Citibank 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

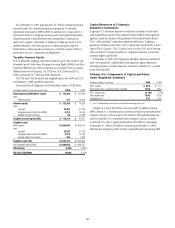

CONTRACTUAL OBLIGATIONS

The following table includes aggregated information about Citigroup’s

contractual obligations that impact its short- and long-term liquidity

and capital needs. The table includes information about payments due

under specified contractual obligations, aggregated by type of contractual

obligation. It includes the maturity profile of Citigroup’s consolidated

long-term debt, leases and other long-term liabilities.

Citigroup’s contractual obligations include purchase obligations that

are enforceable and legally binding for Citi. For the purposes of the table

below, purchase obligations are included through the termination date

of the respective agreements, even if the contract is renewable. Many of

the purchase agreements for goods or services include clauses that would

allow Citigroup to cancel the agreement with specified notice; however, that

impact is not included in the table (unless Citigroup has already notified the

counterparty of its intention to terminate the agreement).

Other liabilities reflected on Citigroup’s Consolidated Balance Sheet

include obligations for goods and services that have already been received,

uncertain tax positions, as well as other long-term liabilities that have been

incurred and will ultimately be paid in cash.

Excluded from the following table are obligations that are generally

short-term in nature, including deposit liabilities and securities sold under

agreements to repurchase. The table also excludes certain insurance and

investment contracts subject to mortality and morbidity risks or without

defined maturities, such that the timing of payments and withdrawals is

uncertain. The liabilities related to these insurance and investment contracts

are included on the Consolidated Balance Sheet as Insurance Policy and

Claims Reserves, Contractholder Funds, and Separate and Variable Accounts.

Citigroup’s funding policy for pension plans is generally to fund to the

minimum amounts required by the applicable laws and regulations. At

December 31, 2009, there were no minimum required contributions, and no

contributions are currently planned for the U.S. pension plans. Accordingly,

no amounts have been included in the table below for future contributions

to the U.S. pension plans. For the non-U.S. pension plans, discretionary

contributions in 2010 are anticipated to be approximately $160 million. The

anticipated cash contributions in 2010 related to the non-U.S. postretirement

benefit plans are $72 million. These amounts are included in the purchase

obligations in the table below. The estimated pension and postretirement

plan contributions are subject to change, since contribution decisions are

affected by various factors, such as market performance, regulatory and

legal requirements, and management’s ability to change funding policy. For

additional information regarding Citi’s retirement benefit obligations, see

Note 9 to the Consolidated Financial Statements.

Contractual obligations by year

In millions of dollars at year end 2010 2011 2012 2013 2014 Thereafter

Long-term debt obligations (1) $47,162 $59,656 $69,344 $28,132 $34,895 $124,830

Lease obligations 1,247 1,110 1,007 900 851 2,770

Purchase obligations 1,032 446 331 267 258 783

Other long-term liabilities reflected on Citi’s Consolidated Balance Sheet (2) 34,218 156 36 35 36 3,009

Total $83,659 $61,368 $70,718 $29,334 $36,040 $131,392

(1) For additional information about long-term debt and trust preferred securities, see Note 20 to the Consolidated Financial Statements.

(2) Relates primarily to accounts payable and accrued expenses included in Other liabilities in Citi’s Consolidated Balance Sheet.