Citibank 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

Consumer Loan Modification Programs

Citigroup has instituted a variety of modification programs to assist borrowers

with financial difficulties. These programs include modifying the original

loan terms, reducing interest rates, extending the remaining loan duration

and/or waiving a portion of the remaining principal balance. Citi’s programs

consist of the U.S. Treasury’s Home Affordable Modification Program

(HAMP), as well as short-term forbearance and long-term modification

programs, each summarized below.

HAMP. The HAMP is designed to reduce monthly mortgage payments

to a 31% housing debt ratio by lowering the interest rate, extending the

term of the loan and forbearing principal of certain eligible borrowers who

have defaulted on their mortgages or who are at risk of imminent default

due to economic hardship. In order to be entitled to loan modifications,

borrowers must complete a three- to five-month trial period, make the agreed

payments and provide the required documentation. Effective June 1, 2010,

documentation must be provided prior to beginning the trial period, whereas

prior to that date, it was required to be provided before the end of the trial

period. This change generally means that Citi will be able to verify income

up front for potential HAMP participants before they begin making lower

monthly payments. We believe this change will limit the number of borrowers

who ultimately fall out from the trials and potentially mitigate the impact of

HAMP trial participants on early bucket delinquency data.

During the trial period, Citi requires that the original terms of the loans

remain in effect pending completion of the modification. As of December 31,

2009, approximately $7.1 billion of first mortgages were enrolled in the HAMP

trial period, while $300 million have successfully completed the trial period.

Upon completion of the trial period, the terms of the loan are contractually

modified, and it is accounted for as a “troubled debt restructuring” (see

“Long-Term Programs” below). For additional information on HAMP, see

“U.S. Consumer Lending— Mortgage Lending” below.

Short-term programs. Citigroup has also instituted interest rate reduction

programs (primarily in the United States) to assist borrowers experiencing

temporary hardships. These programs include short-term (12 months or less)

interest rate reductions and deferrals of past due payments. The loan volume

under these short-term programs increased significantly during 2009, and

loan loss reserves for these loans have been enhanced, giving consideration to

the higher risk associated with those borrowers and reflecting the estimated

future credit losses for those loans. See Note 1 to the Consolidated Financial

Statements for a further discussion of the allowance for loan losses for such

modified loans.

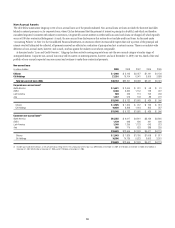

The following table presents the amounts of gross loans modified under

short-term interest rate reduction programs in the U.S. as of December 31, 2009:

December 31, 2009

In millions of dollars Accrual Non-accrual

Mortgage and real estate $7,087 $398

Cards 813 —

Installment and other 1,734 29

Long-term programs. Long-term modification programs, or “troubled

debt restructurings” (TDRs), occur when the terms of a loan have been

modified due to the borrowers’ financial difficulties and a long-term

concession has been granted to the borrower. Substantially all programs

in place provide permanent interest rate reductions. Valuation allowances

for TDRs are determined by comparing estimated cash flows of the loans

discounted at the loans’ original contractual interest rates to the carrying

value of the loans. See Note 1 to the Consolidated Financial Statements for a

further discussion of the allowance for loan losses for such modified loans.

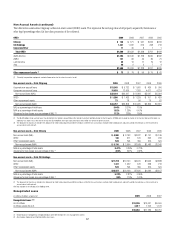

The following table presents the amounts of gross loans related to these

TDRs as of December 31, 2009 and 2008:

December 31

Accrual Non-accrual

In millions of dollars 2009 2008 2009 2008

Mortgage and real estate $8,654 $4,364 $1,413 $207

Cards 2,303 1,054 150 41

Installment and other 3,128 2,345 250 141

Payment deferrals that do not continue to accrue interest primarily occur

in the U.S. residential mortgage business. Other payment deferrals continue

to accrue interest and are not deemed to offer concessions to the customer.

Other types of concessions are not material.

As discussed in more detail in “U.S. Consumer Lending—Mortgage

Lending” and “U.S. Consumer Lending—North America Cards” below, the

measurement of the success of Citi’s loan modification programs varies by

program objectives, type of loan, geography, and other factors. Citigroup

uses a variety of metrics to evaluate success, including re-default rates and

balance reduction trends. These metrics may be compared against the

performance of similarly situated customers who did not receive concessions.