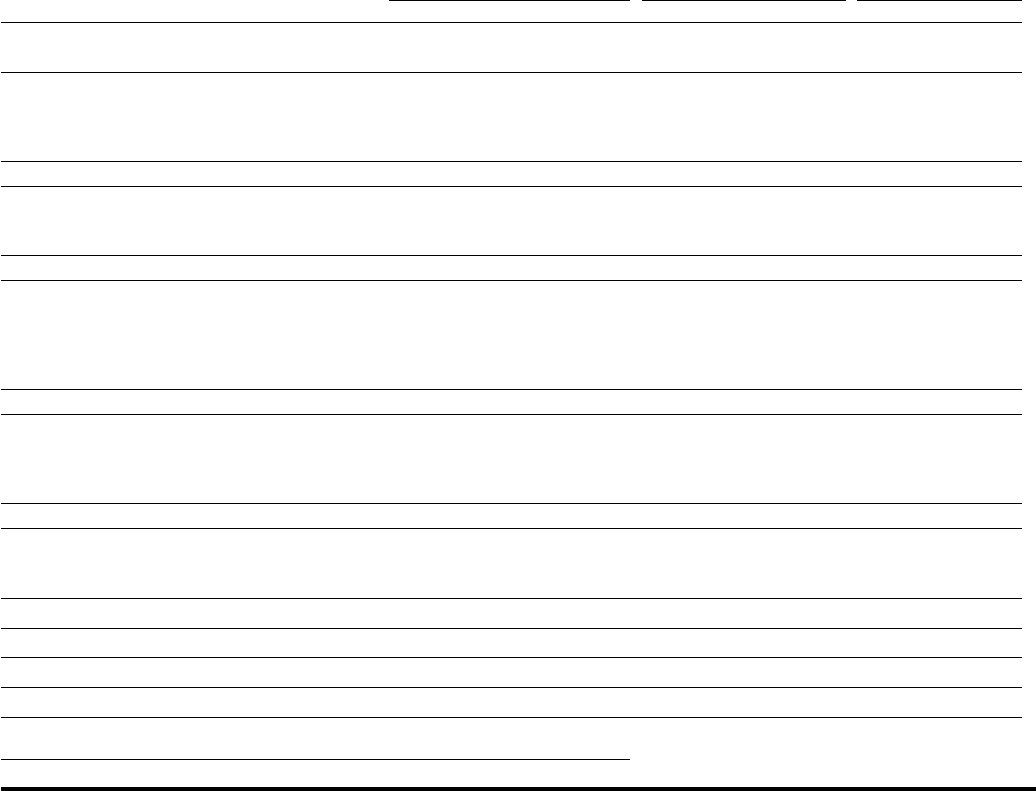

AVERAGE BALANCES AND INTEREST RATES—ASSETS (1)(2)(3)(4)

Average volume Interest revenue % Average rate

In millions of dollars 2009 2008 2007 2009 2008 2007 2009 2008 2007

Assets

Deposits with banks (5) $ 186,841 $ 77,200 $ 53,044 $ 1,478 $ 3,074 $ 3,097 0.79% 3.98% 5.84%

Federal funds sold and securities borrowed or purchased

under agreements to resell (6)

In U.S. offices $ 138,579 $ 164,732 $ 192,824 $ 1,975 $ 5,071 $ 11,728 1.43% 3.08% 6.08%

In offices outside the U.S. (5) 63,909 73,833 129,301 1,109 4,079 6,613 1.74 5.52 5.11

Total $ 202,488 $ 238,565 $ 322,125 $ 3,084 $ 9,150 $ 18,341 1.52% 3.84% 5.69%

Trading account assets (7) (8)

In U.S. offices $ 140,233 $ 221,455 $ 263,922 $ 6,844 $ 12,331 $ 13,557 4.88% 5.57% 5.14%

In offices outside the U.S. (5) 126,309 151,071 171,504 3,879 5,115 4,917 3.07 3.39 2.87

Total $ 266,542 $ 372,526 $ 435,426 $ 10,723 $ 17,446 $ 18,474 4.02% 4.68% 4.24%

Investments

In U.S. offices

Taxable $ 124,404 $ 112,071 $ 136,482 $ 6,208 $ 4,846 $ 6,840 4.99% 4.32% 5.01%

Exempt from U.S. income tax (1) 16,489 13,584 17,796 864 613 909 5.24 4.51 5.11

In offices outside the U.S. (5) 118,988 94,725 108,875 6,047 5,259 5,674 5.08 5.55 5.21

Total $ 259,881 $ 220,380 $ 263,153 $ 13,119 $ 10,718 $ 13,423 5.05% 4.86% 5.10%

Loans (net of unearned income) (9)

Consumer loans

In U.S. offices $ 304,976 $ 339,417 $ 336,742 $ 21,982 $ 27,456 $ 27,794 7.21% 8.09% 8.25%

In offices outside the U.S. (5) 151,262 173,851 157,888 13,402 17,963 17,016 8.86 10.33 10.78

Total consumer loans $ 456,238 $ 513,268 $ 494,630 $ 35,384 $ 45,419 $ 44,810 7.76% 8.85% 9.06%

Corporate loans

In U.S. offices $ 73,961 $ 77,450 $ 62,321 $ 2,709 $ 3,482 $ 5,095 3.66% 4.50% 8.18%

In offices outside the U.S. (5) 116,421 143,806 153,956 9,364 13,435 13,296 8.04 9.34 8.64

Total corporate loans $ 190,382 $ 221,256 $ 216,277 $ 12,073 $ 16,917 $ 18,391 6.34% 7.65% 8.50%

Total loans $ 646,620 $ 734,524 $ 710,907 $ 47,457 $ 62,336 $ 63,201 7.34% 8.49% 8.89%

Other interest-earning assets $ 49,707 $ 94,123 $ 89,742 $ 774 $ 3,775 $ 4,811 1.56% 4.01% 5.36%

Total interest-earning assets $1,612,079 $1,737,318 $1,874,397 $ 76,635 $106,499 $121,347 4.75% 6.13% 6.47%

Non-interest-earning assets (7) $ 264,165 $ 383,150 $ 249,958

Total assets from discontinued operations 15,137 47,010 47,177

Total assets $1,891,381 $2,167,478 $2,171,532

(1) Interest revenue excludes the taxable equivalent adjustments (based on the U.S. federal statutory tax rate of 35%) of $752 million, $323 million, and $125 million for 2009, 2008, and 2007, respectively.

(2) Interest rates and amounts include the effects of risk management activities associated with the respective asset and liability categories.

(3) Monthly or quarterly averages have been used by certain subsidiaries where daily averages are unavailable.

(4) Detailed average volume, interest revenue and interest expense exclude discontinued operations. See Note 3 to the Consolidated Financial Statements.

(5) Average rates reflect prevailing local interest rates, including inflationary effects and monetary corrections in certain countries.

(6) Average volumes of securities borrowed or purchased under agreements to resell are reported net. However, Interest revenue is reflected gross.

(7) The fair value carrying amounts of derivative and foreign exchange contracts are reported in non-interest-earning assets and other non-interest-bearing liabilities.

(8) Interest expense on Trading account liabilities of ICG is reported as a reduction of interest revenue. Interest revenue and interest expense on cash collateral positions are reported in Trading account assets and Trading

account liabilities, respectively.

(9) Includes cash-basis loans.

Reclassified to conform to the current period’s presentation.