Citibank 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

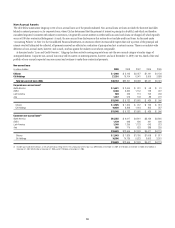

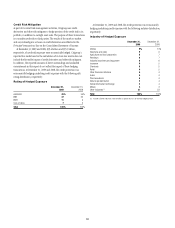

Balances: December 31, 2009—Second Lien Mortgages

AT

ORIGINATION FICO ≥ 660 620 ≤ FICO

<660

FICO < 620

LTV ≤ 80% 48% 2% 2%

80% < LTV ≤ 100% 43% 3% 2%

LTV > 100% NM NM NM

REFRESHED FICO ≥ 660 620 ≤ FICO

<660

FICO<620

LTV ≤ 80% 23% 1% 3%

80% < LTV ≤ 100% 23% 2% 5%

LTV > 100% 29% 4% 10%

Note: NM—Not meaningful. Second lien mortgage table excludes loans in Canada and Puerto Rico. Table

excludes loans subject to LTSCs. Table also excludes $1.7 billion from At Origination balances and $0.8

billion from Refreshed balances for which FICO or LTV data were unavailable. Refreshed FICO scores,

based on updated credit scores obtained from Fair Isaac Corporation. Refreshed LTV ratios are derived

from data at origination updated using mainly the Case-Shiller Home Price Index or the Federal Housing

Finance Agency Price Index.

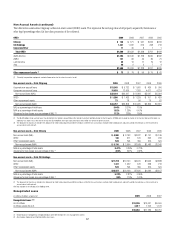

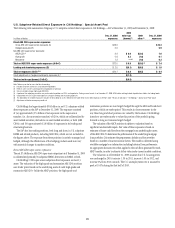

Delinquencies

The tables below provide delinquency statistics for loans 90+DPD, as a

percentage of outstandings in each of the FICO/LTV combinations, in both

the first lien and second lien mortgage portfolios. For example, loans with

FICO ≥ 660 and LTV ≤ 80% at origination have a 90+DPD rate of 7.9%.

Loans with FICO scores of less than 620 exhibit significantly higher

delinquencies than in any other FICO band. Similarly, loans with LTVs

greater than 100% have higher delinquencies than LTVs of less than or equal

to 100%.

The first mortgage delinquencies continued to rise during 2009. Further

breakout of the FICO below 620 segment indicates that delinquencies in

this segment, on a refreshed basis, are about three times higher than in the

overall first mortgage portfolio.

Delinquencies: 90+DPD Rates—First Lien Mortgages

AT

ORIGINATION

FICO ≥ 660 620 ≤ FICO

<660

FICO < 620

LTV ≤ 80% 7.9% 13.1% 14.0%

80% < LTV ≤ 100% 10.2% 17.3% 20.7%

LTV > 100% NM NM NM

REFRESHED FICO ≥ 660 620 ≤ FICO

<660

FICO < 620

LTV ≤ 80% 0.3% 3.8% 18.0%

80% < LTV ≤ 100% 0.8% 8.5% 27.3%

LTV > 100% 2.8% 23.3% 42.0%

Note: NM—Not meaningful. 90+DPD rates are based on balances referenced in the tables above.

Delinquencies: 90+DPD Rates—Second Lien Mortgages

AT

ORIGINATION

FICO ≥ 660 620 ≤ FICO

<660

FICO < 620

LTV ≤ 80% 1.5% 4.2% 5.6%

80% < LTV ≤ 100% 4.2% 5.3% 7.6%

LTV > 100% NM NM NM

REFRESHED FICO ≥ 660 620 ≤ FICO

<660

FICO < 620

LTV ≤ 80% 0.0% 0.7% 8.5%

80% < LTV ≤ 100% 0.1% 1.3% 9.8%

LTV > 100% 0.4% 4.5% 19.3%

Note: NM—Not meaningful. 90+DPD rates are based on balances referenced in the tables above.

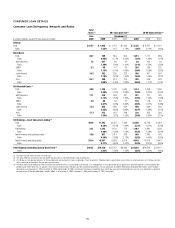

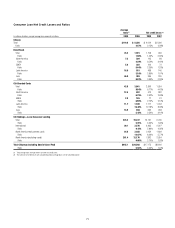

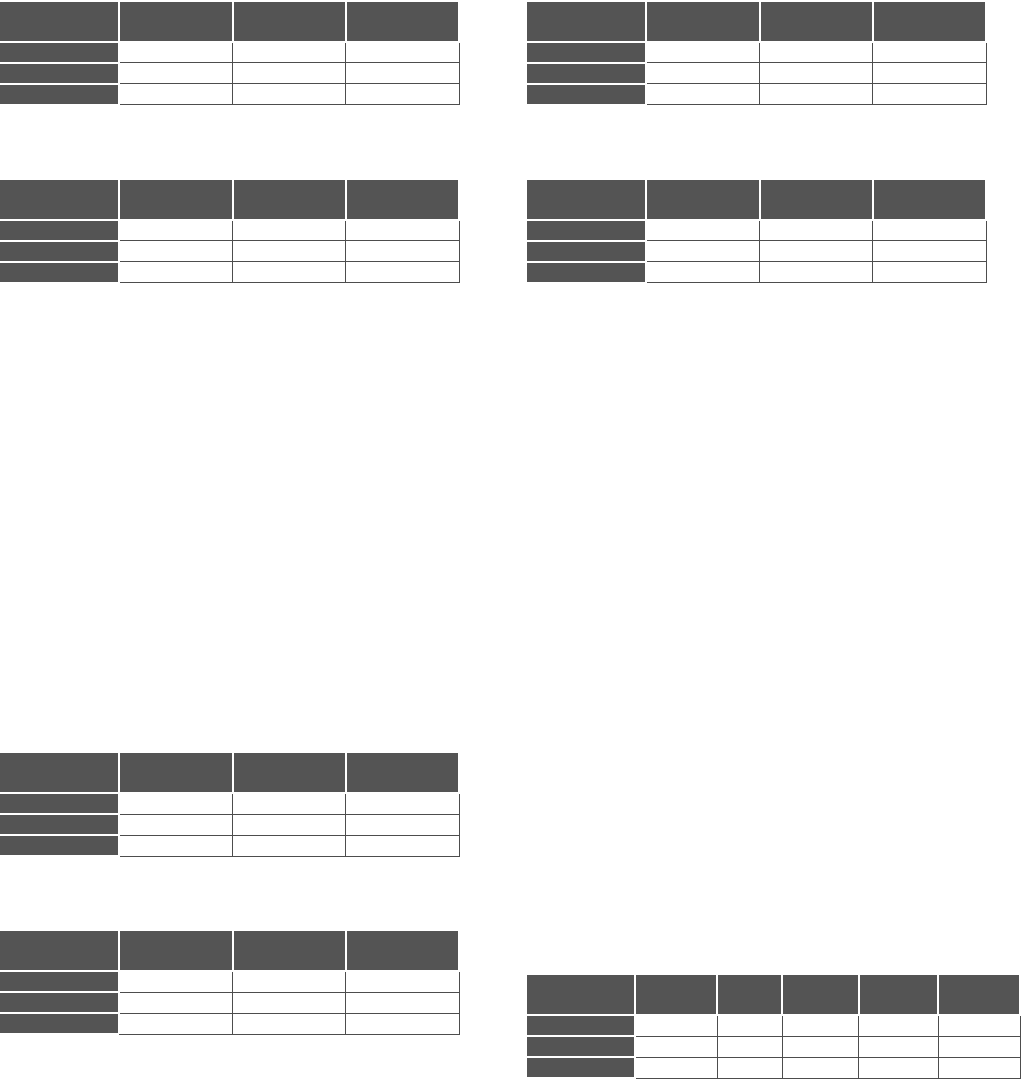

Origination channel, geographic distribution and origination vintage

The following tables detail Citi’s first and second lien U.S. consumer

mortgage portfolio by origination channel, geographic distribution and

origination vintage.

By origination channel

Citi’s U.S. consumer mortgage portfolio has been originated from three main

channels: retail, broker and correspondent.

Retail: loans originated through a direct relationship with the borrower. •

Broker: loans originated through a mortgage broker, where Citi •

underwrites the loan directly with the borrower.

Correspondent: loans originated and funded by a third party, where Citi •

purchases the closed loans after the correspondent has funded the loan.

This channel includes loans acquired in large bulk purchases from other

mortgage originators primarily in 2006 and 2007. Such bulk purchases

were discontinued in 2007.

First Lien Mortgages: December 31, 2009

As of December 31, 2009, approximately 55% of the first lien mortgage

portfolio was originated through third-party channels. Given that loans

originated through correspondents have exhibited higher 90+DPD

delinquency rates than retail originated mortgages, Citi terminated business

with a number of correspondent sellers in 2007 and 2008. During 2008, Citi

also severed relationships with a number of brokers, only maintaining those

who have produced strong, high-quality and profitable volume. Citi has also

discontinued purchasing loans held in portfolio from correspondents and

significantly reduced bulk purchases.

CHANNELS

($ in billions)

FIRST LIEN

MORTGAGES

CHANNEL

% TOTAL

90+DPD % *FICO < 620 *LTV > 100%

RETAIL $48.2 44.9% 5.1% $14.3 $ 9.1

BROKER $19.0 17.7% 11.3% $ 3.7 $ 5.7

CORRESPONDENT $40.1 37.4% 16.6% $14.0 $15.0

* Refreshed FICO and LTV.

Note: First lien mortgage table excludes Canada and Puerto Rico, deferred fees/costs, loans guaranteed by

U.S. government sponsored agencies and loans subject to LTSCs.